We earn commission when you buy through affiliate links.

This does not influence our reviews, ranking, or recommendations.Learn more.

Expense management software helps businesses track, manage, and report expenses in a single platform.

It brings visibility into the companys expenses to understand spending patterns and reduce errors in managing them.

Even small errors can mess with your expense tracking and efforts to control budgets.

Moreover, it doesnt give visibility into expense management, making it difficult to find errors to fix.

An expense management software controls expenses by avoiding manual errors using automation.

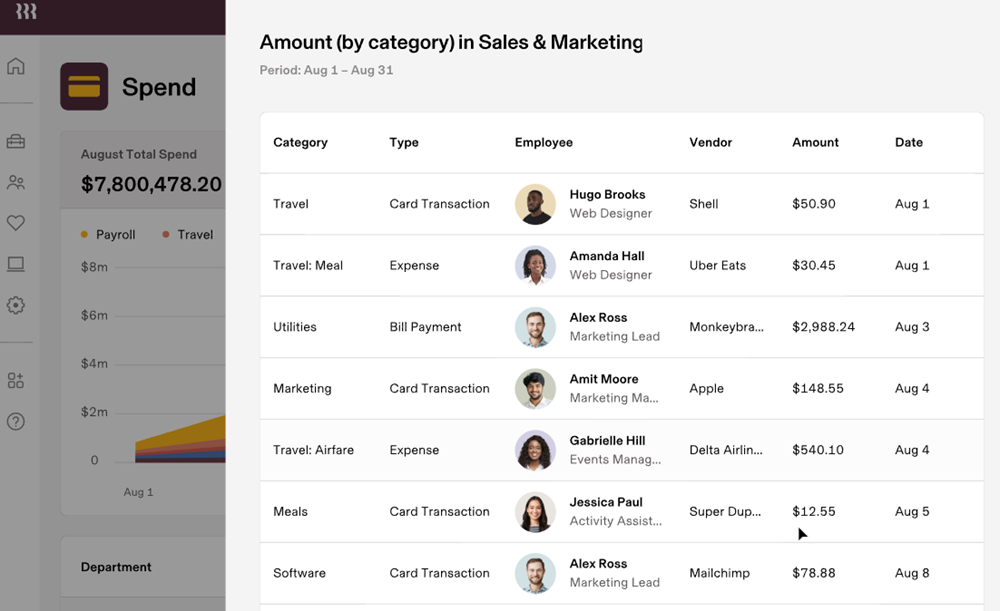

With Rippling, it’s possible for you to integrate payroll and reimbursement to simplify employee management.

The clean layout and automatic categorization help catch irregularities at a glance.

Moss

Best for Financial Transparency and Control

Mosss expense management software focuses on accounting and bookkeeping functions.

It allows you to issue credit cards with custom limits and approval policies tailored to employee roles.

This digitizes data for easy month-end closing calculations, thus improving the productivity of finance teams.

Moss is suitable for UK and European companies.

The interface makes it easy to edit or add new line items without jumping between tabs.

Everything you gotta submit an accurate reimbursement is right there in one place.

Inadequate forecasting features

3.

Companies can track all their expenses in real-time and stay on top of their budget.

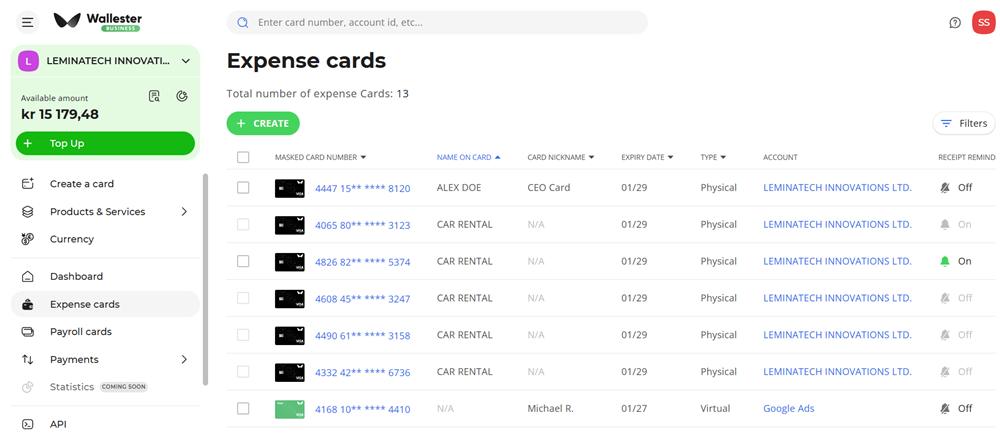

Wallester functions as an all-in-one expense control platform to monitor all kinds of corporate spending.

