We earn commission when you buy through affiliate links.

This does not influence our reviews, ranking, or recommendations.Learn more.

No more late-night number crunching on spreadsheets or frantic Googling of federal and local tax laws.

Payroll software handle everythingautomating calculations, tracking time, and even ensuring your team gets paid on time.

They offer 5 main benefits to business owners and HR professionals.

This is a clear indication of companies looking to improve payroll processing.

you’re free to trust Geekflare

At Geekflare, trust and transparency are paramount.

The features and pros and cons will be discussed in detail later in this guide.

Phone, email, and chat support during business hours.

Phone and email support during business hours.

Phone and chat support during business hours.

Accounting, expense tracking and HR platforms

Financial, productivity, HR platforms.

Accounting, Expense Management, HR tools.

For large enterprises, ADP offers APIs for integration with your existing software.

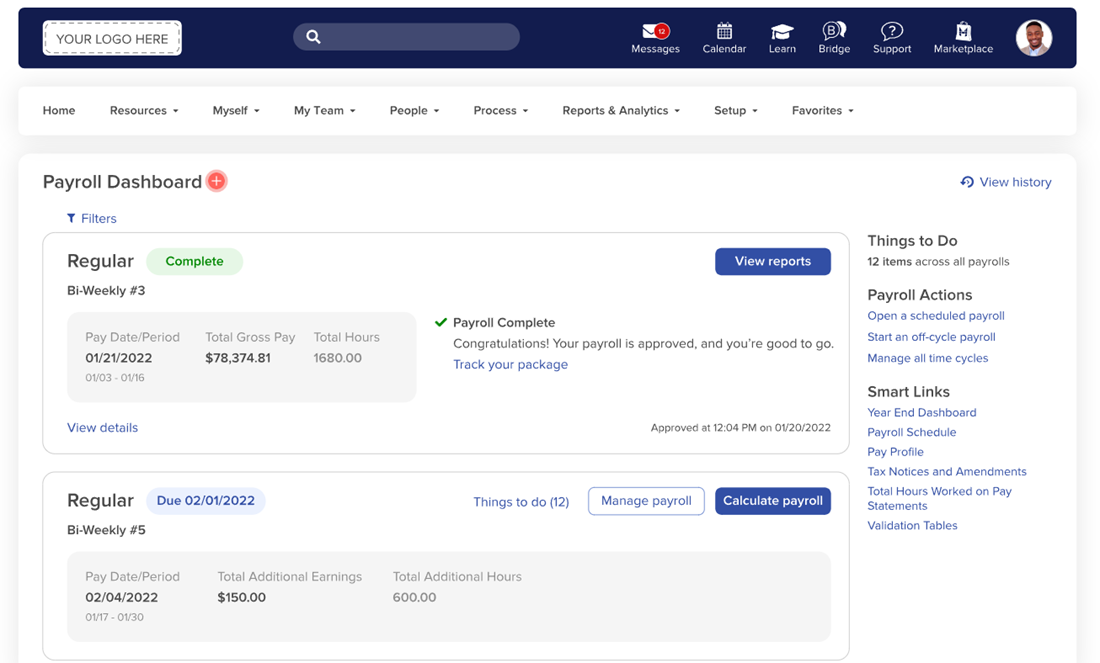

ADP Payroll Softwares dashboard displays payroll status, pay periods, total earnings, and hours worked.

It also includes payroll actions, reports, and quick access to essential payroll management features.

you might see whats completed, whats due, and quick links to reports.

