We earn commission when you buy through affiliate links.

This does not influence our reviews or recommendations.Learn more.

In the world of digital transactions, PayPal has long been a go-to option for individuals and businesses alike.

In this article, well share a comprehensive overview of the best PayPal alternatives.

It charges a percentage of the amount you send.

The fee varies from currency to currency but typically starts at 0.33%.

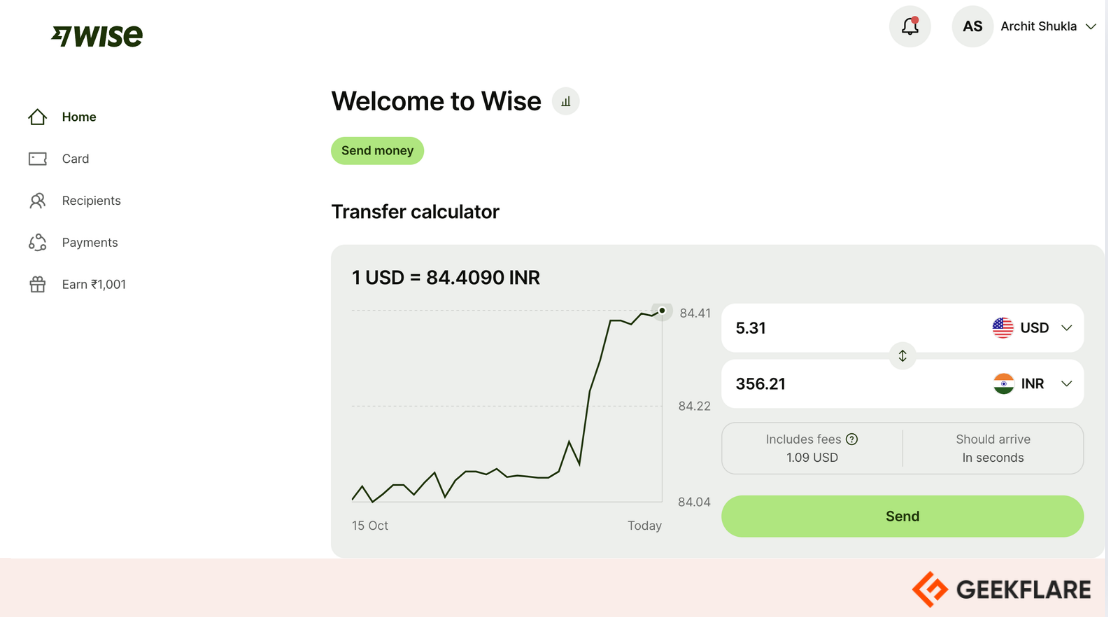

Like PayPal, Wise provides a debit card, making it an excellent choice for international travellers and expatriates.

Provide real-time exchange rates at the mid-market rate.

Cons

Pretty automated customer service, limiting availability and responsiveness.

Impose fees for ATM withdrawals beyond a certain limit.

Wise Pricing

2.

It issues multi-currency corporate cards for employees, allowing real-time expense management and control over spending.

Airwallex Key Features

A developer-friendly finance software solution.

Country-specific rates and lower FX charges than PayPal.

Support virtual and physical cards for business expenses

Airwallex does not support ATM withdrawals.

Restrict services in some countries, which may affect global usability for certain businesses.

Airwallex Pricing

3.