It allows companies to create virtual cards for their employees using the mobile app or the website within minutes.

All the expenses made by the card can be tracked in a unified system.

Below is a screenshot from Wallester showing an overview of expense cards issued under the company account.

It gives finance teams precise control over who spends what, and on which account.

Free plan, which includes 300 free virtual cards, makes it ideal for companies of all sizes.

Multilingual live support is available on any preferred messenger.

API for integration to accountant soft or CRM.

Daily and monthly limit-setting facility for cards and accounts.

Spending policy management for multiple cards.

Multi-level 3D secure 2.0 system to protect all business cards.

Simplified online media purchase facility for ad campaigns.

Steep learning curve for novice users

White-label visa card program launch can take up to 8 weeks.

Its service is not available in Asia.

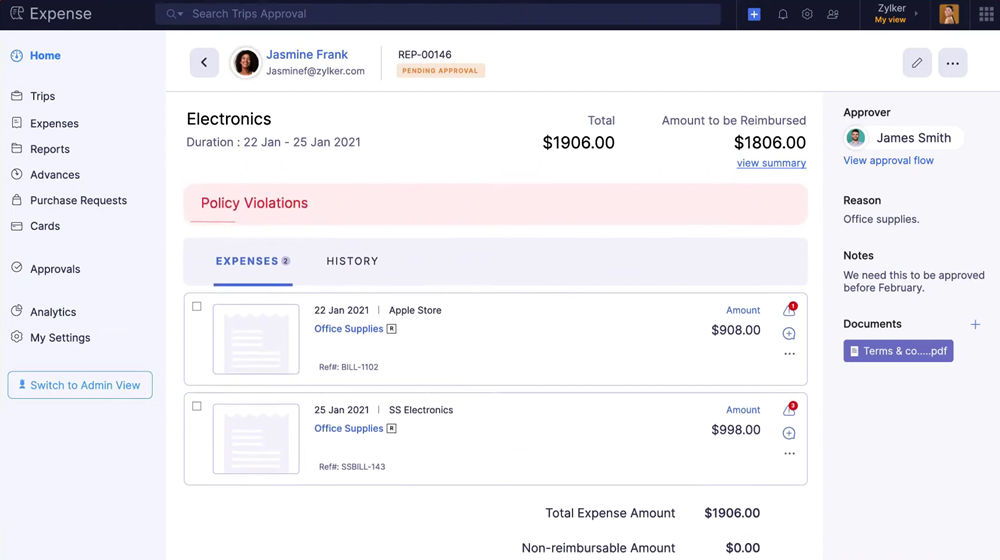

It provides dedicated expense management tools for handling online and offline travel workflows in a single platform.

Zoho provides a cost-effective solution to consolidate business expenses across trips, purchase requests, reimbursements, and more.

The layout also makes collaboration smooth, with notes and reimbursement summaries all neatly organized on the same screen.

Precoro

Best for Small to Medium Businesses

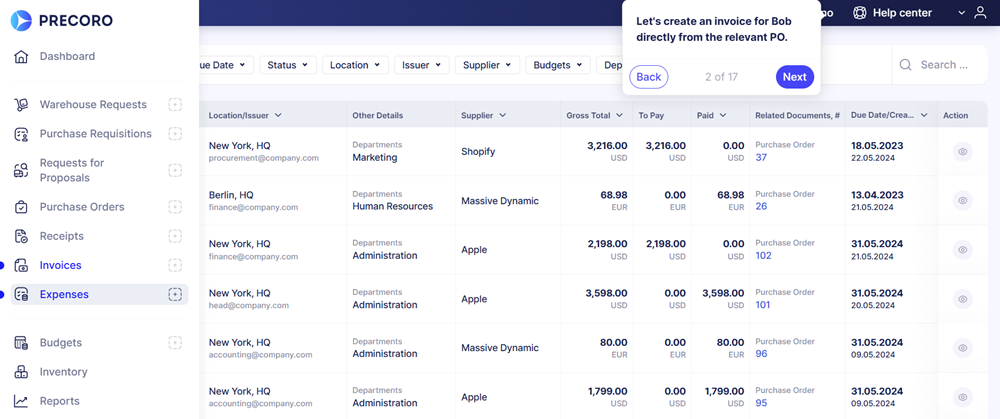

Precoro provides visibility and predictability into your employee expenses.

Procures features target budgeting efficiency in procurement and employee management to help your business make informed financial decisions.