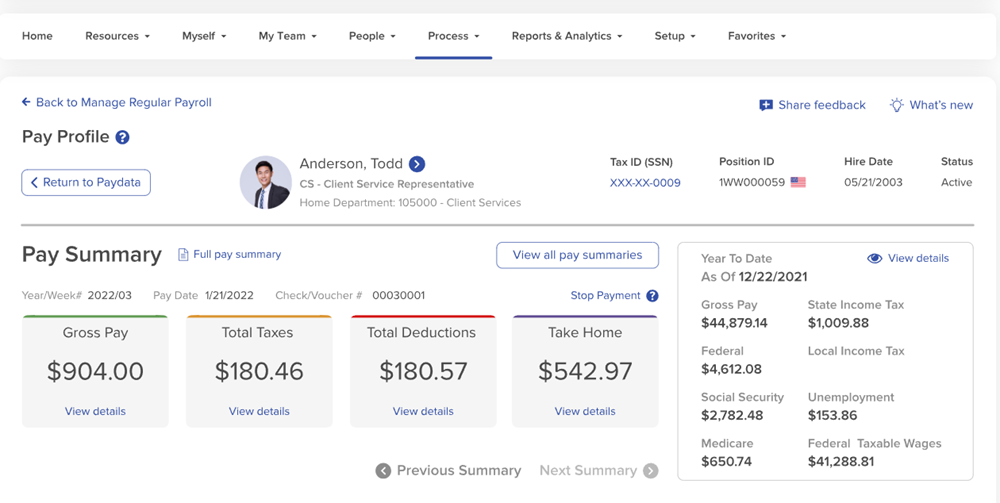

Below is the Pay Profile section.

It includes details such as employee information, gross pay, taxes, deductions, and take-home pay.

The interface also provides access to pay summaries and year-to-date earnings.

I also like the mobile access feature, as it offers on-the-go payroll management.

It also helps in quickly submitting claims and expenses.

24/7 access to certified payroll professionals.

Cons

Form fill up needed to get custom quote.

Steep learning curve for novice use.

Pricing

ADP Payroll offers multiple plans for both small business and mid-large sized business.

it’s crucial that you ask for custom pricing for the plan that suits your needs.

It simulataneously calculates payroll taxes and syncs the data with your accounting software to ensure compliance.

It offers bulk payment option for easy payroll processing and a free HRIS module to manage your workforce.

It allows organizations to compare employer costs, bonuses, taxes, and other parameters.

