We earn commission when you buy through affiliate links.

This does not influence our reviews or recommendations.Learn more.

Not everyone can find the best investing businesses.

But these platforms can surely help you spot those early-stage startups to invest in.

The leading angel investor websites gather the wealthiest and finest angel investors in one location.

Here is a quick summary of the best angel investing platforms Ill be discussing below.

Angel investors are not immune to the fact that most startups fail.

Investing in startup businesses entails assuming the risk of total financial loss.

Investments in startups are frequently sluggish and demand perseverance because it may take years to see any return.

However, theres also a chance you could get a significant return on your investment.

Angel investors frequently fund startup businesses with solid growth prospects.

As a result, if the company is profitable, you could receive a sizable return on your investment.

Check out these platforms and kickstart your angel investing journey with these right away!

StartEngine

Investors should check out theStartEngineAngel Investor website.

It offers a tremendous opportunity to invest in startup companies and new ventures that are provided by this platform.

The dedication to democratizing investment is what distinguishes StartEngine Angel Investor.

Accredited and non-accredited investors can further fund significant firms since it creates a fair playing field.

The platform also provides various investment opportunities, including revenue-sharing agreements and equity crowdfunding.

Thanks to the diversity, you may customize your investments based on your risk tolerance and financial objectives.

Overall, once kickstarted with this site, it will prove to be the angel-investing guide you wished for!

It includes a sizable database of angel investors and companies.

AngelList has more than 100,000 entrepreneurs, jobs, investors, and more than 5 million members.

Startups can even link their social media profiles to the site to receive recommendations for expanding their internet.

A vital component of AngelList is networking.

It allows you to cooperate with other investors on deals, co-invest, and connection.

It also provides a straightforward approach to managing investments, from doing your research to making purchases.

A larger pool of investors can now invest in angels as a result.

This website provides unique business ideas to reach investors seeking to support them with capital and industry knowledge.

One of the unique advantages of this web link is the large database of proprietors from various industries.

Investors can contact companies that are knowledgeable and passionate about investors areas of interest.

Thanks to the Angel Investment web connection, investors may interact with entrepreneurs in a secure environment.

This is a good place to start if you want to become well-known as an angel investor.

Republics user-friendly website makes the investment process pretty simple.

Gust

Gustacts as an online entry point to the fascinating world ofstartup funding.

It is used by 800,000 companies and over 80,000 investment specialists worldwide.

Over $50 billion in financing has been raised through the use of this website.

so that enable conversations with business owners and other possible co-investors, it also provides secure communication methods.

The platforms safe payment system ensures that the investing procedure is quick and secure.

Anyone wishing to explore the world of early-stage investments must use this valuable resource.

Navigation is easy because of the intuitive design and tailored recommendations.

If youve just begun your investment journey, this will prove to be a game-changing website for you.

VentureSouth

VentureSouths geographical focus makes it unique.

Due to the platforms rigorous review procedure, only the most promising startups get to the fundraising round.

Leapfunder

Every angel investor should be aware of the excellent siteLeapfunder.

Leapfunder stands out due to its unique blend of networking possibilities and investment options.

Although their primary product is the convertible note, investors can start with a $1,000 initial payment.

The platform also supports an active community of investors and businesspeople.

Envestors

Like many other platforms for angel investing,Envestorsfacilitates contacts between business owners and possible investors.

Envestors help build meaningful relationships between other angel investors and venture capitalists, establishing a cooperative investment ecosystem.

Its not just about connecting with entrepreneurs.

This platform shines out in the cutthroat competition in the world of angel investing.

This vital tool will further enhance your investing journey by offering an unmatched experience.

Wefunder

Wefunders user-friendly interface streamlines the investment procedure.

This app allows investors to research various companies, examine their business strategies, and evaluate their potential.

Because it just takes contributions of $100, the platform is accessible to a wide spectrum of investors.

It is a shining illustration of the collaborative, democratic investment ethos of entrepreneurship.

MicroVentures

MicroVenturesallows only high-potential startups to register on their platform.

The platform focuses on providing profound insights into every investment option.

The user-friendly interface additionally straightens the investment process and facilitates client portfolio growth.

By providing possibilities for networking and teamwork, MicroVentures aids investors in experiencing a sense of belonging.

A secondary market is also offered, allowing shareholders to trade their shares as needed to boost liquidity.

Overall, it is one of the most popular websites for angel investors.

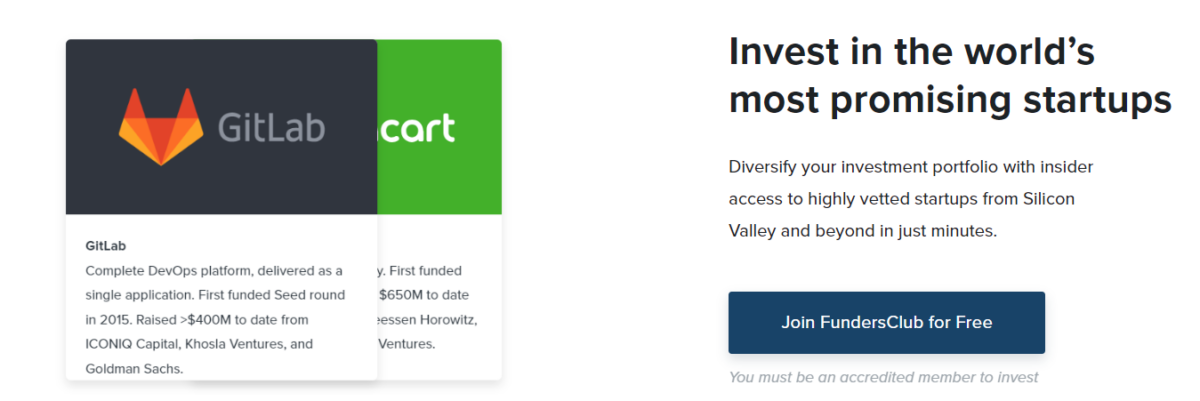

FundersClub

A website namedFundersClubacts as a link between investors wishing to make strategic investments and emerging entrepreneurs.

In the process, this saves investors a lot of time.

The focus on portfolio management is among the crucial elements.

To simplify managing and modifying your portfolio, FundersClub offers tools for tracking the performance of your assets.

Additionally, the website promotes a group of like-minded investors, facilitating networking and information sharing.

FAQs

Several issues need to be resolved before investing in a startup.

Examine the startups business plan and product-market fit first.

Make certain that they present a special response to a real problem.

The teams level of dedication and experience should then be evaluated.

As a significant risk is involved, have a clear exit strategy and be ready for the worst.

Before selecting an angel investing platform, keep key factors in mind to guarantee a successful investment journey.

Check their cost to be certain that it is within your investment budget.

In the subjects or industries that interest you, look for platforms.

If you thoroughly research these issues, you will be able to reach an informed decision.

Conclusion

Numerous opportunities exist in the realm of angel investment to interact with startup companies.

These platforms accommodate a range of risk appetites and investing preferences because of their distinct strengths and priorities.

You may also read aboutStartup funding stagesandfinancial markets news portalsto stay up-to-date as an investor.