We earn commission when you buy through affiliate links.

This does not influence our reviews, ranking, or recommendations.Learn more.

you’ve got the option to trust Geekflare

At Geekflare, trust and transparency are paramount.

This includes managing multi-entity transactions as well you get holistic visibility into complete employee expenses at the organizational level.

Pleo gives teams a clear overview of spending, ensuring every transaction is tracked and categorized.

Cons

Users report glitches like invoice document uploading errors, misaligned tags, transaction failures, etc.

Wallester Business

Best for Monitoring Spending Limits

Wallester Business is an all-in-one business expense control software.

These business cards are highly secured with a 3D secure 2.0 system.

Moreover, it shares instant notifications to reduce the chance of fraud cases.

Businesses can even track their progress toward budget limits and get alerts when they exceed their limits.

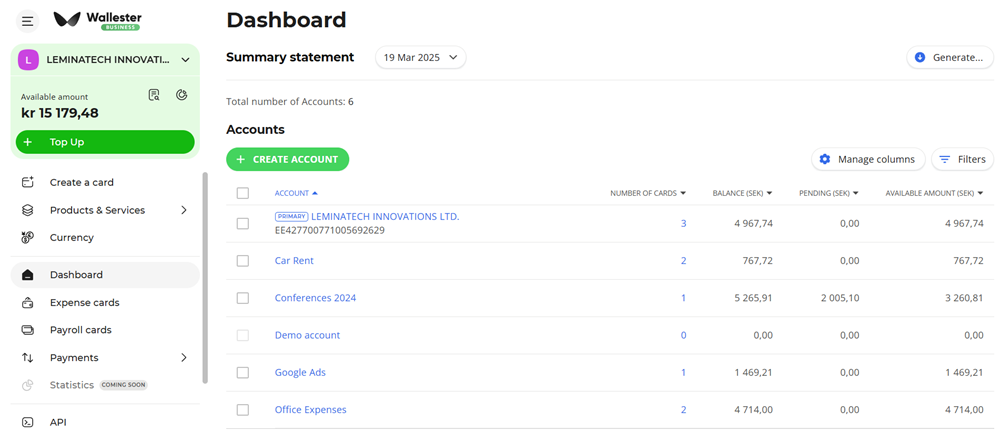

Above is Wallesters dashboard showing account balances, available funds, expense categories, and pending transactions.

It allows businesses to manage multiple accounts, create new accounts, and filter financial data for better insights.

Wallester is free forever, but charges for your card usage.

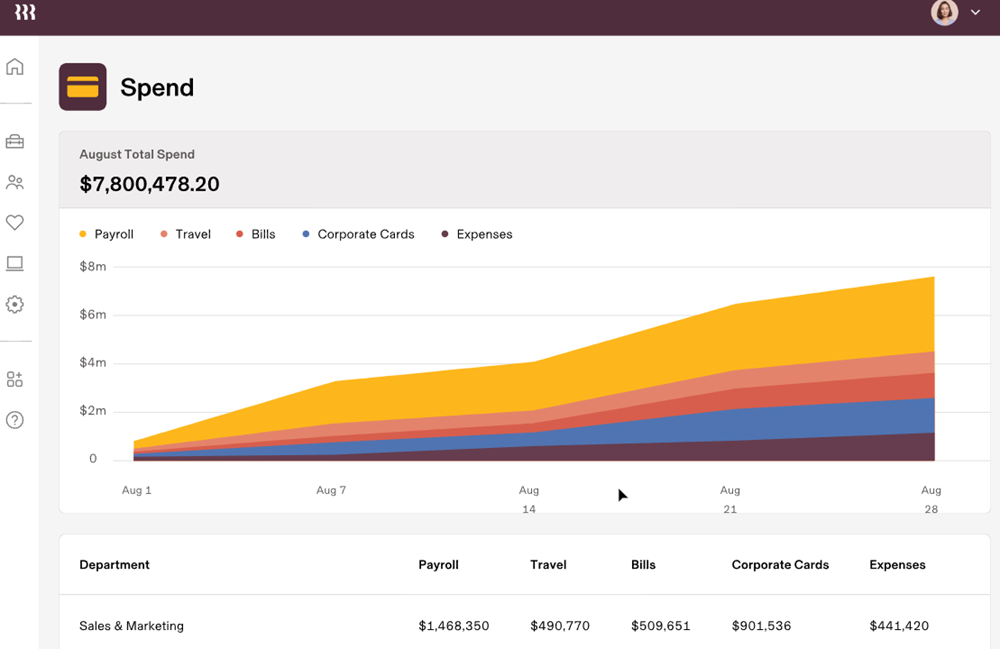

you’re free to centralize expenses across corporate cards, travel, bills, and more.

