We earn commission when you buy through affiliate links.

This does not influence our reviews, ranking, or recommendations.Learn more.

Managing your business finances and tracking its ins and outs feels like an uphill task.

Moreover,91% of accountantsbelieve that accounting technology has delivered value to their business.

Thats why choosing the right accounting software is a must-have for modern business.

it’s possible for you to trust Geekflare

At Geekflare, trust and transparency are paramount.

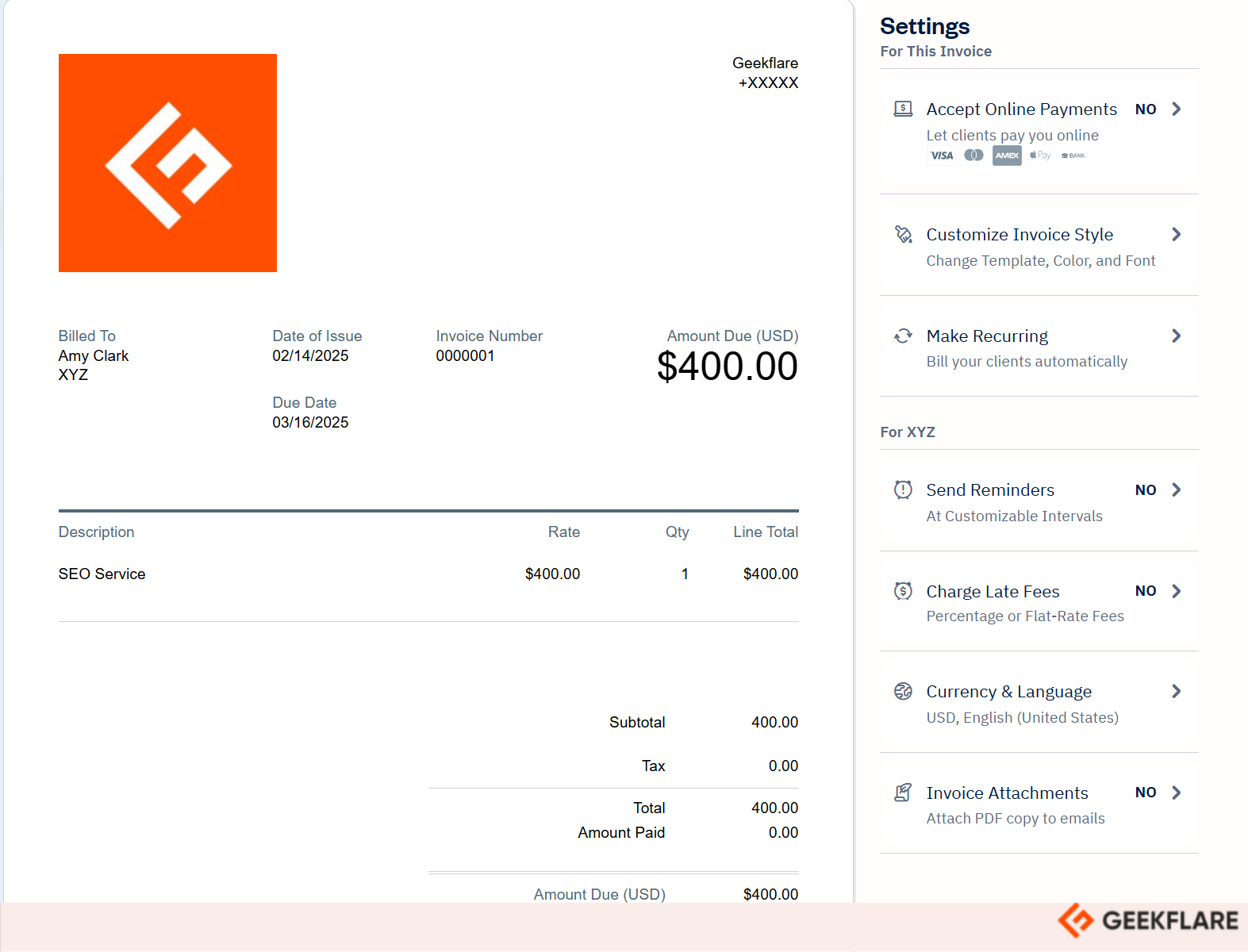

In myFreshBooks review, Ive extensively covered everything about this accounting software and its features.

FreshBooks has an interface and features that are best suited for service-based businesses.

One of its core features is the free customizable invoicing.

For a more customizable invoice, FreshBooks lets you add a logo and important business details.

Further, you might set up reminders at customizable intervals and charge late fees from the clients.

I like the flexibility with FreshBooks that it offers in creating multilingual invoices with a range of currency options.

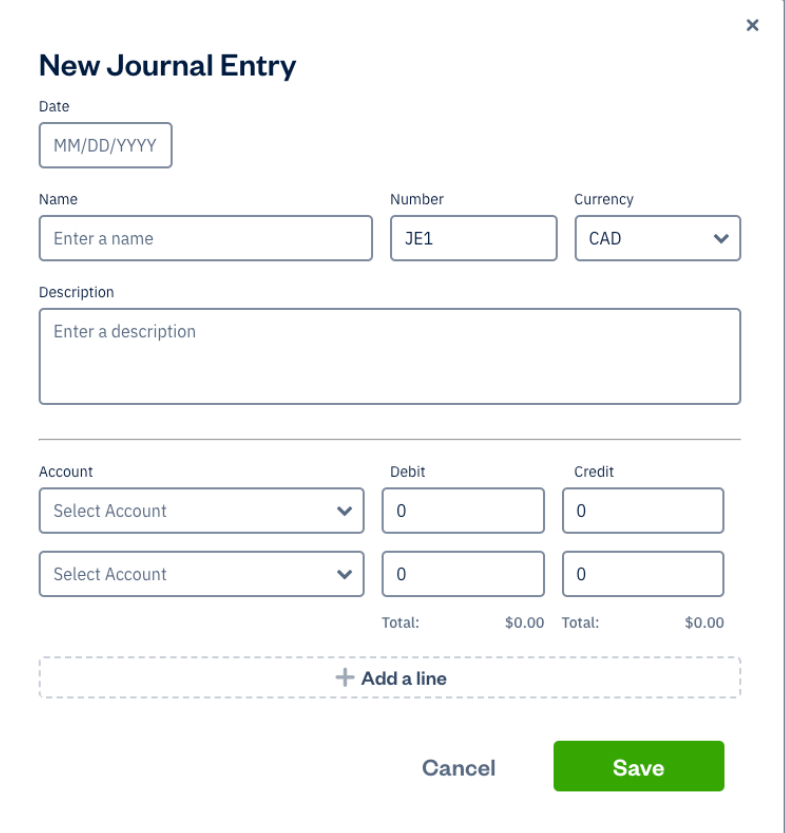

FreshBooks features a double-accounting system, allowing you to keep a record of AP & AR separately.

To get started, connect your bank account, and FreshBooks will automatically import your bank transactions.

Its advanced accounting feature gives you access to an intuitive journal entry interface and bank reconciliation in autopilot mode.

Therefore, we have awarded FreshBooks with the Geekflare Value Award.