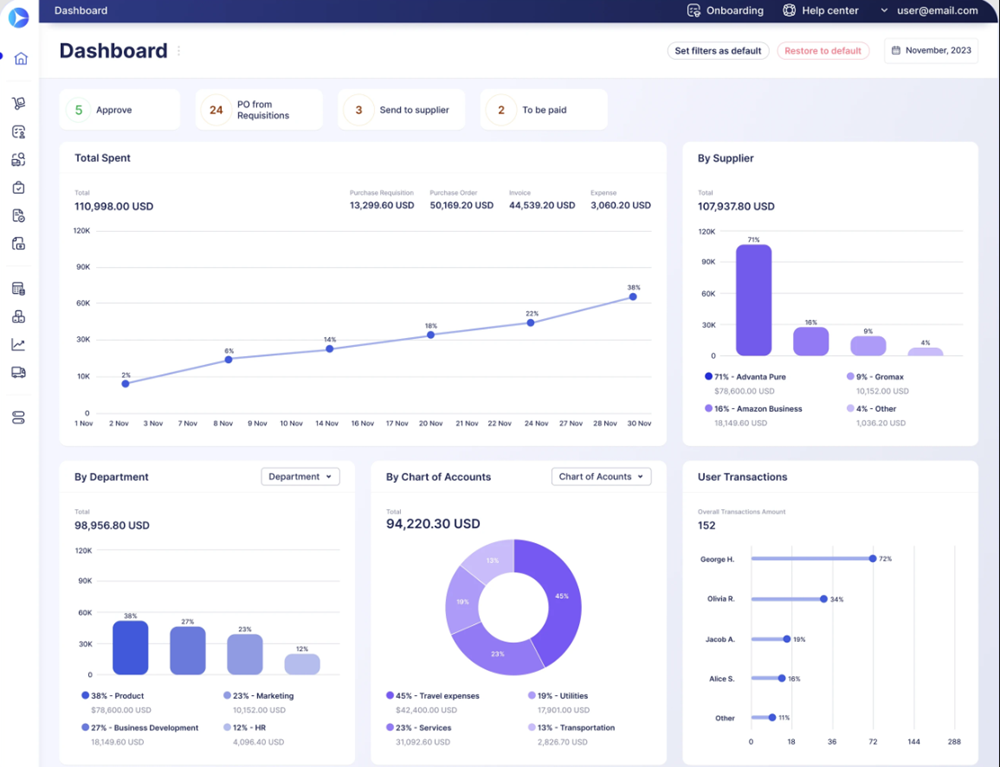

I found Precoros UI easy to use for managing expenses.

Filters for suppliers, departments, and issuers add precision, especially when working across multiple teams or locations.

The interactive charts help teams quickly understand whos spending the most and where.

This makes accounting easy, including for multi-entity expenses, thus making finance teams more productive.

With spending controls and insights, the business can strategize to ensure it meets budgets as decided.

A unique feature includes subscription management, where it can remove duplicates and handle recurring payments.

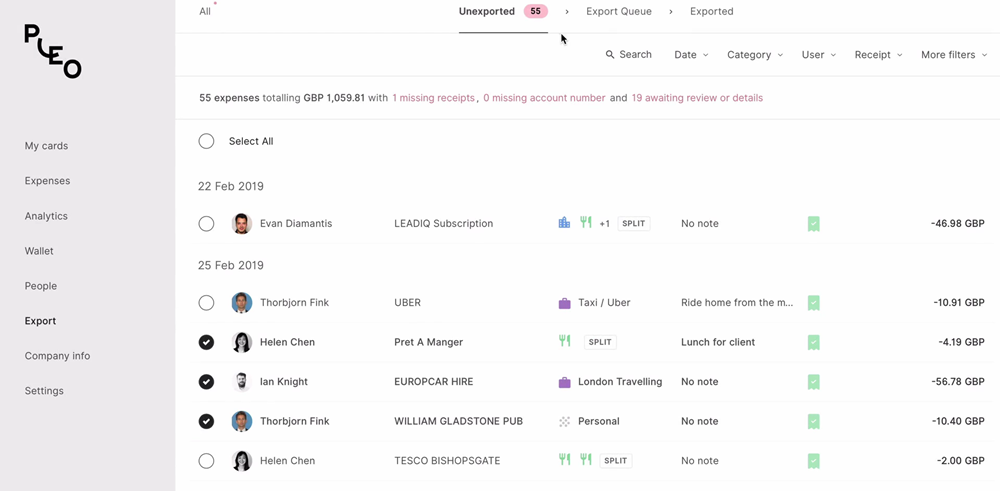

Below is Pleos expense management dashboard, giving a clean view of expenses incurred by each employee.

It also flags items with missing receipts or pending reviews.