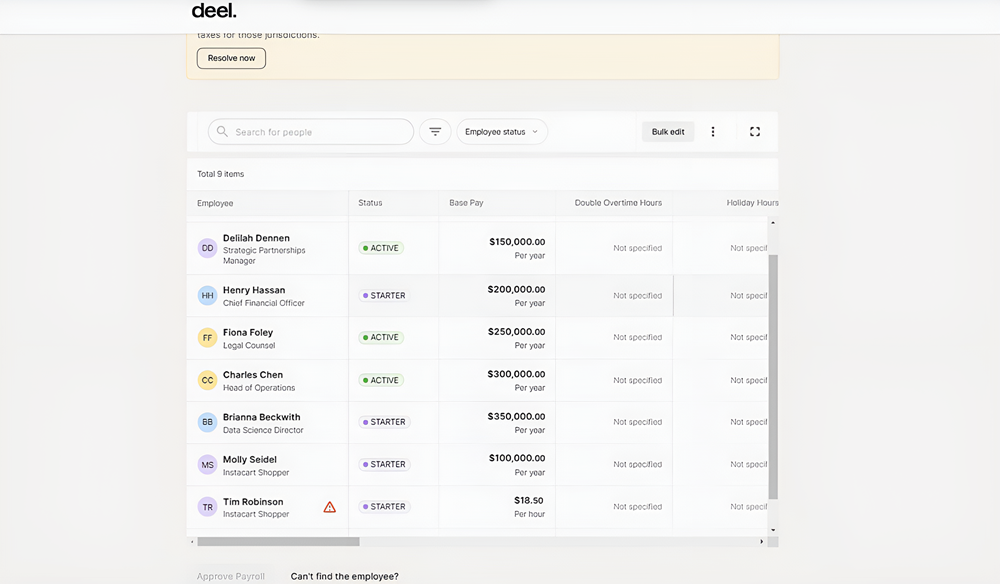

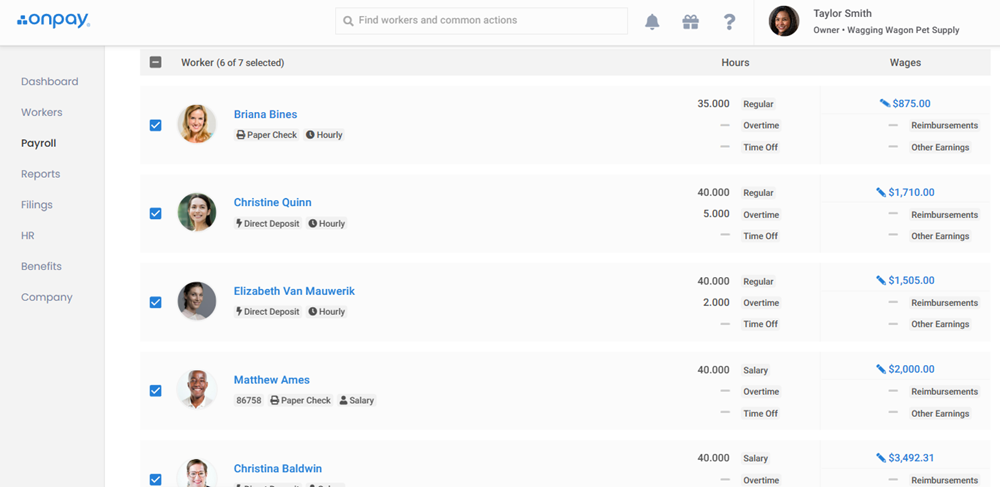

The interface allows for bulk editing and filtering by employee status for streamlined payroll management.

This integration simplifies businesses management and increases efficiency.

Deel API to connect with HRIS, finance, and ERP systems.

Payroll support for all 50 states of the US.

24/7 support with dedicated CSM.

No additional charges for off-cycle payroll runs

Payroll implementation might take up to 3 months.

No free trial available.

you’re able to choose from the following subscription plans to use Deels payroll service.

Its intuitive and self-explanatory UI makes it the best payroll software for a user-friendly experience.

Your employees can use Pre-Check service to instantly approve their pay check before payday and avoid costly payroll discrepancies.

