We earn commission when you buy through affiliate links.

This does not influence our reviews, ranking, or recommendations.Learn more.

For that, you need payroll software to automate payroll processes.

you might trust Geekflare

At Geekflare, trust and transparency are paramount.

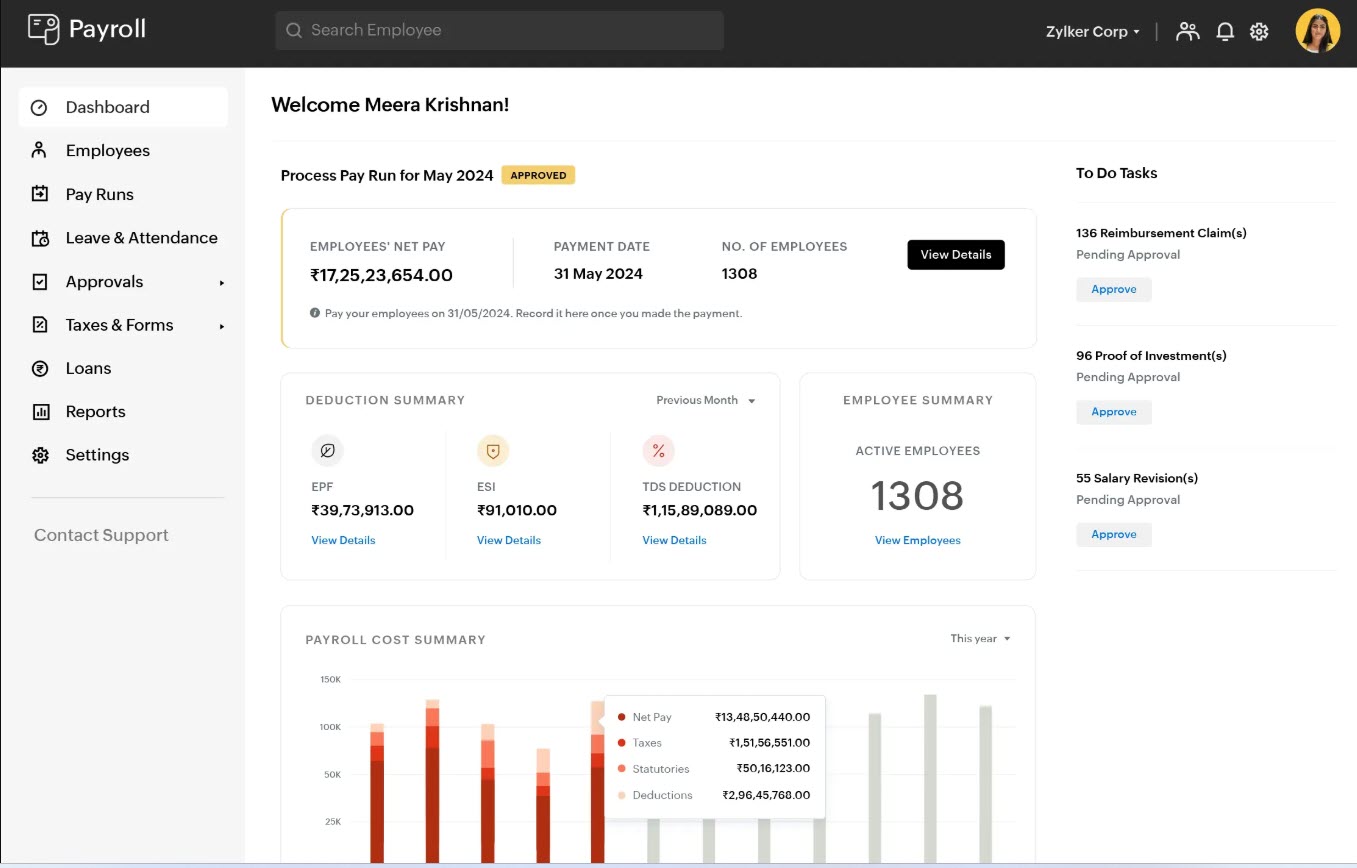

Its multi-level approval feature makes the payroll process secure and reliable.

you could even integrate with Zoho applications such asZoho One.