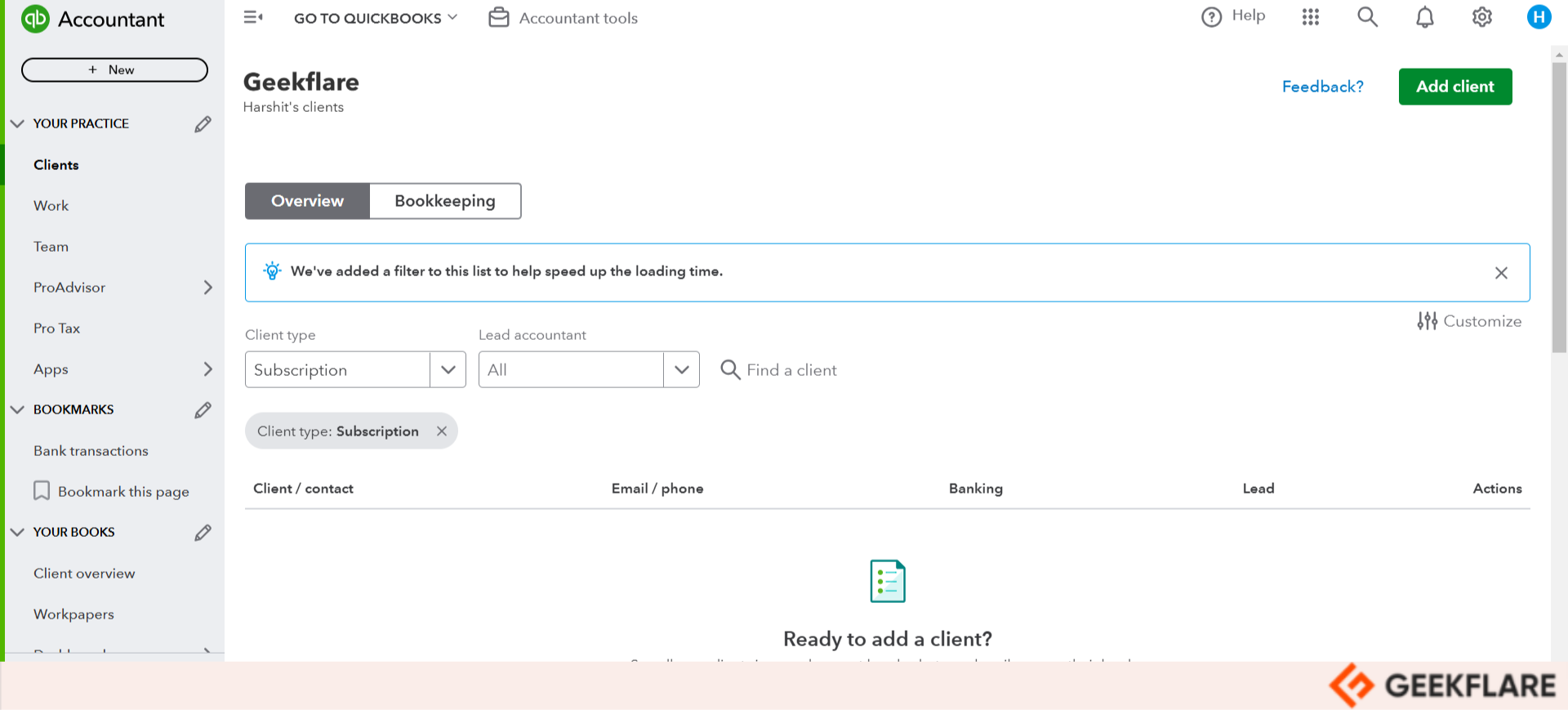

QuickBooks outclasses FreshBooks in terms of features offered.

However, QuickBooks comes with a learning curve since it is overwhelmed with various features.

So, Id recommend going for its free trial before you get started with the paid version.

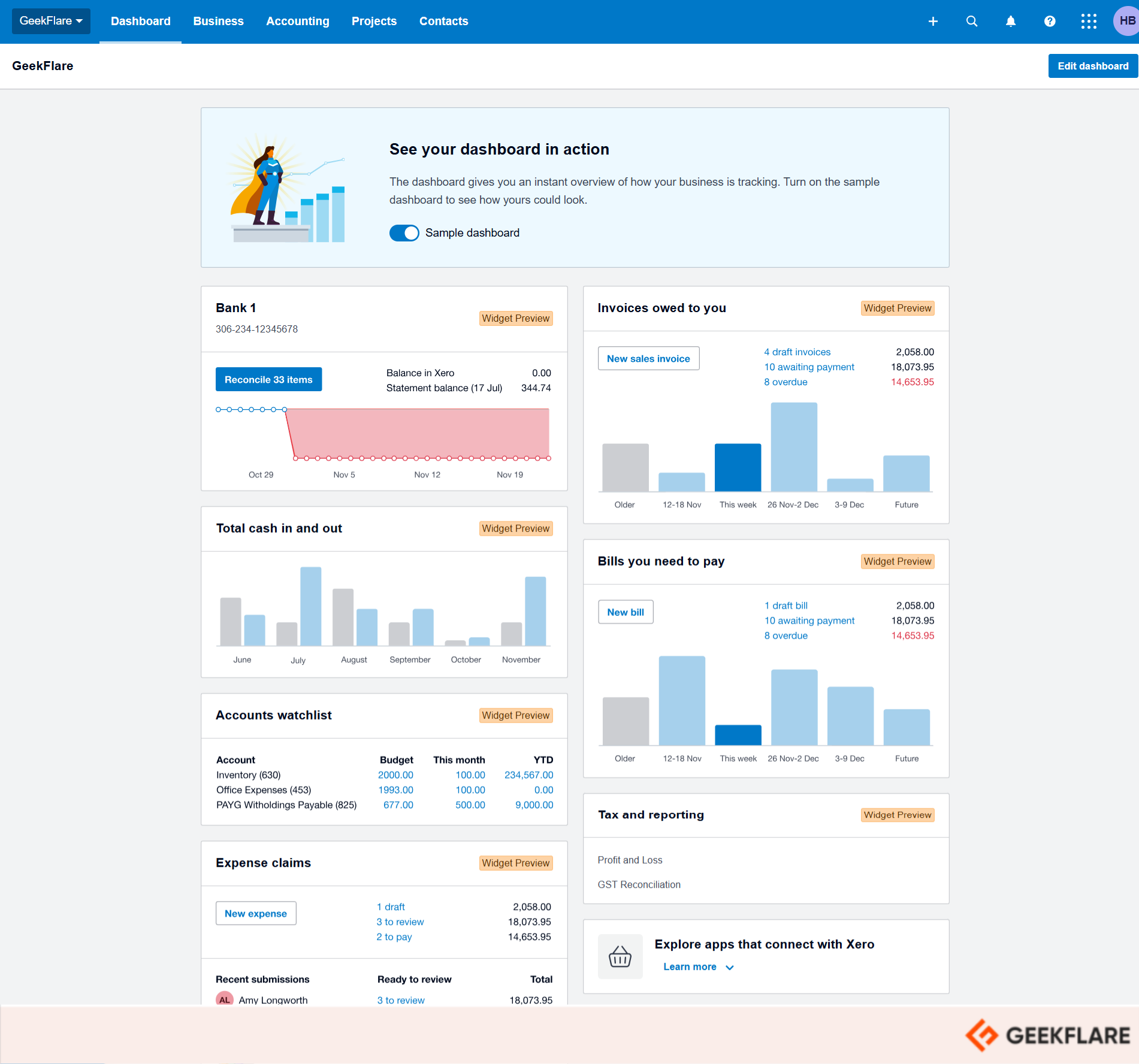

you’re free to reorder and drag and drop these elements within the dashboard.