The ability to split expenses and bulk-select them for export speeds up month-end reviews significantly.

Using its adaptable expense policy feature, you might tailor its expense management software to your industry.

Its travel expense management features make it ideal for organizations with frequent employee travel requirements.

It also provides physical and virtual cards that make controlling employee spending more seamless and integrated.

Its easy to add categories, business purpose, and team info all in one place.

Submitting receipts is simple you’re able to drag and drop or upload them straight from your gallery.

Complex integrations setup

Allows uploading only one receipt per transaction

9.

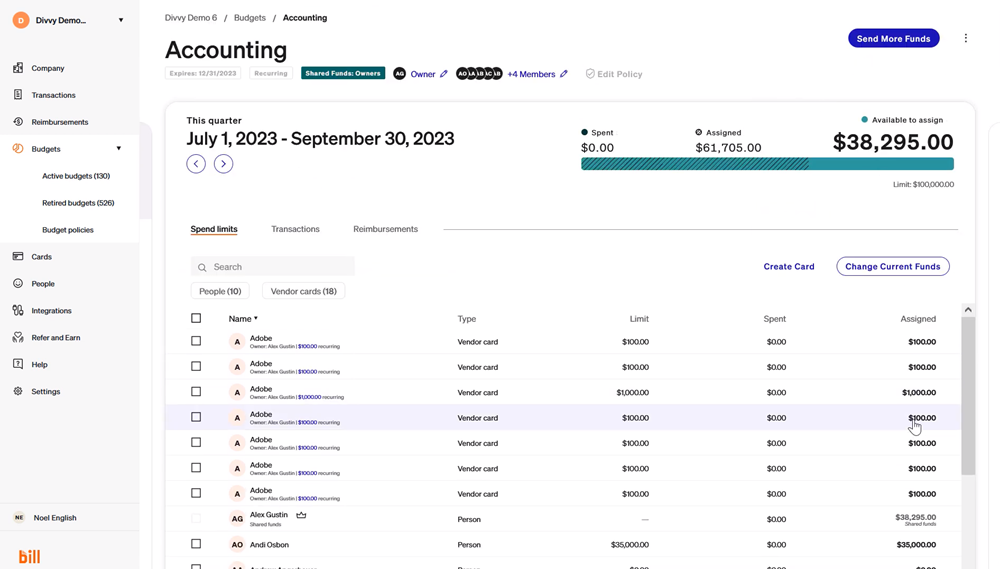

It also provides dedicated features to handle travel booking and expense tracking using the BILL Divvy Corporate Card.

It integrates with multiple third-party software, thus helping you make informed decisions with additional functionalities.

Its super handy when you better keep track of multiple subscriptions or team spend all in one place.

The interface shows the spend limits, transactions, and reimbursements for various vendor cards and users.

With budget-friendly pricing and a free expense management tool for individuals, it is good to get started.