Zoho Payroll not only provides you with payroll features but also generates40+ reportsto provide real-time visibility into payroll operations.

I like how it allows you to include personalized salary components.

Pros

Android and iOS mobile apps.

Intuitive interface with a minimum learning curve.

Free calculator for income tax, bonus, and gratuity.

Cons

24/7 phone service is not available.

Limited number of third-party integrations.

Zoho Payroll Pricing

2. you might access challans on the self-service dashboard for simplified record keeping and audit trail.

Razorpays primary functionality is not restricted topayroll automationin both regular and off-cycle.

Whether you use HRMS software or not, its integration helps you keep accurate track of attendance and leaves.

Its reimbursement feature is worth trying.

Besides helping employees in need, it helps you build a positive reputation as an employer.

360 payroll for employees, interns, and freelancers.

Free GST calculator and ROI calculator tools.

Pricing includes an additional 18% GST.

Live chat is only available from 10 am to 10 pm.

RazorpayX Pricing

3.

It makes the payroll completely automated yet fully configurable with a range-based salary structure.

It lets you manage local and national compliances without having extensive payroll knowledge.

you might set up provident fund rules according to salary range or management bands.

It supports ESI computation rules and generates filing outputs in ESI standards.

It enables you to keep track of salary revision cycles and lets you revise your salary anytime.

Kekas analytics data makes compensation planning easier for you by identifying pay gaps between genders and departments.

The finance management functionalities of this employee-centric payroll software caught my attention.

It also enables them to claim expenses and get reimbursements without switching the platform.

Smooth migration from other solutions.

Employee mobile app for tax declaration and payslips.

Setup fees for onboarding.

Comparatively costly for large enterprises.

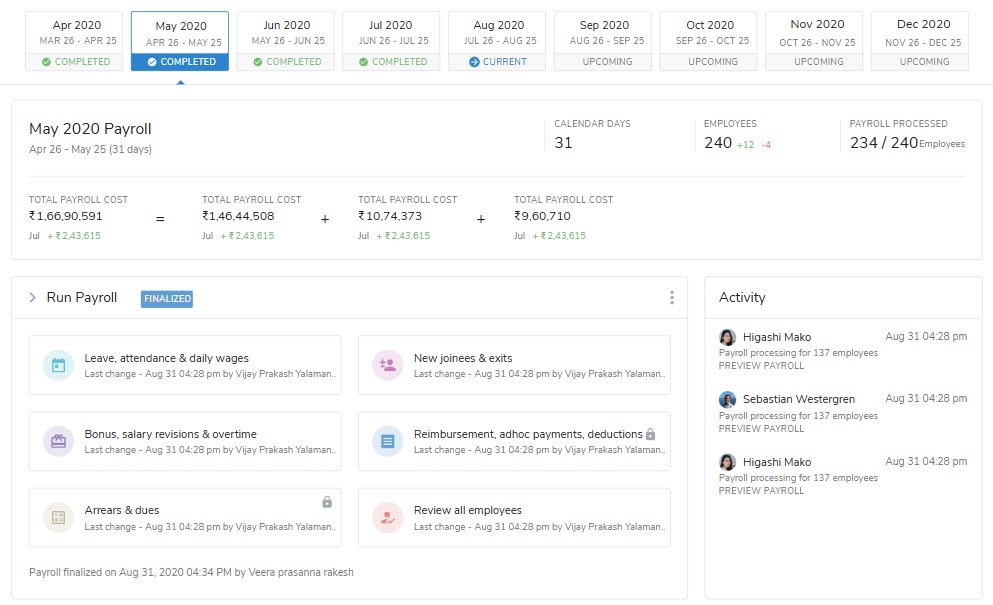

It enables you to run payroll on time every month with 100% statutory compliance.