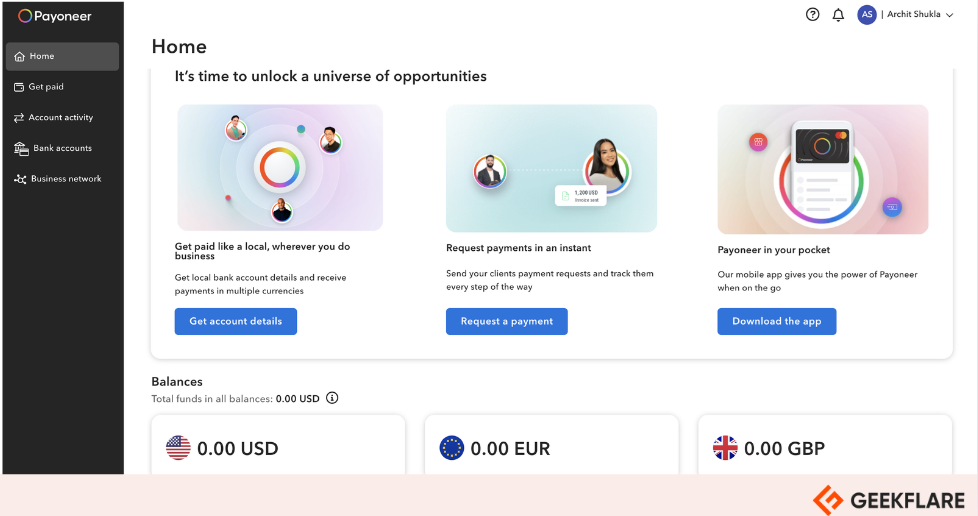

Payoneer offers intelligent dispute management with pre-dispute alerts and a dedicated chargeback protection team.

Payoneer Key Features

Low currency conversion fees compared to PayPal.

Maintains robust customer support through email, live chat, and phone.

Partnership with 2000+ marketplaces, including Fiverr, UpWork, AirBnB, and more.

The service charge for incoming payments is slightly higher compared to PayPal.

Lacks a payment gateway or POS system.

Payoneer Pricing

4.

Stripe also allows you to customize the on-site payment gateway to match your shops brand and aesthetic.

In comparison, PayPal requires a paid upgrade for users who want a custom-integrated checkout experience.

However, setting up Stripes gateway can be challenging and may require coding knowledge.

you might consult your in-house developer or hire one from Fiverr for as little as $20.

Developer-friendly platform with well-documented APIs.

Ensure high-level security with PCI Service Provider Level 1 certification, safeguarding sensitive payment information.

Well-integrated with e-commerce platforms like Wix, Shopify, WooCommcer, and more.

Require technical expertise for advanced customization.

Provides limited customer support.

Stripe Pricing

5.

It offers virtual and physical cards for secure online and in-store purchases.

Revoluts multi-currency business account is an upgrade from personal finances.

Revolut Key Features

Support cryptocurrency trading and investments directly within the app.

Offer disposable virtual cards for enhanced online transaction security.

Provide real-time currency exchange at interbank rate

Limit customer support options, with no live telephone assistance available.

Experience occasional technical issues, including app outages.

Revolut Pricing

6.

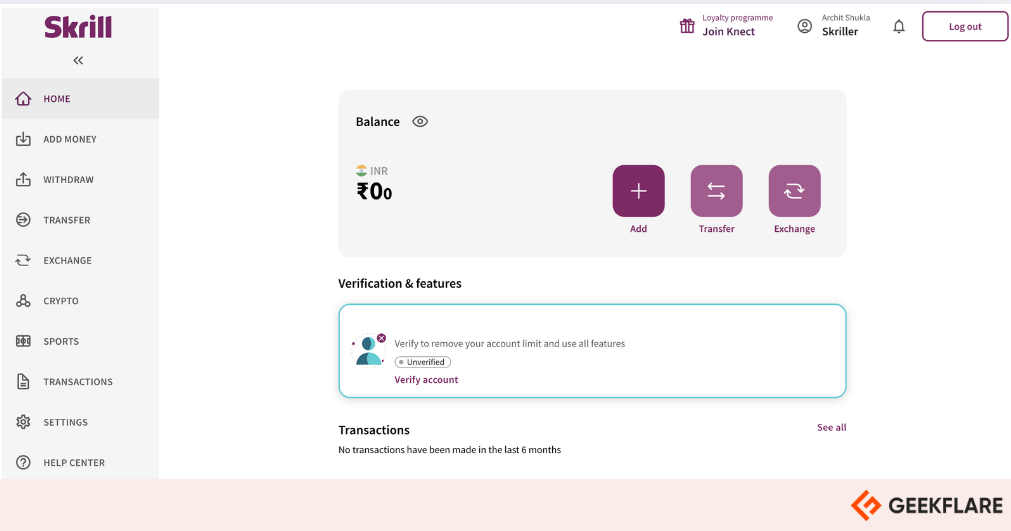

It supports over 40 cryptocurrencies.