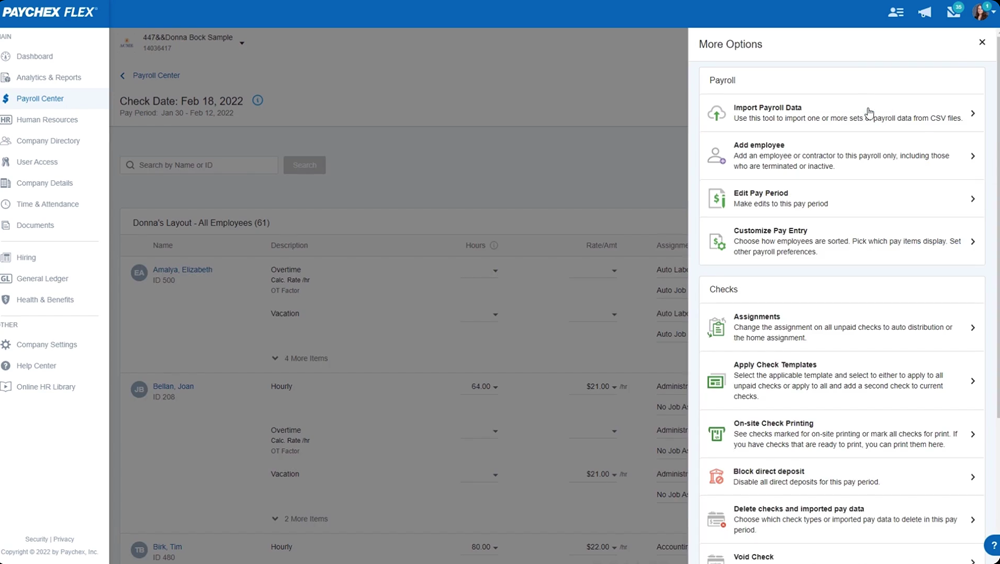

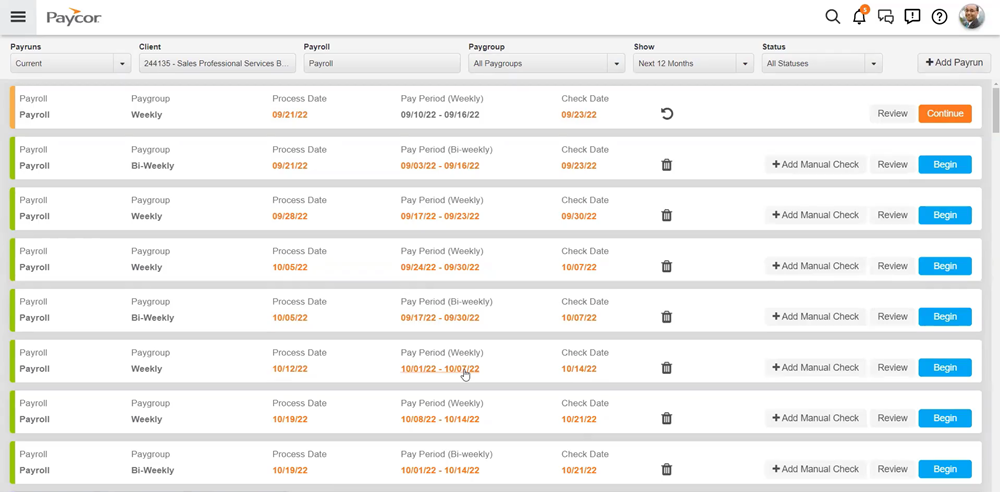

Below is a screenshot of Paychex Flex payroll software.

It shows the Payroll Center with employee payroll details, check dates, and pay periods.

I find Paychexs ever-expanding API library to be a valuable feature for the companies with in-house developers.

It makes hiring, managing, paying, and retaining employees easier.

Free mobile payroll app for employees.

24/7 US-based customer support.

A separate tool is needed for time-tracking.

Costly tool for smaller teams.

Paychex has three plans Select, Pro and Enterprise.

you should probably provide your company information to get a custom quote.

Gusto

Best Payroll Provider for Small Businesses

Gusto provides industry-specific payroll and HR solutions for US companies.

Its proactive compliance alerts and automated tax reporting features prevent businesses from making human errors.

It ensures accurate and timely tax submissions, avoiding potential penalties.

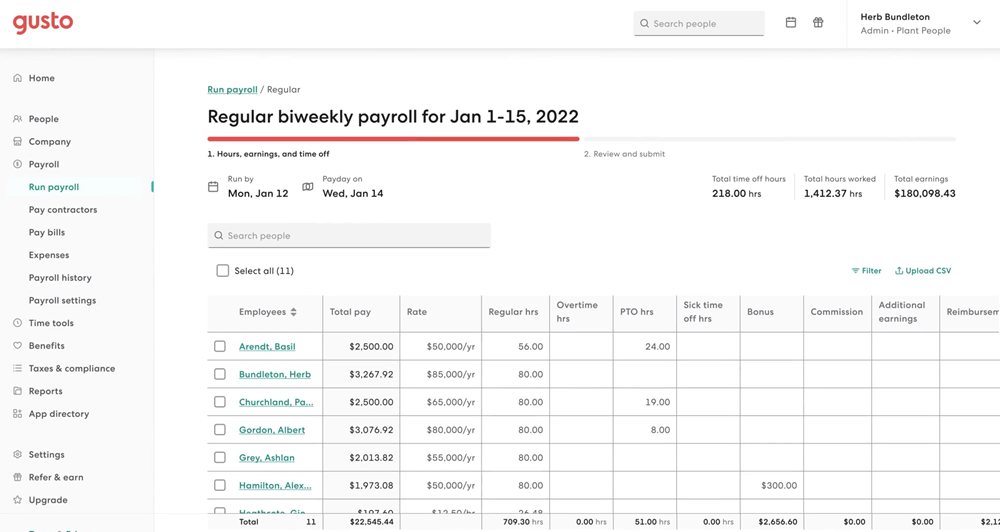

The interface provides options to filter data, upload CSV files, and review payroll before submission.

The Payroll history section is particularly useful for quickly reviewing past payments and ensuring payroll accuracy.

It offers HR functionalities that sync well with the payroll software to simplify the data management process.

Its employee self-service portal reduces your HR workload.

Businesses looking for HR and payroll integration should opt for Paycor.

Paycors in-product compliance updates is a very useful feature.

With the Review button, you could double-check payroll details before finalizing and processing payments.

Tax Compliance Dashboard with proactive alerts.

Paycor mobile wallet for employees to access wages and pay card info.

Global payroll feature not available.

Customer support needs to be improved.

Hence, its unified system allows smooth syncing of HR data with payroll.

Companies can track time and attendance from the same platform, review expenses, and manage employee benefits.

I find Ripplings extensive integration support to be highly beneficial.

It integrates with 600+ applications, including QuickBooks Online, Xero, Sage Intacct, and NetSuite.

Its reports on payroll analytics help with visualization and informed decisions.

Rippling featuresbuilt-in compliance tools that help businesses stay aligned with tax regulations and labor laws.