There are 3 main modules offered by Rippling Spend.

I like the workflow automation and policy builder, it allows you to stay compliant and control the budgets.

ping the sales team with your requirements.

you might also link different virtual cards to your physical card for seamless card management.

These features make Ramp a great option for companies of all sizes looking for corporate card management features.

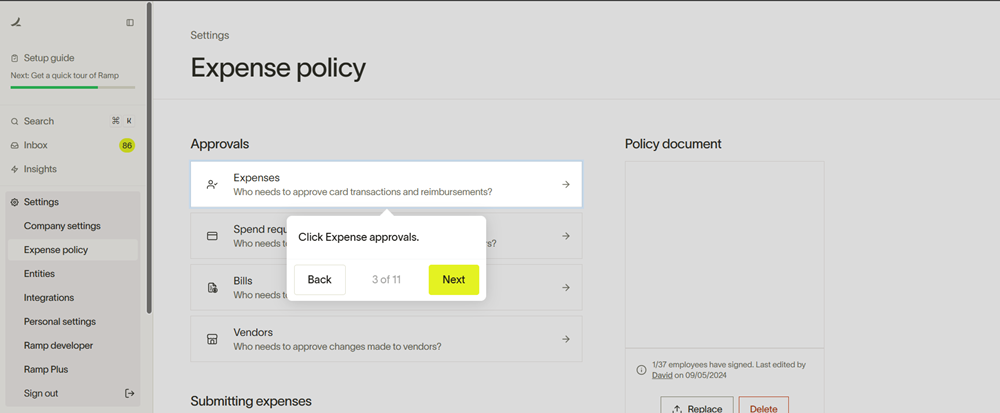

Ramp lets you set up expense policies and define who approves transactions at different levels.

However, there are charges for card usage.

It uses corporate cards to decide spending limits and track transactions for easier and faster month-end closing accounting.

Moss provides dedicated ERP integrations, and its pricing is not based on the number of users.

This makes it a practical option for enterprises or organizations with large teams looking to control their finances.

This ensures that accounting teams spend less time chasing details and more time on meaningful tasks.

Pricing for Moss is available on request.

This means it can process invoices and receipts in 60+ languages, saving you time translating them manually.

Payhawk offers ERP integrations, unlimited users, and customizable spending policies for effective budget control.

This makes it ideal for multi-entity companies with large teams looking for exhaustive finance management features.

It provides a unified platform for tracking spending across departments and global branches, enhancing visibility and control.

I liked how it pulls relevant data directly from the invoices, reducing the hassle of manual data entry.

Plus, categorizing each expense and adding notes makes expense tracking effortless, even when traveling.

Payhawk offers 3 options Premium Cards, All-in-one Spend, and Enterprise.

Pricing for all these plans is available on request.