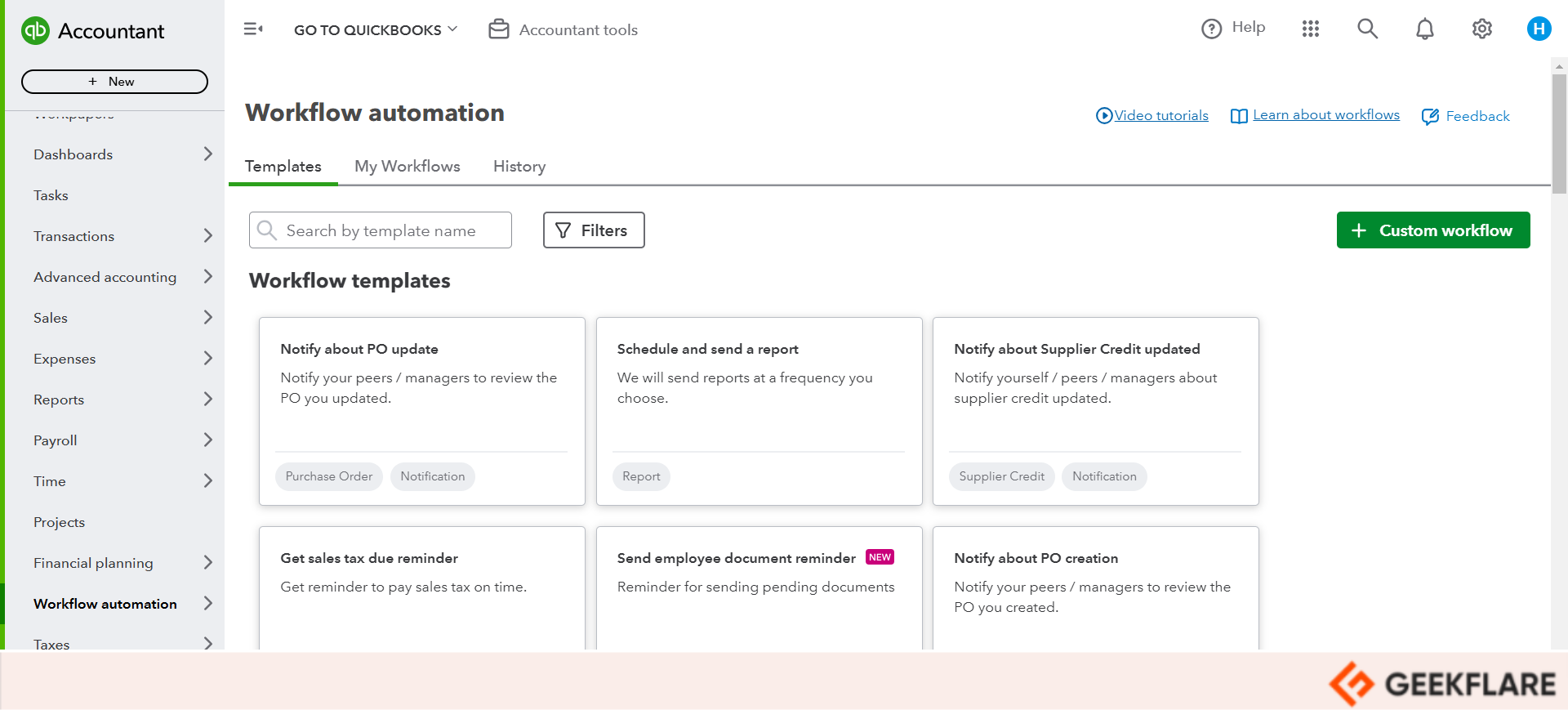

For example, you could use the template to automate the sales tax payment reminder on time.

Or a template to receive accounting reports over a frequent period.

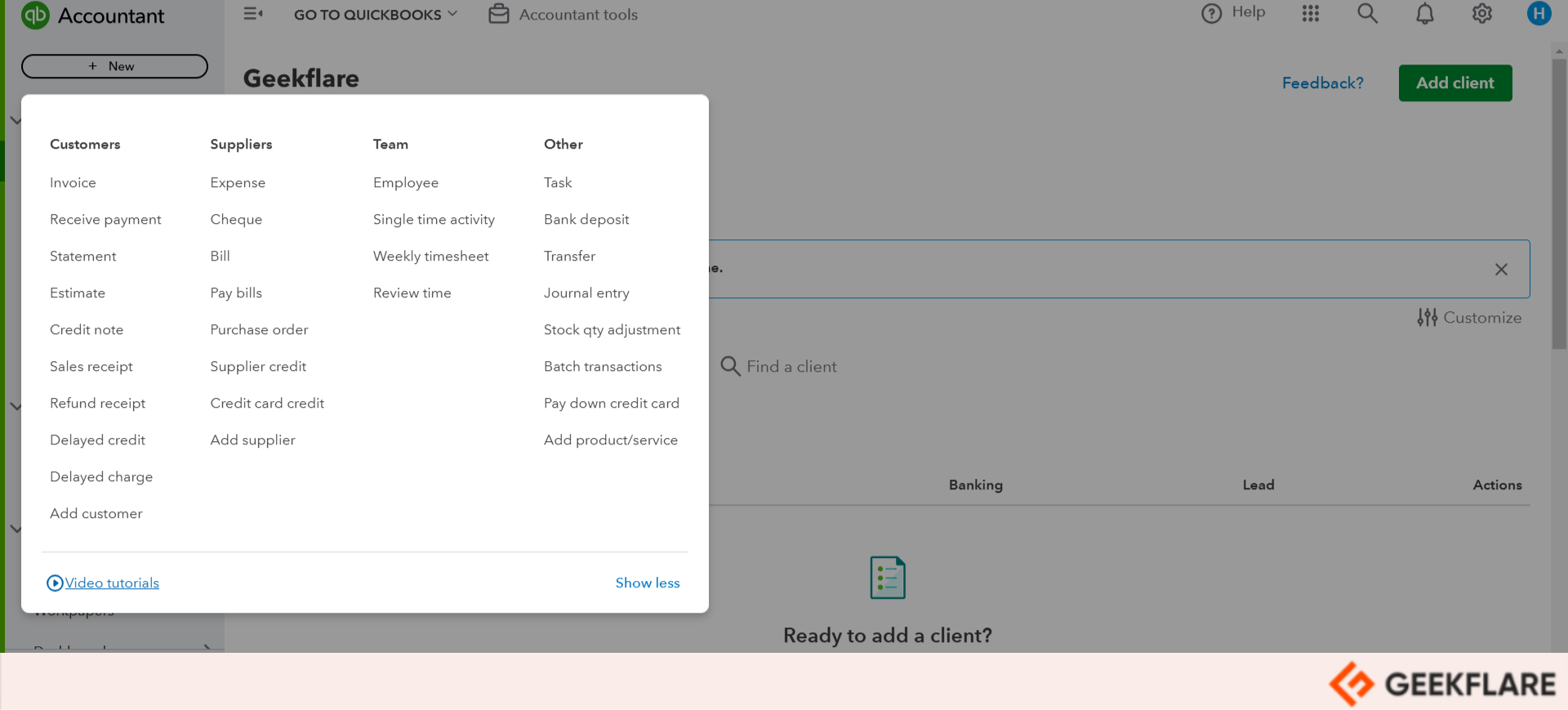

Want to create an invoice, estimate, or set up a payment?

punch New from the dashboard to create customizable invoices, bills, journal entries, or purchase orders.

QuickBooks offers an AI-powered invoicing feature that reads your accounts and automates your invoices on autopilot.

Choosing an annual plan offers 50% off for 3 months.

Read howFreshBooks compares with QuickBooks.

you’re able to remove or add these widgets from the centralized dashboard.

The tool comes with amazing import capabilities, allowing you to add data in CSV or .txt format.

For example, you could set up recurring profiles and automate payment reminders along with bank reconciliation.

Overall, Xero focuses more on sales rather than the accounting.

Though it offers advanced accounting, such as fixed asset management, it lacks the bookkeeping feature.

I would recommend it to small businesses that need basic accounting with more focus on sales tax and invoicing.

Read ourXero Vs. QuickBooks comparison.

Note that Wave is only limited to U.S. and Canadian businesses.

If you have businesses outside this jurisdiction, Wave partners with Zoho Books.