Its reports on payroll analytics help with visualization and informed decisions.

100% guaranteed error-free payroll.

Run payroll in 90 seconds.

Pricing information not available.

it’s crucial that you contact Rippling for a demo and the pricing.

To know more about the features in detail, read ourRippling HR review.

Its monthly base pay and per-employee charges are affordable for businesses of all sizes.

Hence, Patriot is an affordable payroll and ideal for startups.

Patriot softwarecan be accessed from any unit without downloading it.

These enable businesses easily interpret payroll data.

I would recommend Patriot payroll for its feature of filing company tax on time with 100% accuracy.

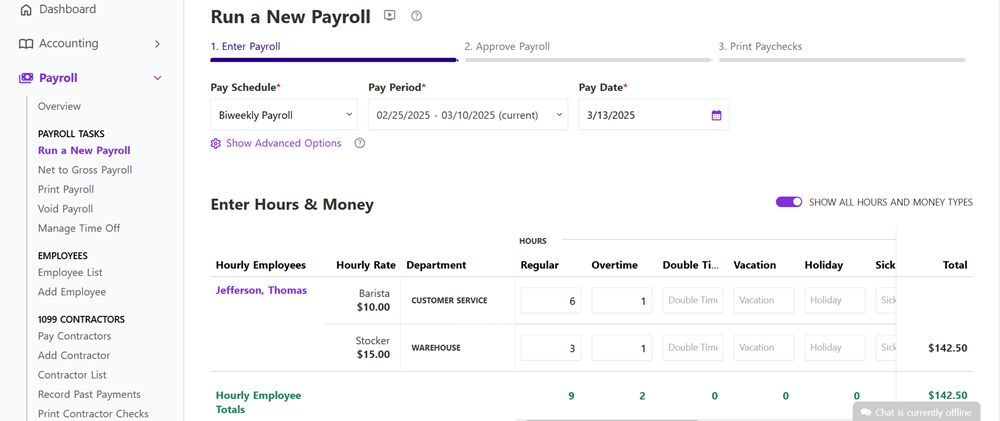

It also shows employee hours, hourly rates, and department details.

Unlimited payroll runs without extra charges.

30-day free trial

Free integration with 401(k) and workers comp.

Integration with Patriot Accounting and QuickBooks.

Year-end payroll tax filing without extra charges.

Only available to companies in the US.

No mobile app is available.

Partiot offers 2 plans on the payroll software.

There is a 30-day free trial and a 50% discount for the first 3 months.

Hence, QuickBooks Payroll is the best choice for integrating with other QuickBooks products.

I like the feature of syncing QuickBooks Payroll with QuickBooks Time.

It increases payroll accuracy and reduce risks involved with manual entry.

It also supports managing timesheets and connecting time-tracking data to reduce payroll costs.