It offers prepaid Visa/Master cards and VIP club benefits for frequent users.

It offers a loyalty program, Skrill Knect, where users earn points on transactions.

Skrill Key Features

Generally offers free or lower fees for deposits and transactions.

Excellent for trading in cryptocurrencies.

Offers loyalty programs that allow users to earn points on transactions.

Maximum and minimum withdrawal limits make Skrill unappealing to businesses and freelancers.

Charge relatively high fees (3.99%) on currency conversion.

Skrill Pricing

7.

Unlike apps like PayPal, OFX does not charge upfront transfer fees.

It also charges about 1.5% or less for currency conversion for international fund transfers.

OFX Key Features

Unlike PayPal, you get a personal account manager with OFX.

Excellent 24/7 multilingual support at any time.

A responsive mobile app for easy finance money management.

Minimum transfer limit of AU$250 and additional fees for transfer amount less <AU$10,000.

Limited payment options are available other than local bank transfers.

OFX Pricing

Note:OFX monthly plans are limited to the number of monthly cost-free transactions.

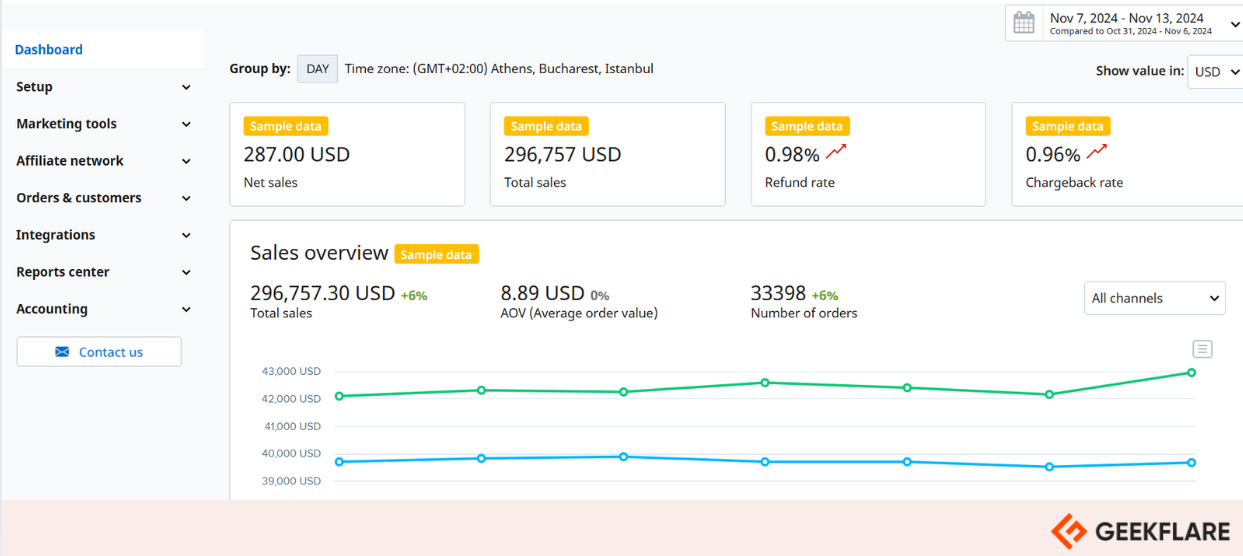

It supports several payment models, including one-time purchases, subscriptions, and digital goods sales.