Airbase

Best for Procure-to-pay Software

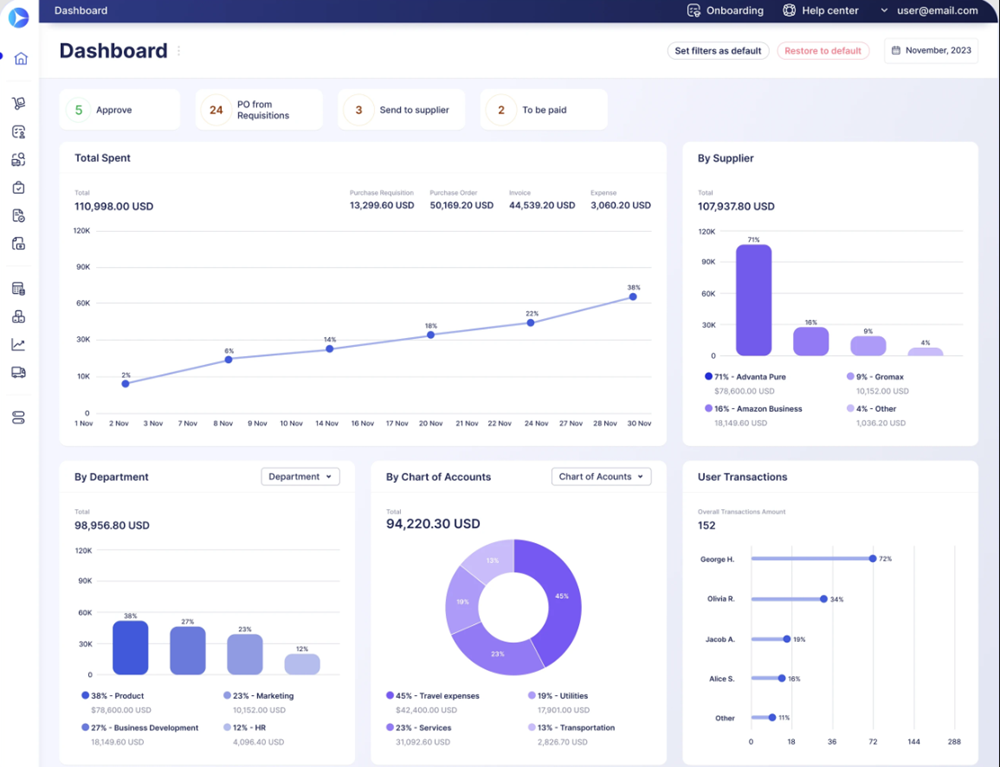

Airbases spend management solutions focus on automating procurement to payment workflows.

Airbase suits multi-entity companies looking for guided procurement software with ERP integrations and multi-currency to manage business spending.

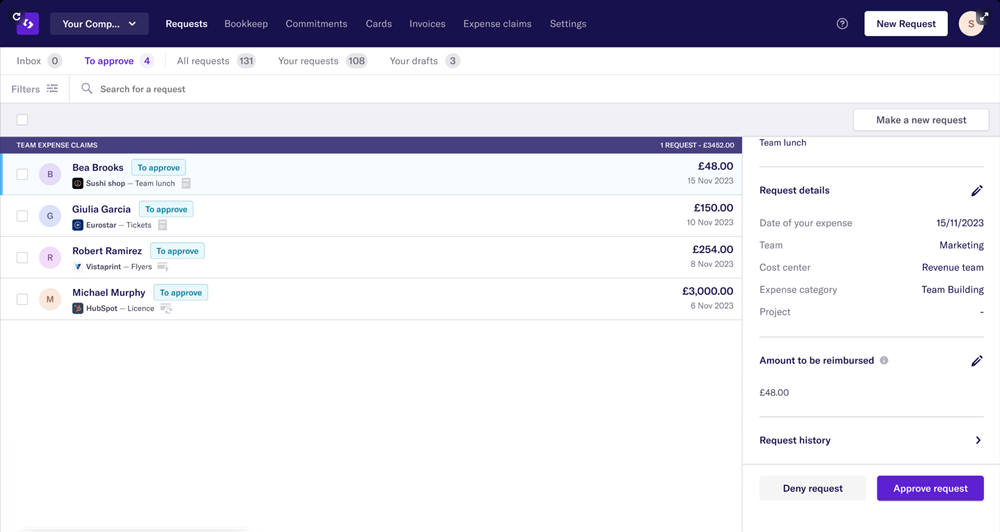

The quick access to receipts and expense reports on the right side is another handy feature I noticed.

They also offer custom packages.

Its easy to monitor ongoing approvals and track transactions, making sure nothing slips through unnoticed.

only

Does not allow advance or partial payments

Precoro offers the below 3 plans.

Spendesk

Best for Real-Time Spend Visibility

Spendesk focuses on streamlining operational spending for better finance management.

Tracks multiple payment formats across subscriptions, travel, ads or marketing, reimbursements, and more.

Spendesk offers 3 plans Essentials, Scale, and Premium.

The pricing for these plans is available on request.

It syncs and shares data with leading ERP solution providers like NetSuite or Quickbooks for seamless accounting.

It also helps manage global business spending and reimbursements.