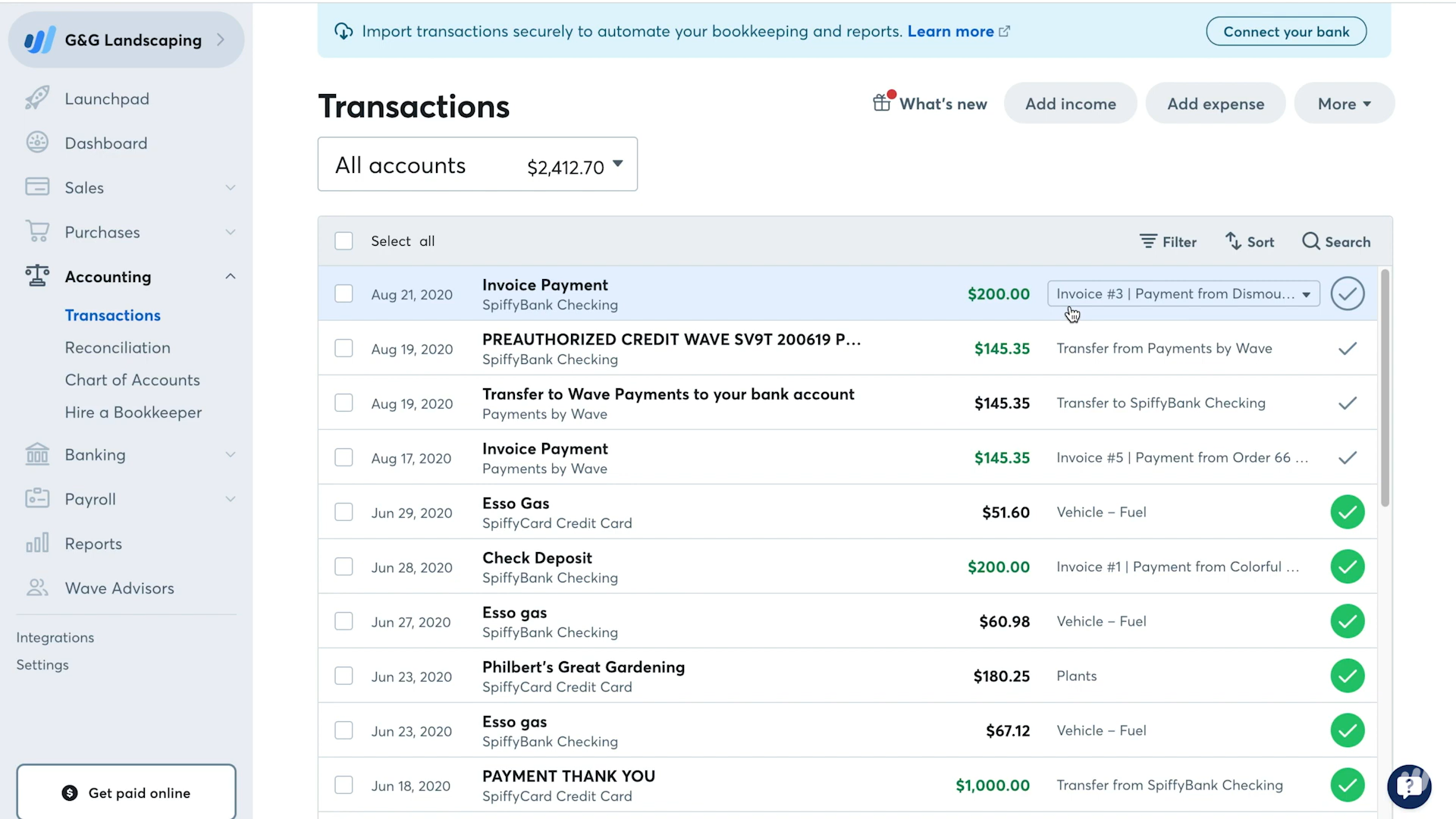

Its most intriguing feature is automated bank reconciliation that matches your transactions in real time.

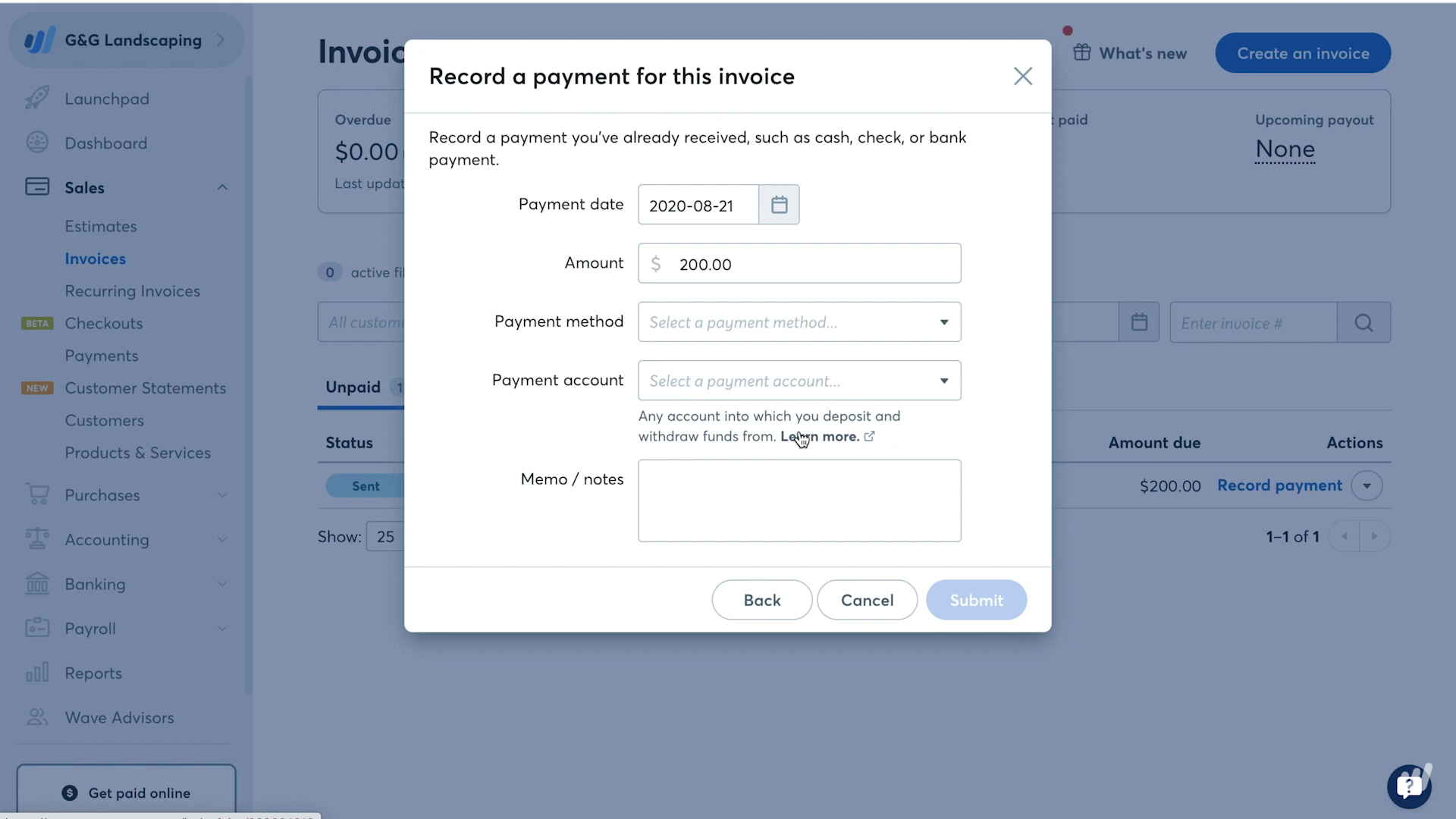

However, you will need to manually record the invoice.

Once done, the system will automatically record the transaction in the bank account books.

Id also recommend its mobile accounting app for iOS and Android.

It also lacksinventory management, time-tracking, and mileage tracking, which is an essential add-on for businesses.

Overall, if youre looking for a straightforward accounting solution without unnecessary extras, Wave is an ideal pick.

Wave Features

Customizable templates for estimates and invoices.

Low processing fees for card and online payments.