It enables you to handle complex payroll use cases.

you could directly debit the payment from your account and transfer it online to all major banks.

Thus, you could have better control and flexibility over payments and manage cash flow.

The below screenshot shows the overview of the dashboard with employee details, payout details, etc.

99.5% uptime to prevent month-end stress.

Transparent self-help ESS portal.

Free trial comes with feature limitations.

Trial sign-up does not always work.

greytHR Pricing

5.

Automated salary calculation, auto salary slip generation, and flexible payment methods ensure timely and accurate salary payments.

It makes their life so much easier by bringing everything to their fingertips.

Paybooks have an advanced attendance tracking system to track time, overtime, and absence.

Regular audits and data encryption.

Support via phone, email, and live chat.

Limited third-party integration support.

Free trial is only available for 7 days.

Paybooks Pricing

6.

Trusted by 15000+ companies worldwide, it helps small and medium businesses with self-service, configuration, and compliance.

Features like multi-step approval workflow and maker-checker reduce the chances of error and offer full control over the process.

It offers multiple dashboards, generates30+ reports, and 256-bit encryption.

I had to uninstall the add-on to be able to complete the onboarding steps.

Free for 25 users, making it ideal for small businesses.

Supports Form 24Q and Form 16.

Exemptions and deductions mapping for income tax.

Leave management module comes as an add-on.

Custom pay cycle available only for Enterprise plan users.

Empxtrack Pricing

7.

It lets you directly deposit the salary with online salary credit.

Thus, it ensures that you avoid penalties and legal issues due to non-compliance.

The screenshot below shows the salary setting components, which include allowance types and deduction types.

As a result, you’re able to make more accurate salary payouts and avoid post-payroll corrections.

I like how Sumopayroll allows employees to download their estimated tax sheets based on their current salary.

It helps you get a clear understanding of their potential tax deductions and plan their tax savings effectively.

Ideal for startups and small businesses.

Settlement payroll for resigned or terminated employees.

Additional GST will be included in the pricing.

Employee mobile app incurs extra charges.

Sumopayroll Pricing

8.

Its automated Cost-to-Company (CTC) calculator accurately determines compensation packages.

The highlighted feature of Sumopayroll is3D reports.

As you spin up the payroll on Sumopayroll, it automatically deducts PF and ESI to ensure compliance.

Its automatic approval workflow and EMI deduction reduce the workload of your accountants.

Its smart algorithm enables you to pay error-free payroll in a single click.

It even generates an error list to address post-payroll errors.

3D reports with detailed analysis.

Powerful and intuitive dashboard.

Auto-database sync with integrated apps.

Trial enrollment is a time-consuming process.

Limited number of integrations.

HROne Pricing

9.

It accommodates complex payroll calculations, regardless of salary structure and tax.

Using its automated workflow, it’s possible for you to manage their leave requests easily.

The software supports financial document download, payslips, and integration with top business and HRMS software.

Wallet HR comes with comprehensive analytics and reporting tools that enable you to make smart business decisions.

I like how Wallet HR enables employees to see updated salary details through the self-service portal.

Thus, they can identify increments and enjoy transparency in the payment process.

Automatically calculates payable days.

Encryption and secure servers.

Supports importing previous payroll records.

Lack of transparent pricing.

Does not offer any free trial.

One-time licensing starts from 53,700.

Kredily:Kredilyoffers you freedom and flexibility in terms of having payroll details and generating independent pay slips.

Pricing starts from 1499/month/up to 25 employees with a free forever plan.

Pricing starts from 2499/month.

Nitso Payroll:Nitso Payrollsmoothly integrates with the attendance management system to facilitate one-click payroll processing.

Pricing starts from 3000/month.

Whats Next?

What Is Managed Payroll?

What Is a Payroll Cycle?

All you better Know

Reasons Why Payroll Is Important