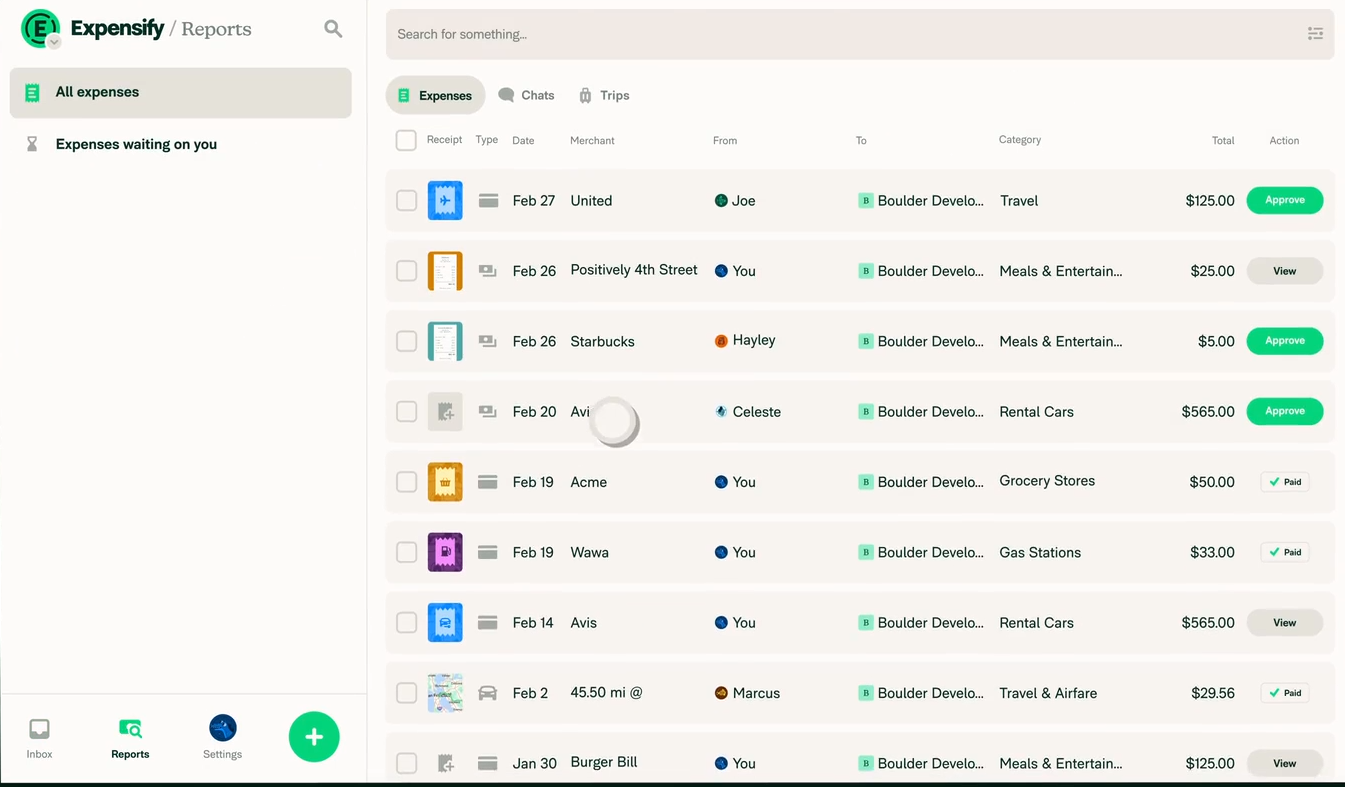

Expensifys dashboard, as shown above, is simple to understand and get started.

This makes reviewing and processing simple, speeding up the reimbursement workflow significantly.

What is an Expense Management Software?

Expense management software provides visibility into your business and employee expenses across operations.

This automates transaction entry and compliance checks.

What are the Benefits of Using Expense Management Software?

The software automatically flags non-compliant submissions and helps follow up with flagged expenses to investigate issues more deeply.

This reduces the risk of fraud or unauthorized spending.

It also notifies employees when they reach expense limits so that they are mindful of their ongoing expenditures.

Increase Business Visibility

Expense management software provides real-time visibility into spending patterns across business operations.

Finance teams can access dashboards that display current expenses, trends, and budget utilization.

With this visibility, they can make informed financial decisions.

For example, finance teams can quickly identify that travel expenses have surged in a particular department.

With this insight, they can investigate further and implement measures to curb unnecessary travel costs.

Optimize budgets

Cloud-based software to track expenses helps save, categorize, and organize data in real-time.

For example, a company may find that its marketing department consistently overspends on events.

With this insight, they can adjust future budgets or implement stricter approval processes for event-related expenses.

What is the Difference Between Expense Management and Spend Management Software?

Spend Management Softwareand Expense Management Software help automate and streamline business expenditures.

Do include cases where expenses might offshoot.

Then, optimize your spending limits in this range based on real expense values.

Explore setting up alerts in the expense management software when spending limits are approaching.

This helps employees quickly add receipts as they happen.

The mobile apps AI extracts required data instantly and submits or shares it with accounting software for further processing.

A mobile app increases the pace at which finance teams receive expense data for making on-time financial decisions.

These benefits include faster processing times and reimbursements.

Enforce Timely Submissions

Sometimes, employees lack the discipline to submit expenses on time.

In addition, such late submissions negate the benefit of gaining visibility into employee expenses.

Finance teams cannot make informed decisions in real-time about controlling budgets and maintaining cash flow.

For this, set up automated notifications within your expense management software that remind employees of upcoming submission deadlines.

Explore expense management software like Zoho Expense, Pleo, and Rydoo, which provide dedicated expense auditing features.

For other software, you might use analytics features to generate reports on spending trends.

It also helps track and sync expense data in real-time.

With corporate cards, you simplify the reimbursement process as they are easier to monitor than individual reimbursements.

This reduces claim related delays and eliminates the need for a manual reimbursement and approval process.

Corporate cards help in automatic matching of receipts and month-end account reconciliation.

Many corporate roles involve using employees personal devices for official purposes.

Companies also provide mobile devices and laptops to employees, who may at times use them for personal purposes.

Of the tools discussed in this article, Emburse offers telecom expense management feature.

Apart from this, there are specialized Telecom expense management solutions offered by Genuity, Brightfin, and Tangoe.