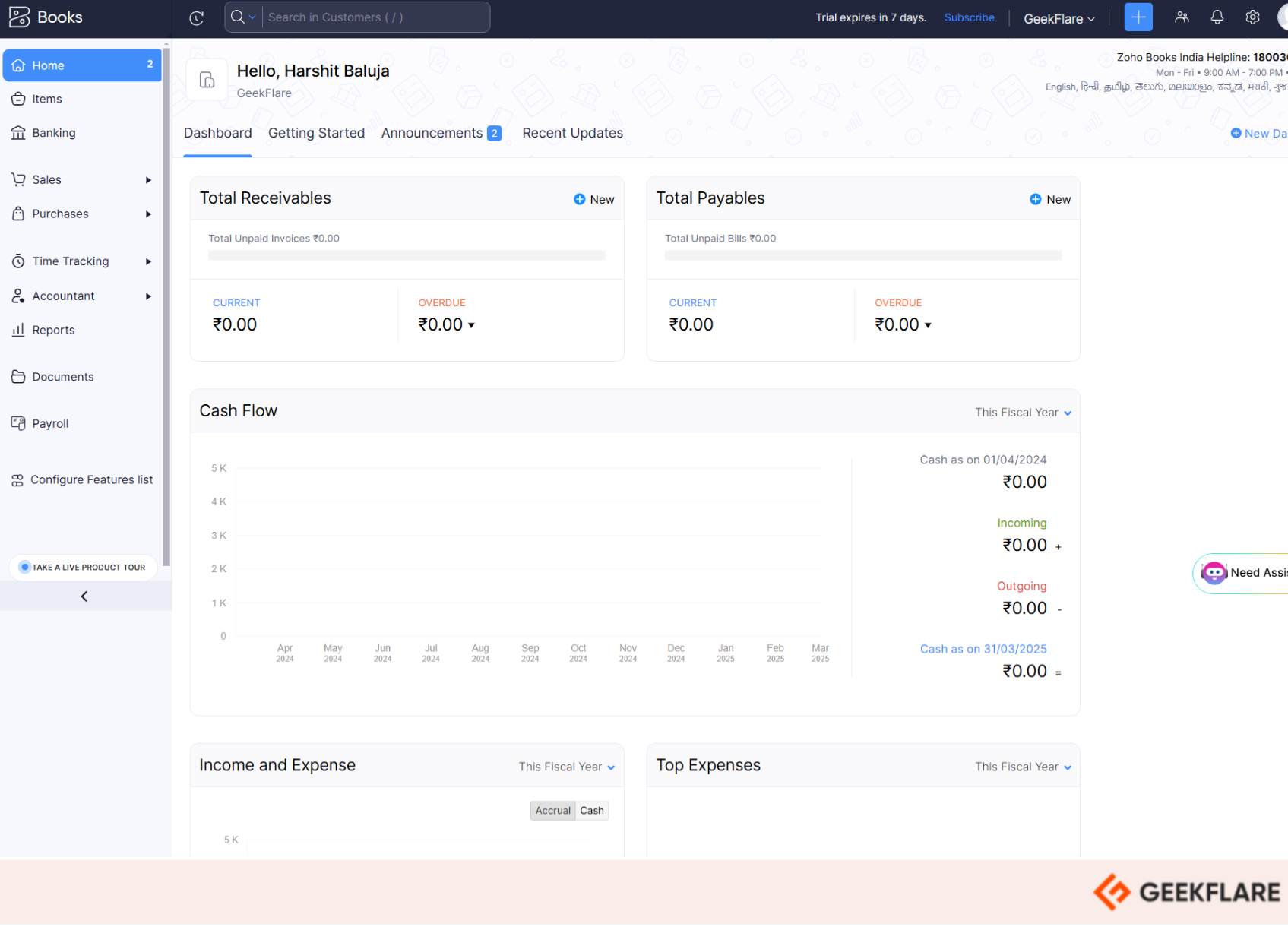

During my testing, I found Zoho extremely intuitive, with all the accounting options on the left side.

Zoho Books lets you create custom invoices with the flexibility to create them once or in a recurring period.

Zoho connects with various banks, either through direct connection or a third-party provider.

you might also connect with the bank manually by entering the account details.

Check out ourdetailed review of Zoho Booksfor more information.

Read ourSage 50 Accounting review, where we cover this tool extensively.

