We earn commission when you buy through affiliate links.

This does not influence our reviews or recommendations.Learn more.

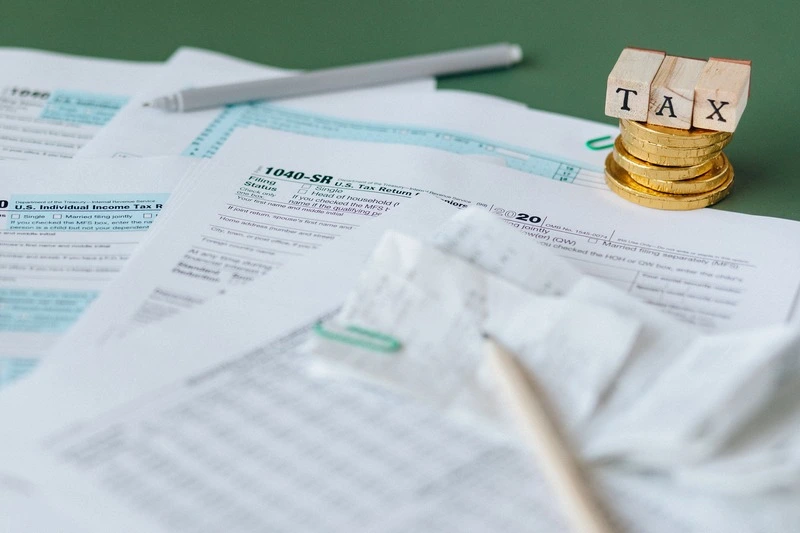

Crypto tax regulation plays a significant role in the wider adoption of cryptocurrencies.

How Is Crypto Taxed?

Youre not liable to pay taxes when you hold a particular cryptocurrency.

Moreover, this taxation is also applicable to crypto-based businesses.

For example, platforms that accept crypto payments are taxed under the business income category.

But what about cryptocurrency miners?

Miners need to pay taxes under the ordinary income category.

Next, lets check the workings of crypto taxation right away!

The IRS has set several tax events for every crypto-based payment and transaction.

Therefore, you should probably pay taxes for all such listed events.

In addition, you should probably pay a municipal tax of 10%.

This high cryptocurrency tax policy slows down crypto adoption in Japan.

In addition to this tax, the residents must pay a communal tax between 0% to 9%.

Meanwhile, profit from crypto asset transactions falls under professional income.

As a result, a tax rate of up to 50% is applicable.

The higher the cryptocurrency taxes, the lower the investments.

Therefore, investors dont consider Belgium to be an ideal country for crypto investing.

The tax rate in both cases varies between 15% and 33%.

In a nutshell, individual investors only need to pay tax on 50% of their crypto capital gains.

#4.United States

Internal Revenue Service (IRS) taxes crypto based on your tax bracket.

Moreover, short-term and long-term capital gains have two different taxation.

Long-term crypto capital gains can attract a tax rate between 0% to 20%.

#5.United Kingdom

The United Kingdom offers a tax-free allowance for crypto capital gains up to 12,300.

Things get worse when it comes to the crypto income tax policy.

These taxes range between 19% and 28%.

These taxes vary from 19% to 47%.

Therefore, you better pay a 42% tax on your crypto capital gains.

In addition, your income from crypto assets is also taxed heavily.

This tax rate is 37.1% or 52.1%, according to your income bracket.

#8.Netherlands

Belastingdienst, the tax authority of the Netherlands, charges high-income taxes for crypto assets.

As a result, you gotta pay a tax of 49.50% for income over 73,030.

On top of that, crypto lending and airdrops attract a 31% tax charge.

Moreover, mining and staking activities also attract taxes of over 30%.

#9.South Africa

The South African Revenue Service (SARS) is strict with crypto taxation.

Therefore, you better pay up to 18% taxes for your capital gains on your cryptocurrencies.

Additionally, income from crypto assets is also heavily taxed between 18% and 45%.

The income tax is charged for referral rewards, crypto trading, mining, and staking.

#10.Ireland

Irelands Revenue Commissioners implement high taxation on crypto-related assets.

Therefore, you oughta pay both capital gain and income tax for your cryptos.

The crypto capital gain tax has a fixed rate of 33%.

Meanwhile, crypto income tax varies between 20% and 40% based on your income slab.

Besides, taxes for crypto businesses go as high as 53%.

#12.Austria

The Austrian Ministry of Finance considers cryptocurrency as an intangible asset.

As a result, crypto assets are taxed as per the Austrian Income Tax Act.

Moreover, the crypto income tax rises to a maximum of 55%.

#13.Italy

The Italian Budget Law of 2023 introduced updated taxation on cryptocurrencies.

On top of that, an income tax is applicable for any income generated from crypto assets.

This income tax rate ranges between 23% and 43%.

This income tax is fixed at 22%.

Moreover, the income tax is applicable for all crypto-related activities.

you should probably pay this tax for crypto mining, trading, and staking.

#15.India

India introduced its latest crypto taxation in the 2022 budget.

Additionally, you also need to pay a 1% Tax Deducted at Source (TDS).

This TDS applies to crypto trading activities above 50,000 in a single financial year.

Moreover, this tax is applicable for capital gains above 305 per year.

However, the tax rates for professional crypto traders and miners are on the higher side.

Now, lets dive into the list of countries that charge the lowest crypto taxes.

For example, you dont need to pay capital gain taxes on crypto assets.

Moreover, part-time mining activities are charged only 10% tax and are exempted from other types of taxes.

However, crypto day trading profits are considered business income and taxed highly.

Therefore, this West Asian country doesnt charge any crypto capital gain or income taxes from investors.

In addition, you also dont need to pay taxes to stake or transfer your crypto assets.