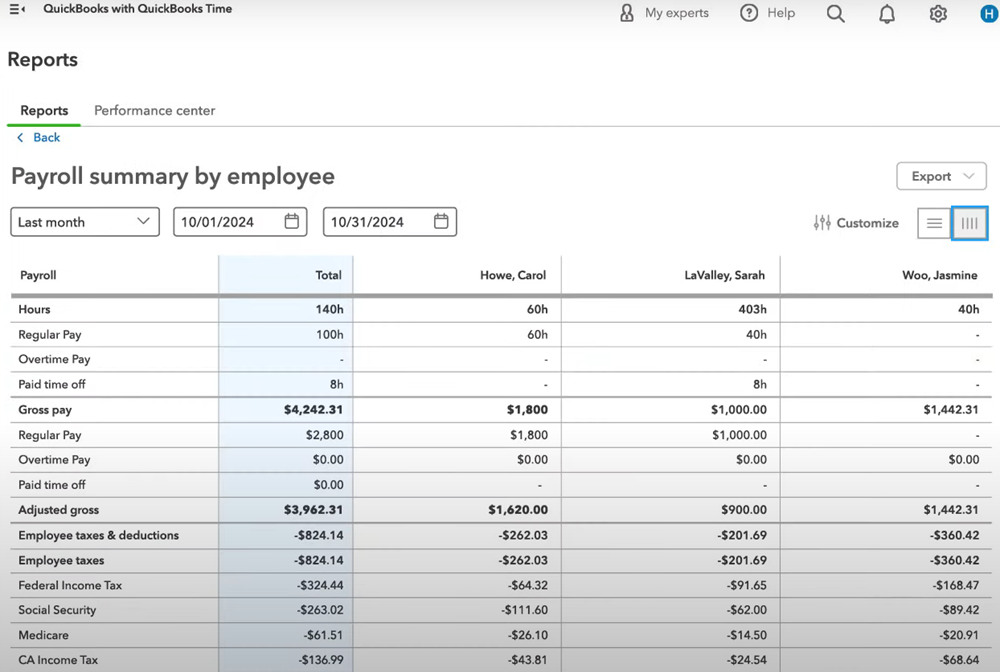

As shown above, the QuickBooks Payroll software displays a payroll summary by employee.

This report helps businesses track payroll expenses efficiently.

100% accurate tax calculation guaranteed.

Workflow automation is only available for Advanced plan users.

Time-tracking feature is not available for Core plan users.

QuickBooks Payroll is available as standalone and QuickBooks Online add-on plan.

Standalonebase pricing starts at $42.50/mo + $6/employee/mo.Add-onstarts at $25/mo + $6/employee/mo.

Add-on subscription will be ideal if you are already using or planning to use QuickBooks Online accounting software.

Its straightforward pricing is suitable for a small team and includes basic HR tools in addition to the suite.

So, if you are a growing business, OnPay is the perfect choice for you.

OnPays report designer caught my attention.

It enables custom views and filtering by employee jot down, location, or department.

OnPays payroll section shows a list of employees with their work hours and wages.

Unlimited payroll run per month.

Free setup and data migration.

Includes full suite of HR tools.

Multi-state payroll with no extra fees.

No phone or chat support on weekends.

OnPay offers simple pricing of $40/month base fee with $6/person/month.

It reduces the workload of payroll management and saves companies from manual, time-consuming calculations.

For these reasons, Wave Payroll is ideal for small businesses and freelancers.

Such updates financially and strategically benefit freelancers and small businesses.

Setting up and managing payroll straightforward.

Live chat on weekdays and email support for prompt assistance.

Automatic payroll journal entry.

Unavailability of live phone support.

Tax filing available in limited states.

Wave users can opt for its free forever plan or choose paid subscription at $16/month.

BambooHR Payroll

Best for Customization

BambooHR Payroll is an HRIS solution that streamlines your compensation process.

It offers customizable workflows, custom reports, and self-service tools for admins and employee management.

Thus, BambooHR Payroll is an excellent choice for those looking for customization in payroll software.

BambooHR Payroll automatically fetches all time-tracking, benefits, and time off data from one place.

It eliminates the need for double data entry or manual approval.

