We earn commission when you buy through affiliate links.

This does not influence our reviews, ranking, or recommendations.Learn more.

Accounts Payable(AP) automation tools let you automate the process of fulfilling the companys payments.

you’re free to trust Geekflare

At Geekflare, trust and transparency are paramount.

It is suitable for businesses of all sizes andaccountingfirms.

It supports payments to 137 countries.

Based on the numbers, youll get an additional discount of 10-20% on client subscriptions.

It also offers a free plan for accountants, and their clients.

Payhawk offers a paperlessaccountingprocess, adhering to local tax regulations and enabling effortless expense archiving.

It guarantees security by carrying out intelligent verifications to mitigate the risk of fraud or inaccurate spending.

You have to go through their demo process and purchase via their sales team.

Trial plan is not available.

Only a demo is offered.

Payhawk is available only in a limited number of countries.

This helps enhance cash flow and eliminates heavy paperwork.

Multiple payments can be processed at once, saving time and earning reward points when paying by credit card.

Therefore, businesses located in other countries may not be able to use Melio.

The dashboard is simple to use, even for beginners.

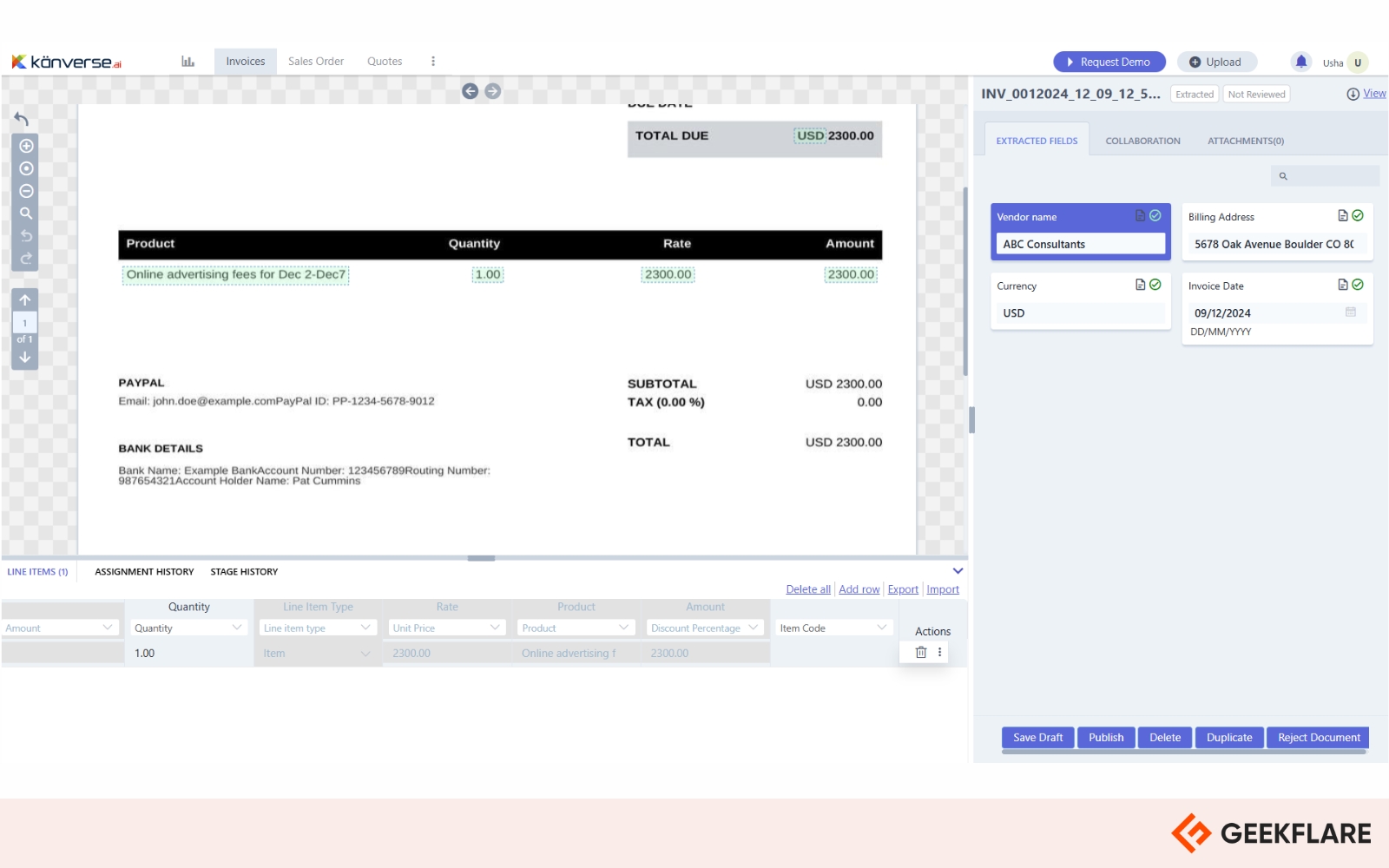

You need not manually upload invoices.

This is a very useful feature and ensures you dont miss any invoice due to human error.

There are 2 paid plans.

It can also fetch invoices from different channels like email and SharePoint.

99.5% processing extraction efficiency.

Fraud prevention and data privacy.

Kanverse AI Cons

AI-powered invoice processing can lead to inaccuracies without human oversight.

It also includes automated receipt compliance enforcement.

Key Features of Airbase:

Airbase allows you to set prefs and rules based on your preferences.

It learns from your transactions to make intelligent recommendations for the next one.

Airbase does not let you sign up online.

you gotta go through a guided tour or wait for a demo from the sales team.

The insights and analytics feature is pretty detailed.

The platform lets you add virtual and physical cards for easy payment processing.

it’s crucial that you schedule a demo to know whether it can work for your company.

You also have an option to link it with your accounting system.