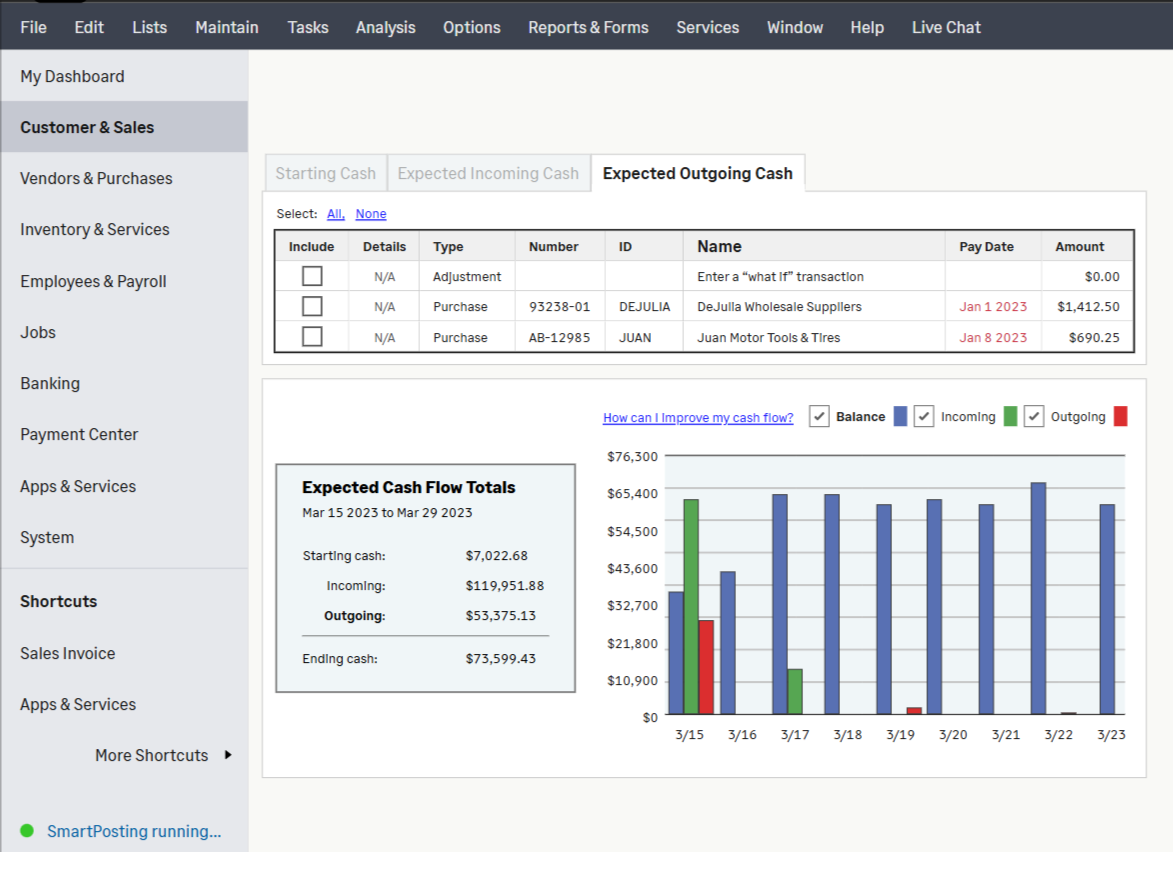

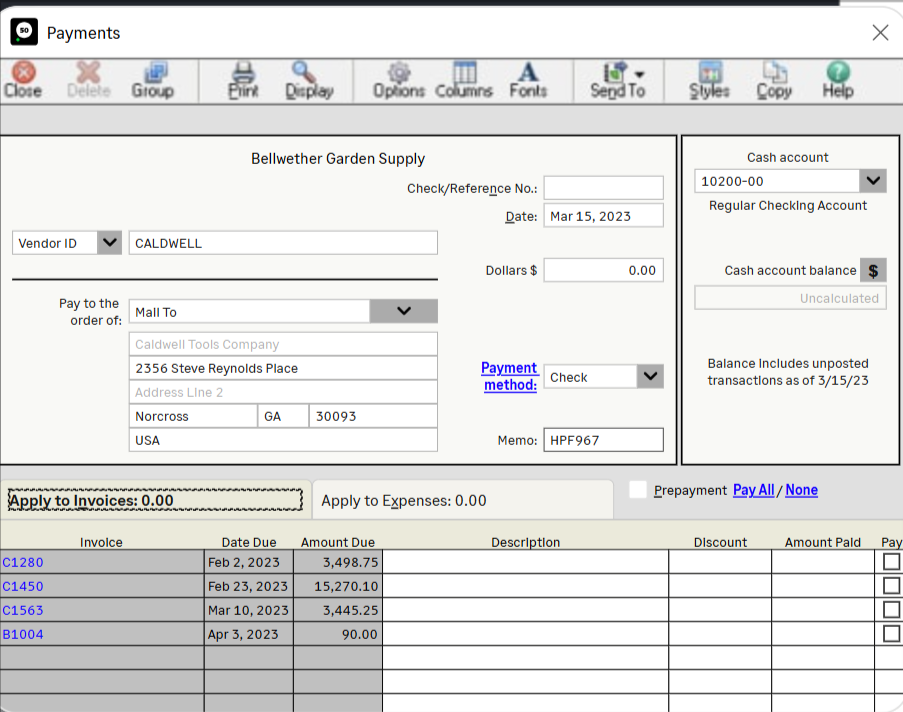

What I liked most about Sage is its choice of accounting tools.

Youll have all the menu elements on the left side of the dashboard, just like QuickBooks.

The most intriguing feature is the cash flow, which allows you to track the cash ins and outs.

Sage 50 also stands up to my expectations in terms of high-grade security.

It offers a security shield that safeguards your business identity and keeps your financial wellness in check.

However, Sage 50 isnt the most affordable option.