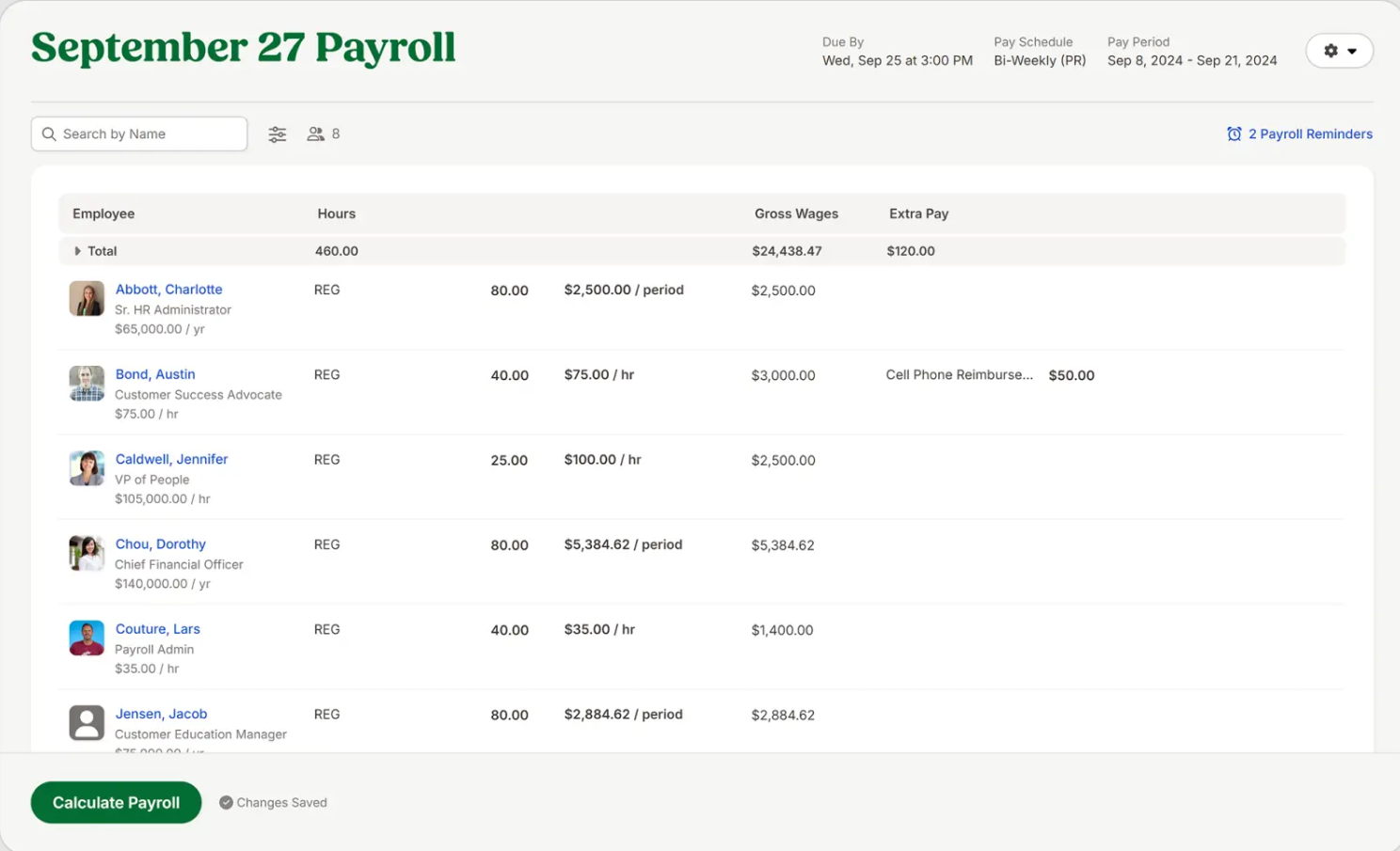

The Calculate Payroll button ensures you might finalize payroll efficiently, with changes automatically saved to prevent errors.

The Payroll Reminders feature on top right ensures you never miss a pay run.

With the wages and reimbursements displayed transparently, you could quickly verify totals before processing payments.

Mobile payroll app available.

120+ software integration support.

Unavailability of a transparent pricing structure.

The interface is difficult to use.

Why Do Small Businesses Need Payroll Software?

Small businesses needpayrollprocessing software to calculate employees and contractors wages and streamline payment processing and payslips.

It helps in 5 ways, as listed below.

How Does a Payroll Software Work?

Payrollsoftware automates the process of calculating and making employee payments.

If needed, companies can apply different rates for different employees.

Then, it pays the employees via direct deposit or cheque on a scheduled date.

Somepayrollsoftware generates pay stubs for employee records and allows users to print them.

What is the Best Time to Switch Payroll Providers?

It will be easier to start using the new payroll software with a clean slate in January.

What is the Average Pricing for Payroll Software?

The average starting base pay of apayrollsystem ranges between $10-$30 per month.

These applications additionally cost $4-$6 per employee.

Deel US Payroll charges $19/employee/month.

Wave, on the other hand offers a free forever plan with limited features.

The 5 factors that contribute to the pricing ofpayrollsoftware are as follows.

What are the Advantages of Payroll Software?

Usingpayrollsoftware has the 5 following advantages.

What are the Disadvantages of Payroll Software?

Usingpayrollsoftware has the following disadvantages.

What is the Difference Between Payroll Software and Accounting Software?

Payrollandaccountingsoftware differ, though someaccountingsoftware likeQuickBookshas apayrollfeature.

Withpayrollsoftware, companies manage employee compensation, while anaccounting softwareoversees broader financial tasks.

Apart from this, there are 6 differences betweenpayrollandaccountingsoftware, which are as follows.

Key Takeaways

Below are 5 main takeaways from the discussion on the top payroll providers.

References

1.HR Payroll Software Market Insights Skyquest2.Switching payroll providers Gusto3.Switching payroll providers ADP Payroll