The tools option lets you configure workflows, view credit notes, recurring expenses etc.

I liked the simple design of the tool and ease of locating the necessary features.

for the process you want to automate.

However, Pipefy has no integrated payment methods.

It is more of a process automation tool.

you better make the payments through third-party tools and update the status on Pipefy by uploading the payment confirmation.

This process can be prone to human errors or even fraud if other checks are not in place.

Pipefy has an AI chatbot which can help you navigate through the dashboard and get familiar with the interface.

When I tried, it first answered in Portuguese, which seems to be its default language.

But when asked it switch to English, it did give me instructions in English too.

No integrated payment processing system and automatic payment status update.

Business and enterprise plans are available for custom prices.

Key Features of Stampli:

Stampli does not have a free trial or online sign up option.

it’s crucial that you purchase it by contacting their sales team.

I found Stampli to be a complete all-in-one solution for accounts payable with advanced features.

Key Features of Spendesk:

Spendesk is not available to users in the US.

It is only available in UK and Europe.

The dashboard sows the list of invoices to be reviewed, scheduled and confirmed.

You may make payments via the Spendesk account balance or from a bank account.

What is Automated Accounts Payable Software?

Automated Accounts Payable software handles your financial transactions from start to finish.

It digitizes the supplier/vendor invoice and bill process to create leaner, cost-effective, and faster workflows.

Thus, no manual forwardings, cutting paper checks, and no paper invoices anymore.

Many modern AP solutions have abusiness rule enginethat helps enforce company-specific policies automatically.

How to Automate Accounts Payable?

you might automate your accounts payable process by following the steps below.

They enhance data accessibility, give you more control over cash flow, and strengthen fraud protection.

The 4 benefits of using cash flow automation have been elaborated upon below.

References

1.IOFM, Maximizing your Automation ROI, 2021.

Whats next?

Further, you’re free to explore the below software to manage your accounting and finance.

Best Accounts Receivable Software

Best Time Billing Software

Free Accounting Software