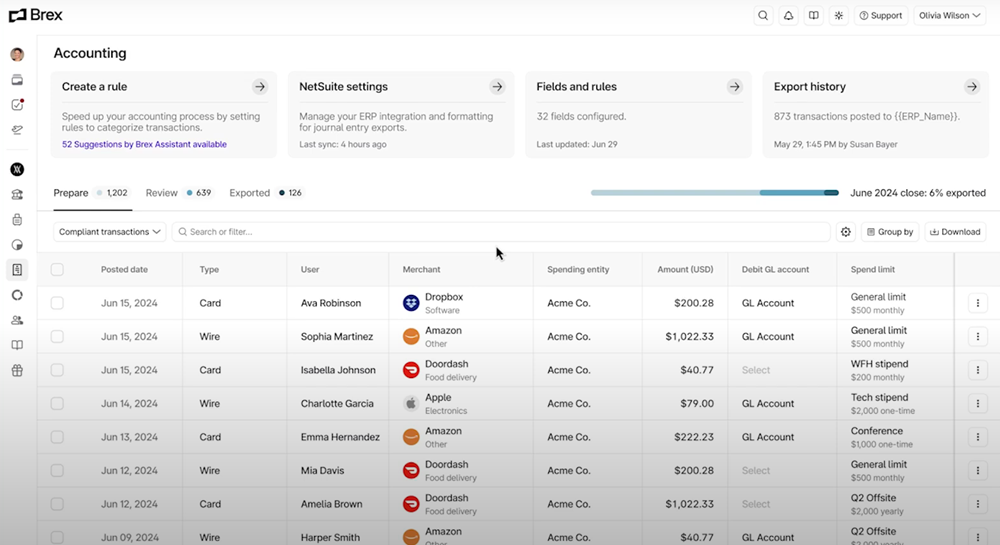

Such features make Brex ideal for companies overseeing transactions and expense reviews in depth for better budget controls.

Also, having detailed transaction tracking and export history gives clear visibility into company spending.

SMEs can take their ventures global as Emburse supports 64 languages and 140+ currencies for spend management.

It also allows you to manage card transactions, approvals, and reimbursements directly within the interface.

It also provides corporate cards with automatic expense categorization.

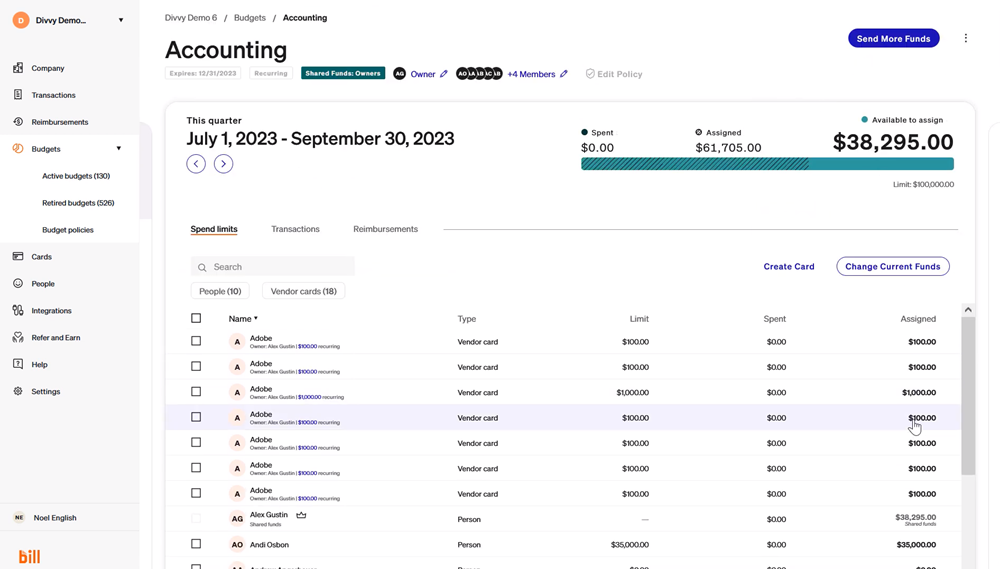

It instantly shows whats spent and whats available, giving a clear financial snapshot.

It clearly presents budgets, transactions, and reimbursements all in one place.

What is Spend Management Software?

The aim is to reduce expenses, vendor risk, and budget fluctuations by placing automated spend control measures.

Effective spend management solutions typically include accounts payable, procurement, and expense management tools.

What is the Difference Between Expense Management Software and Spend Management Software?

Expense management software focuses on tracking and reimbursing expenses made by employees after the transaction has occurred.

Other tools analyze spending patterns to identify vendors that deviate from your budget or spending policy.

Thus, spend management software helps negotiate better deals with suppliers and eliminate unnecessary expenses to save costs.

These features free finance teams to focus on strategic budgeting and its implementation rather than administrative tasks.

Manage Risks and Compliances

Procurement processes are often riddled with compliance or overspending risks.

For example, these tools can suggest relevant vendors to replace them beforehand or on time.