However, you should probably pay a 5% VAT whenever a purchase is made using cryptocurrencies.

#3.Bahamas

The Bahamas is an island country that offers investors a tax-neutral environment.

Therefore, you dont need to pay capital gain, income, or inheritance taxes on crypto assets.

However, you’re gonna wanna pay low taxes when it comes to cryptocurrency trading.

As a result, a traders profits are charged under value-added tax (VAT).

#4.Bermuda

Bermuda is considered a prominent tax-free destination for crypto investors.

You dont need to pay capital gain, income, or withholding taxes for your crypto assets.

In addition, digital asset companies are encouraged to operate with Bermuda as their base.

For this reason, the Ministry of Finance has implemented tax benefits for crypto-based companies and their operations.

#5.Puerto Rico

Puerto Rican residents need not pay any taxes associated with cryptocurrencies.

This tax benefit applies to trading, staking, and mining income.

Furthermore, Puerto Rico charges very low taxes for crypto corporations.

For example, a corporation that generates profit using staking and mining is charged just 4% in taxes.

#6.Cayman Islands

The Cayman Islands gained popularity among U.S. investors for its tax benefits.

These islands dont charge business or corporate taxes.

In addition, residents also dont need to pay capital gains or income taxes.

Most importantly, the islands zero property tax policy reduces all the total taxes to zero.

#7.Seychelles

Seychelles is one of the prominent tax-free crypto countries on this list.

This smallest African country incorporates20% of the total crypto exchanges in the world.

This tax-free destination doesnt charge any tax for income and capital gains.

As a result, Seychelles is favorable for crypto investors and traders alike.

#8.Monaco

Henley & Partners rankedMonaco among the best crypto-friendly countriesafter Singapore and UAE.

This Western European country is a tax haven for high-profile investors.

Monaco doesnt charge any personal income or crypto capital gain taxes from its residents.

In addition, the overall tax laws and policies favor crypto investors and traders.

Moreover, you dont need to pay taxes for crypto capital gains.

This liberal crypto taxation policy allows more foreign companies to invest in Panama.

Moreover, such policies make it the best country for crypto tax.

Therefore, this Central American country is regarded as one of the most crypto-friendly countries in the world.

For this reason, you dont need to pay taxes for the capital gains generated from your crypto assets.

El Salvador is a prominent example of the adoption of efficient crypto policies.

These policies help to attract more crypto projects and investors to this country.

#11.Indonesia

The Indonesian trade ministry considers crypto assets as commodities.

Therefore, their government charges VAT and income tax on crypto capital gains.

You also need to pay these two taxes on each crypto transaction.

At the time of writing, Indonesia charges 0.1% each for VAT and income tax on crypto assets.

#12.Gibraltar

Gibraltar doesnt charge taxes on any crypto investments.

As a result, individual investors need not pay capital gains or withholding taxes.

In addition, Gibraltar also exempted VAT for crypto-based activities.

However, companies shall pay a 12.5% corporation tax for the crypto profits.

#13.Liechtenstein

Liechtenstein has no taxation policies on capital gain taxes for profits made on security tokens.

Therefore, you dont need to pay to trade, invest, or transfer such crypto tokens.

However, this small Central European country considers utility tokens as commodities.

As a result, profits on utility tokens can attract a 12.5% tax.

#14.Germany

Germany is one of the best countries for crypto tax savings for long-term investors.

Therefore, you dont need to pay any taxes once your investments are above one years time.

Moreover, you wont be taxed for short-term capital gains below 600.

These tax benefits are applicable for crypto trading, staking, and mining.

For instance, you dont need to pay income or capital gain taxes for your crypto assets.

Moreover, this developed Southeast Asian country exempted GST on crypto-based payments.

In short, private wealth assets are exempted from capital gain taxes.

However, you should probably pay taxes for short-term trading, mining, and staking of cryptocurrencies.

What is Crypto Capital Gain Tax?

Crypto capital gain tax is similar to the capital gain tax on stocks and other financial instruments.

As a result, you better pay taxes when your crypto investment generates profit.

For example, lets say you bought a cryptocurrency and sold it for a higher price.

In that case, you are liable to pay tax for the profit amount.

These gains include:

Next, lets understand the calculation of capital gains.

How are Crypto Capital Gains Calculated?

Crypto capital gains are calculated after deducting the losses made in that year.

Here, its important to separate short-term and long-term gains and losses.

First, you oughta calculate the difference between short-term capital gains and losses.

Similarly, calculate the value for long-term capital gains and losses.

In that case, you oughta pay capital gains tax for the profit, which is $10,000.

In addition, the tax rates for short-term gains are higher than those for long-term gains.

Now, here are some amazing tips for your crypto journey!

By doing so, youll be able to save a lot on taxes.

For example, youll fall into a lower crypto tax bracket during the low-income period.

As a result, the taxation will also be low.

#2.Take Crypto Loans

Crypto loans are considered non-taxable events.

Therefore, you’ve got the option to take crypto loans instead of selling your cryptocurrencies.

Moreover, taking a loan also provides you access to fiat currency without taxation.

Therefore, wait at least a year before selling your asset to reduce crypto taxes.

#4.Send Gifts as Cryptos

Sending cryptocurrencies as gifts is a simple method to avoid crypto taxes.

In that case, you might consider relocating to any of the lowest crypto-taxed countries listed in this article.

Panama has the best crypto regulation favorable for foreign investments.

The best method to avoid high taxes is to invest your crypto assets for at least one year.

Final Thoughts

Countries with low or zero tax rates are always favorites for crypto investors.

However, always remember that tax rates are not permanent and change based on government policies.

These countries are currently the tax havens for investors across the world.