We earn commission when you buy through affiliate links.

This does not influence our reviews, ranking, or recommendations.Learn more.

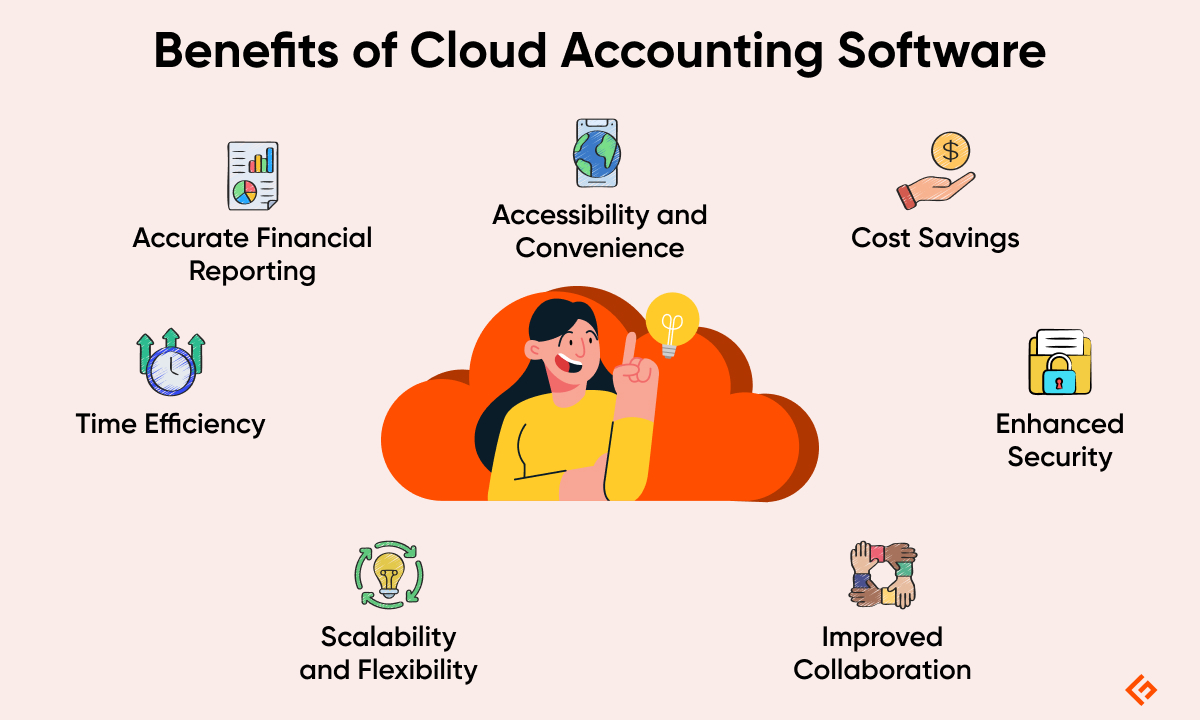

Cloud accounting software is a web-based solution.

It helps businesses manage finances, automate tasks, and access real-time financial data from anywhere.

Cloud-based accounting systems eliminate the need for manual data entry and provide real-time financial insights.

This streamlines bookkeeping and financial management enabling seamless collaboration among team members.

Cloud accounting is also accessible from any gear and often provides APIs for connecting third-party software.

In this article, we will explore the best cloud accounting software options for small businesses.

The platform offers essential features like automated invoicing, double-entry accounting, and smooth integration with various payment processors.

FreshBooks also supports project management, allowing businesses to track time and collaborate with clients efficiently.

Log billable hours for projects with a built-in time tracker, ensuring you dont miss out on any revenue.

Manage payroll seamlessly within FreshBooks through integrations like Gusto, simplifying your employee payment process.

FreshBooks Pros/Cons

User-friendly interface designed for non-accountants.

Comprehensive invoicing features, including customization and automation.

Integrated time tracking and project management tools.

Double-entry accounting offers detailed reports for deeper financial insights.

The highest-tier plan only includes two users by default.

The Lite plan limits billable clients and lacks key features like bank reconciliation and double-entry accounting.

Higher-tier plans are expensive for small businesses/freelancers

A hefty fee per month for an additional team member.

QuickBooks lets users easily link bank accounts, categorize transactions, and monitor cash flow in real-time.

QuickBooks also supports integration with various third-party applications, enhancing its utility across different industries.

QuickBooks provides a user-friendly experience for beginners, simplifying financial management.

And experienced users can leverage its comprehensive features for detailed financial analysis.

QuickBooks also offers one of the top accounting apps for smartphones.

QuickBooks Features

Manage vendor bills effectively.

Track payments, schedule payments, and apply credits for efficient bill handling.

Get access to tax resources and connect with qualified professionals to ensure accurate tax filing and maximize deductions.

Generate customizable reports to gain insights into your business performance.

Track income, expenses, profit and loss, and other key metrics.

Track your miles effortlessly for business purposes with integrated mileage tracking tools.

Organize projects, manage tasks, collaborate with team members, and track profitability for efficient project execution.

Streamline your online sales process by integrating with popular e-commerce platforms.

Receive payments easily through various online options and automate bill payments for improved cash flow management.

Manage your bank accounts directly within QuickBooks for effortless reconciliation and real-time financial data.

QuickBooks Pros/Cons

Extensive feature set catering to various business sizes and types.

Strong integration with third-party apps and services like CRM software, e-commerce platforms, and payment processors.

Industry-standard accounting software trusted by accountants.

Advanced reporting and analytics for detailed financial insights.

For users with limited accounting experience, QuickBooks may have a steeper learning curve.

Higher-tier plans with advanced features are expensive for small businesses.