SaaS providers and digital product sellers can choose debit/credit card payments or subscription billing for timely payments.

2Checkout Key Features

Enable customizable checkout to enhance the user experience.

Unlike PayPal, 2Checkout does not facilitate in-person card transactions.

Charges a percentage of sales as a fee may not impress cost-conscious users.

2Checkout Pricing

9.

Private clients get unlimited free Euro transfers in terms of amount and number.

It offers business accounts with customizable payment solutions and API integrations for e-commerce platforms.

Paysera Key Features

Support a multi-currency account system, facilitating transactions in over 30 different currencies.

Charge low fees for international money transfers.

Ensure compliance with EU financial regulations

Users struggle with Payseras long onboarding processes.

Incidents of random account freezing and unreliable customer support.

Paysera Pricing

10.

Tipalti

Best for Accounts Payable Automation

Tipalti focuses on an integrated approach to financial management.

It is best for businesses requiring accounts payable setup and automation capabilities.

Tipalti is a solid alternative to PayPal because it focuses on automating processes.

It provides end-to-end automation for accounts payable, invoicing, reconciliation, mass payment, and tax management.

It is ideal for small to large enterprises dealing with large volumes of payments or requiring vendor management services.

Tipalti Key Features

Integrated AI capabilities make payments more efficient and less manual.

Integrates with various ERP and accounting systems, including NetSuite, QuickBooks, and Sage.

Enterprise-grade security and fraud protection.

The initial setup and integration of Tipalti can be complex and time-consuming.

Lacks real-time notifications, especially for cancelled approval requests.

Tipalti Pricing

11.

Helcim Key Features

Economical pricing structure for businesses processing large volumes.

Reliable support via phone and email, with options to schedule callbacks.

Offers tools for invoicing, subscription management, APIs, and developer tools for customization.

Limited to CAD/USD and does not allow transactions in local currencies from other countries.

Impose higher fees for low-volume businesses

Helcim Pricing

Helcim charges vary based on monthly sales volume.

Venmos social feed adds a layer of engagement that PayPal lacks, making transactions feel more connected.

Free and instant transfers within the U.S.

Get purchase protection without any extra costs.

A familiar Google Pay style interface makes adoption easy among freelancers and small contractors.

Lacks international payment capabilities; limited to U.S. users.

Daily withdrawal limit from ATMs using the Venmo debit card is $400.

It operates within U.S. boundaries and allows you to send/receive/split money between friends, family, and local shops.

Lacks purchase protection

Zelle Pricing

Zelle is free to use.

Razorpay

Best for Indian Market Payment Solutions

Razorpay is among the best PayPal alternatives for Indian businesses.

Razorpays developer-friendly API makes it easy to embed payment buttons and links into websites and mobile applications.

Additionally, you’re free to access business banking services through RazorpayX and tools for managing vendor payouts.

Razorpay Key Features

Lower transaction fees compared to PayPal.

Dedicated systems like instant settlements help quickly resolve conflicts and provide chargeback protection.

Automate disbursals and vendor payments.

Support recurring billing and subscription management.

Face occasional downtime and technical issues.

Manual verification and KYC documentation are required, which may delay the onboarding process.

Why Look for PayPal Alternatives?

We dug into some first-hand PayPal user reviews, and heres why you must consider alternatives to PayPal.

Each of these services lets consumers make fast and easy purchases in stores and online.

The platform is also a go-to choice for person-to-person transactions.

Amazon Pay

Amazon Pay is primarily targeted at businesses or individuals who shop on Amazon.

Apple Pay

Apple Pay is an excellent choice for online shoppers seeking a seamless checkout process.

Beyond facilitating payments on websites and within applications, Apple Pay also supports person-to-person transfers.

Cryptocurrencies as a PayPal Alternative

A large number of users are switching to cryptocurrencies for online payments.

Crypto is a fast, secure, and cost-effective alternative to traditional methods.