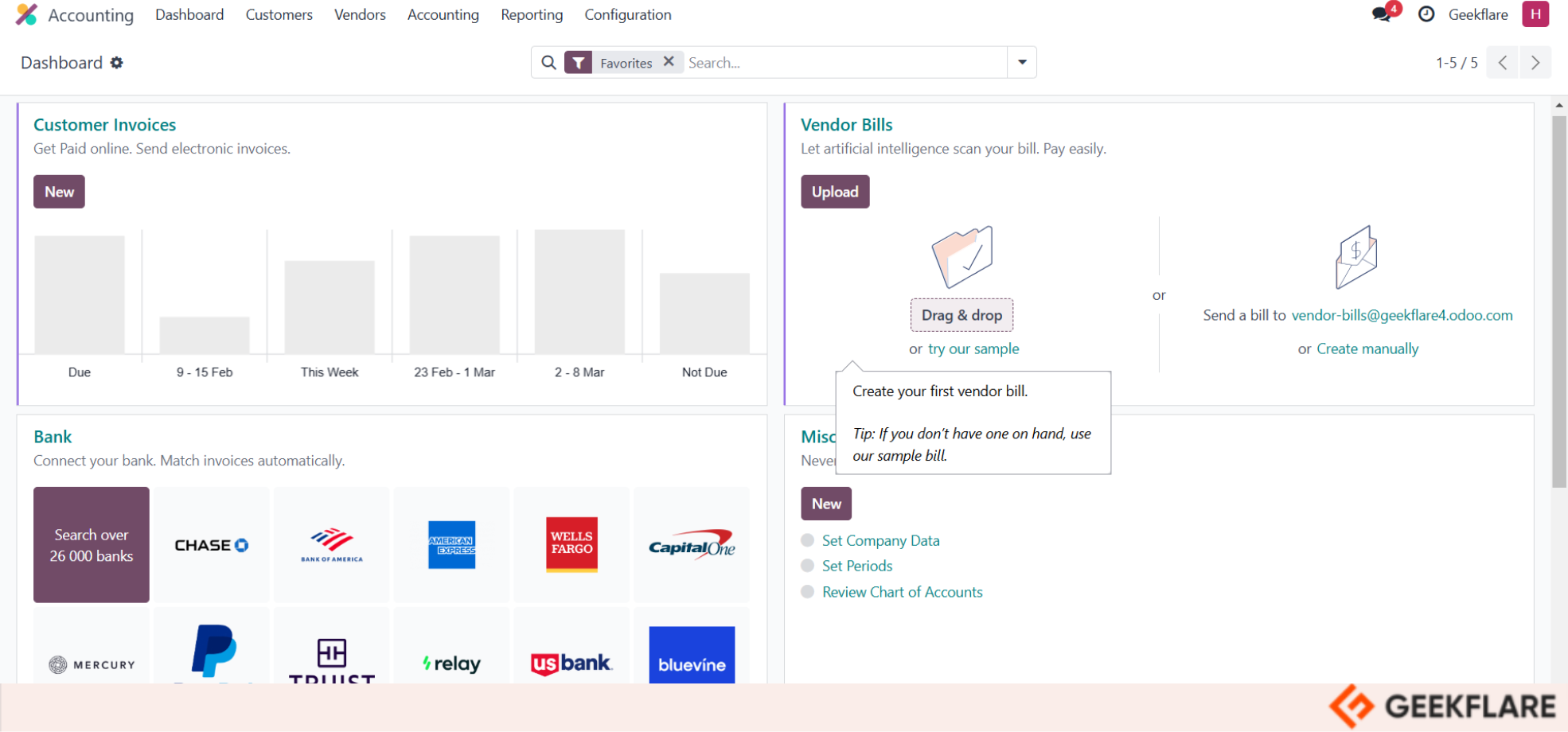

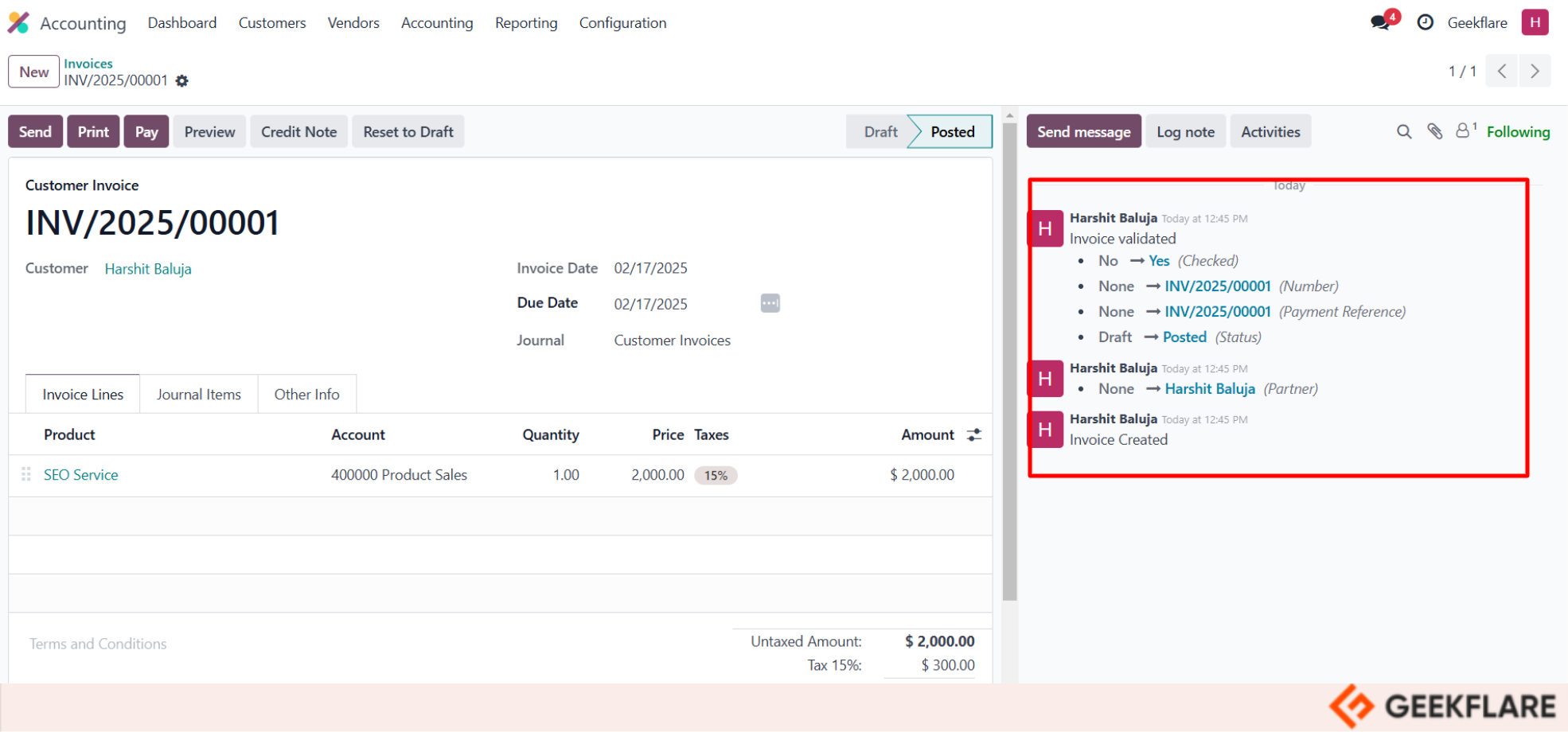

Odoo also excels in terms of its configuration capabilities for invoices, bills, and accounting.

I also found its log note that tracks the activities for invoices and bills in real-time very useful.

Say, when you have posted the invoice or changed the status or when an invoice is paid.

It offers incredible features for accounts payable and accounts receivable.

I would pick Odoo for its flexibility to choose between different payment providers and sync with various banking institutions.

Moreover, it also allows you to switch between different currencies in real-time and add to your accounts.

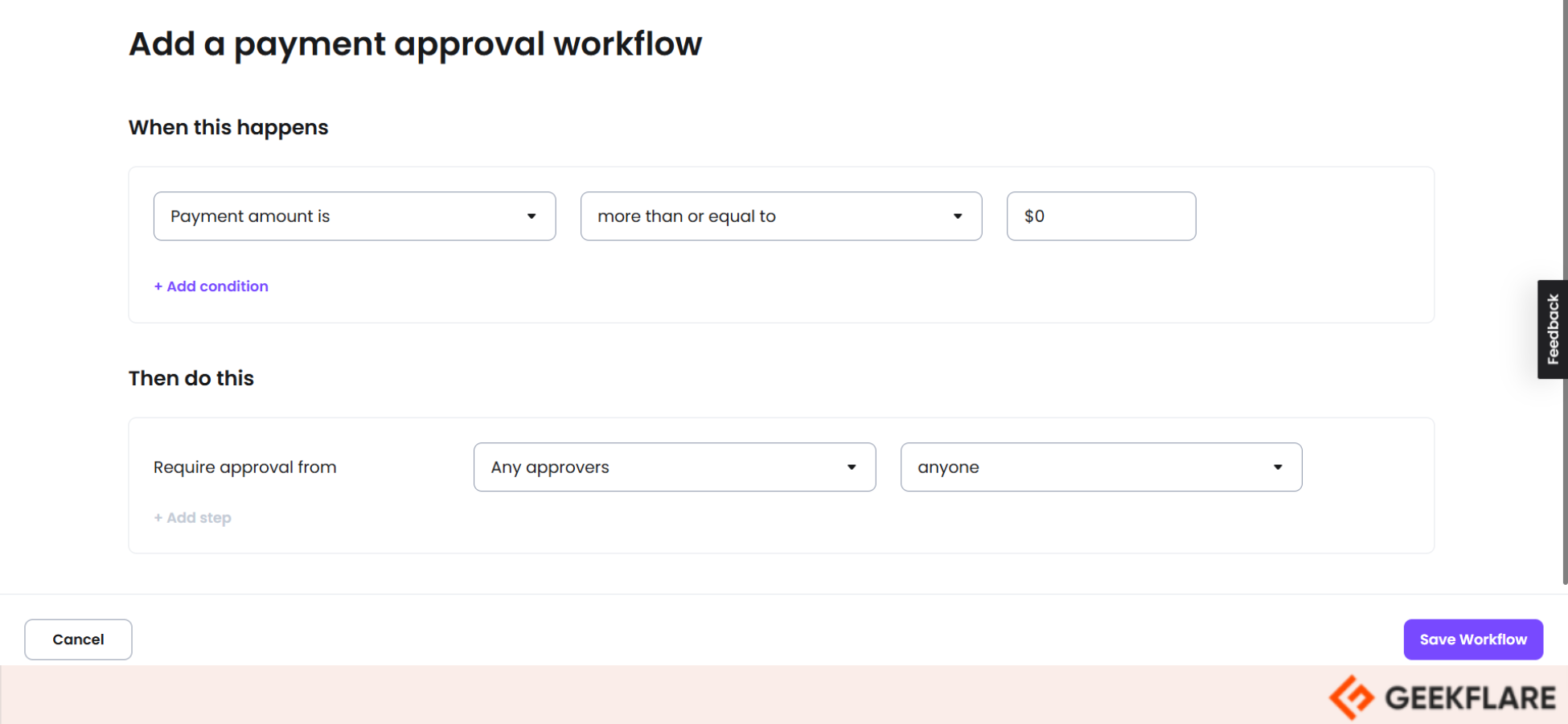

I liked Melio for its automated payment reminders, approval workflows, and 2-way accounting feature.

you could set up payment terms, manage limitations, and track payments in a single view.

you’ve got the option to also connect to your preferred bank using account or routing numbers.

Melio also allows you to upload and scan receipts, which connects with your accounting software.

Once youve connected it, the bills get automatically uploaded and tracked within the software.

However, Melio doesnt offer a direct accounting tool for bookkeeping and bank reconciliation.

Furthermore, I had to read a few guides before connecting the accounting software.

Melio offers integration with QuickBooks and Xero and tax software like Tax1099.

Another unique feature is Melios custom invoicing email.

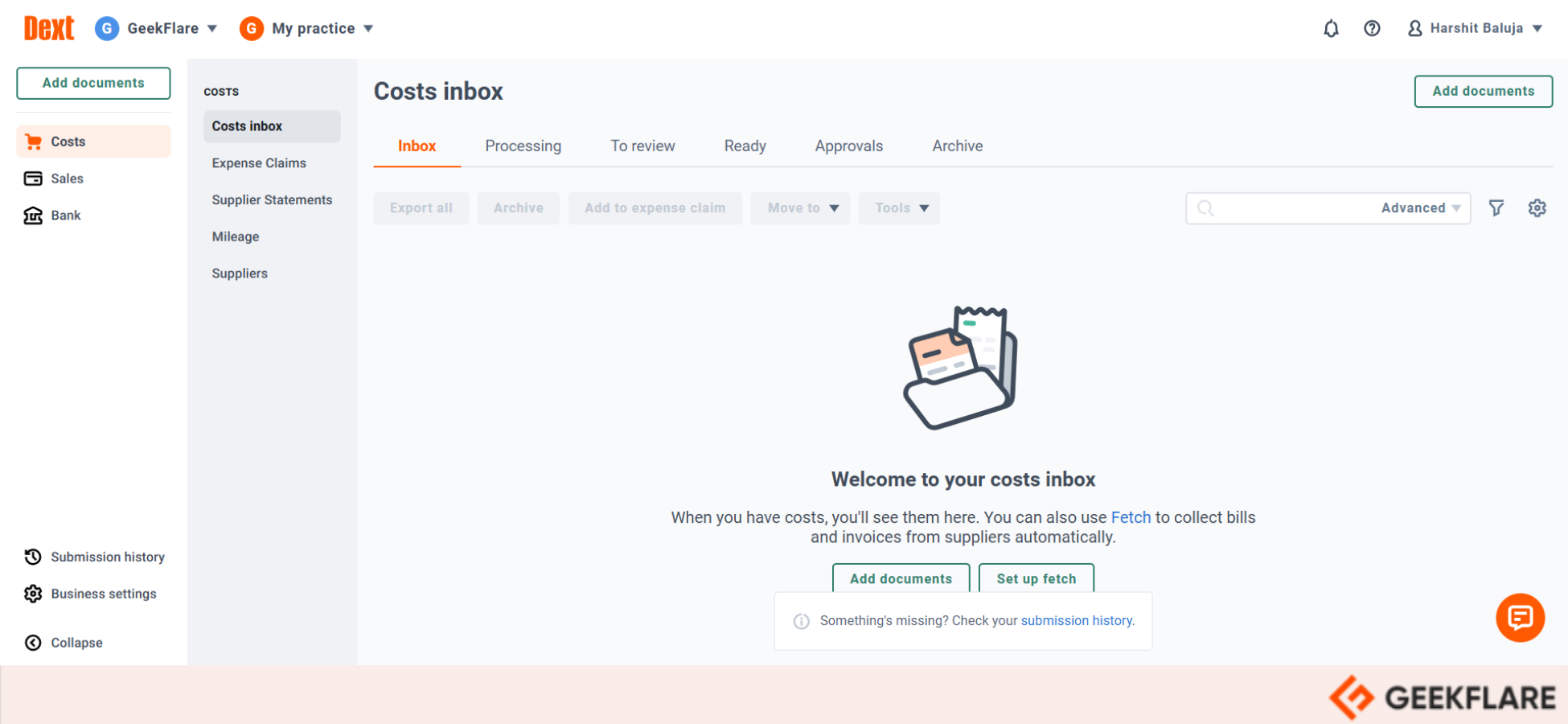

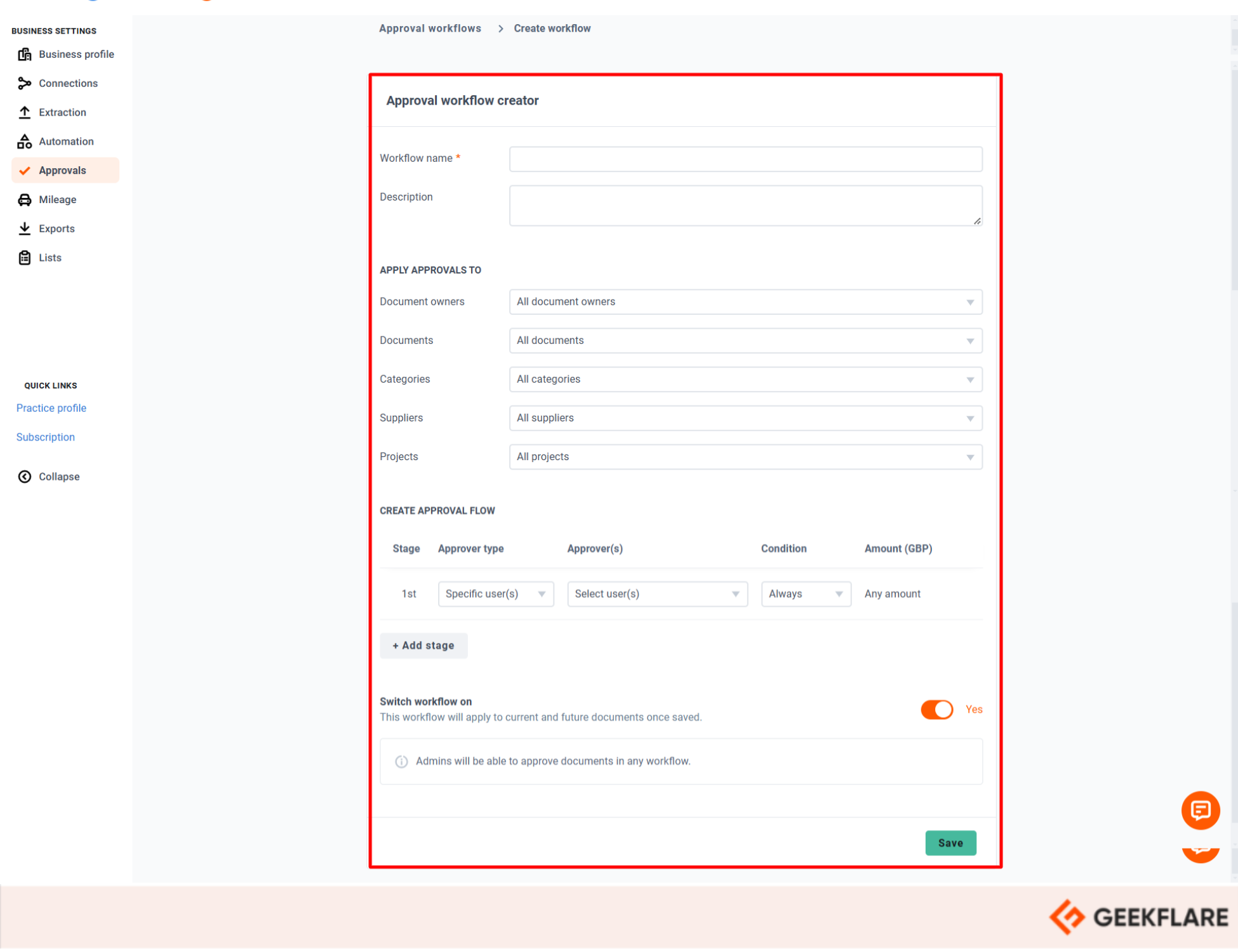

Automation is at the heart of this software.

Dext allows you to create automated workflows for processing invoices and expense claims.

you could also automate invoice matching and transaction categorization.

The tool also offers a collaboration feature that allows team members to engage and improve work efficiency.

BILL makes it into my list because of its extensive accounting features for accounts receivable and accounts payable.

Whats most intriguing for me is its AP and AR in conjunction.

What is Accounting Software?

Accounting software is a program that helps accountants and bookkeepers in recording and tracking financial transactions.

It helps you to keep check of the invoices, expenses, bills and sales tax.

Accounting software includes various features such as:

How much does accounting software cost?

In some software, such as Zoho Books or Melio, adding users may cost additional fees.

Are accounting software cheap?

Most accounting software is relatively cheap, depending on the size and features of your business.

However, the lower tier plans bring a limit on the number of users or limits the features.

What is the easiest accounting software?

Their offerings meet the core accounting management features for handling invoices, expenses, transactions, and payments.

Each solution is best for everyday accounting needs without overwhelming users with a dense, feature-rich platform.

What is the Best Accounting Software for Bookkeeping?

QuickBooksis one of the best and most popular bookkeeping solutions for small and medium businesses.

Higher tiers include tools to manage employees, project costs, and overall budget.

Are accounting software and budgeting software the same?

Accounting software and budgeting overlap heavily, but are not the same.

Accounting tools focus on recording transactions, managing invoices, reconciling bank statements, and generating financial reports.

Is Accounting software better than spreadsheets?

Is it okay to use invoice software instead of accounting software?

It depends on your requirements.

What is the difference between accounting software and payroll software?

Both applications coincide when it comes to tracking payments and tax forms.

What Does accounting software do?

Accounting software helps you manage your financial business information.

It is designed to automate and streamline tedious workloads and keep you on top of important bills and payments.

More robust systems will offer detailed reporting and analytics.

How does accounting software work?

Accounting systems are built on the concept of managing and analyzing financial data.

They aid business operations by helping you enter, import, extract, organize, and filter data.

Many tools offer limited or advanced financial reporting to highlight valuable insights.

What are the benefits of using accounting software?

Accounting software platforms provide the following 6 benefits to businesses.

Why do small businesses need accounting software?

What are other enterprise software programs that can help my business?

Knowing what integrations are available can also help you grow your current tech stack.

FAQs

Yes, Accounting software can handle multi-currency transactions in a vast number.

Some software can automatically convert currencies, record transactions, and generate financial reports.

Software like FreshBooks, Wave, and Zoho Books are prominent in multi-currency transactions.

Many free options offer essential features like invoicing, expense tracking, and basic reporting.

However, they lack advanced features, stellar support, and high-grade security.

More on Accounts and Payments

Best Free Accounting Software

Best Online Payment Solutions