Overall expensive subscription with no free forever plan.

QuickBooks is not available in some regions like India.

The softwares comprehensive reporting capabilities make it easy to generate detailed financial statements, helping businesses make informed decisions.

Xero Features

Access bank data from over 21,000 global institutions for easy reconciliation.

Track and manage expenses, submit claims, and handle reimbursements efficiently.

Plan, budget, and track project costs with integrated job tracking tools.

Monitor stock levels and auto-populate invoices and orders with items.

Handle transactions in multiple currencies, making it ideal for global business operations.

Ensure your transactions are up-to-date with automatic bank reconciliation.

Generate accurate financial reports and collaborate with advisors in real time.

Automatically capture and store documents and key data with Hubdoc integration, simplifying data entry and organization.

Strong security through multi-factor authentication, continuous monitoring, and regular audits.

Provides scalability so a small business can grow without running into early limitations.

Inventory management is basic and not suitable for complex needs.

Customer support is primarily online, with no phone support.

Some businesses find invoice and report customization options limiting, which hinders branding consistency.

Take a look at ourreview of Xero Accountingfor more details.

Kashoo calls itself The Worlds Simplest Accounting Software as the platform doesnt want the users to get overwhelmed.

Kashoo offers two variants: Trulysmall accounting and Kashoo.

Create and send professional invoices quickly, allowing for efficient payment processing and tracking of outstanding payments.

Automatically import and categorize transactions from your bank, simplifying the bookkeeping process and reducing manual data entry.

Capture receipts on the go using the mobile app, ensuring that all expenses are recorded accurately and promptly.

Generate real-time financial reports to get insights into your businesss financial health, helping you make informed decisions.

Use simple project management tools to track time and expenses associated with specific projects, ensuring accurate billing.

Kashoo maximizes tax deductions with automated data entry, ML-powered categorization, and IRS & CRA alignment.

Prints traditional paper paychecks using a step-by-step guide.

Offers an unlimited number of users and is overall inexpensive.

Great customer support with live chat and phone assistance.

Offers only two plans, limited options for those seeking more flexible pricing options.

Reporting capabilities are relatively basic and do not meet the needs of businesses requiring detailed financial analysis.

Limited integration options compared to other software.

Lacks advanced features like time tracking, workflow management, and document management.

It offers extensive features including invoicing, expense tracking, and automated workflows.

Zoho Books supports multi-currency transactions and provides in-depth financial reporting to aid business decisions.

Its user-friendly interface and customizable templates make managing finances straightforward.

The software also includes solid automation features like recurring billing and auto-payment reminders.

Connect your bank accounts for seamless reconciliation, ensuring that all bank transactions are accurately recorded and matched.

Monitor project expenses, billable hours, and profitability by linking expenses and time tracking directly to specific projects.

Automate repetitive tasks like payment reminders, recurring invoices, and approvals, improving efficiency and reducing manual work.

Ensure your data is secure with advanced encryption, role-based access, and multifactor authentication.

Integrates seamlessly with other Zoho applications, such as CRM, marketing, and HR software.

Comes with a free forever plan (conditions apply).

Automates recurring tasks and bank reconciliation.

Steep learning curve for those unfamiliar with the Zoho suite.

Imposes restrictions on the number of users, which can be limiting for growing businesses.

Third-party integration is relatively limited.

The most expensive plan (premium) caps at 10 users only.

Waves intuitive interface makes it easy to create and send invoices, manage receipts, and track cash flow.

The software simplifies payment collection by allowing clients to pay directly from invoices through integrated payment gateways.

Wave also includes basic accounting reports and integrates with bank accounts for automatic transaction syncing.

Besides the free plan, Wave offers a Pro plan for businesses seeking more customization.

Accept online payments securely, send automated payment reminders, and track outstanding invoices to get paid quickly.

Capture receipts on the go using the Wave mobile app for effortless expense tracking.

Run payroll in minutes with Wave.

Pay your employees quickly and electronically, handle taxes effortlessly, and streamline thepayroll accountingprocess.

Leverage the expertise of Wave Advisors whenever you need help with accounting, tax, or business matters.

Easily categorize and track your business expenses for better financial control and informed decision-making.

Generate customizable financial reports to analyze your business performance.

Track income, expenses, profit and loss, and other key metrics.

Wave Pros/Cons

Free forever plan with all essential features, perfect for budget-conscious users.

Unlimited numbers of users, even in the free plan.

Offers unlimited estimates, invoices, bills, and bookkeeping records in the free plan.

Easy to navigate even for beginners.

No native time-tracking feature.

Additional fees for accepting online payments per transaction, with charges applied after the first 10 transactions each month.

Accounting features are less advanced compared to QuickBooks, Sage, or FreshBooks.

Limited customization, support, and scalability.

Odoos accounting module supports multi-currency transactions, automated reconciliation, and comprehensive financial reporting.

The platform allows for customizable workflows and reports, catering to specific business needs.

Odoo features advanced automation for tasks like invoicing, expense tracking, and bank synchronization.

The softwares user-friendly interface facilitates seamless navigation and integration with other Odoo modules.

Additionally, Odoo has a vibrant community and extensive documentation that offers valuable support and resources.

Odoo has one of the worlds largest business app store thanks to its open-source nature.

The store has 40k+ apps.

Streamline reconciliation by automatically matching bank statements with your Odoo transactions, saving you time and effort.

Gain instant insights into your business performance with customizable financial reports generated in real time.

Track income, expenses, profit and loss, and other key metrics for informed decision-making.

Manage multiple companies in a single database with separate charts of accounts and consolidation reporting.

Designed to scale with your business, accommodating businesses of all sizes.

It has a large and active open-source community, providing resources, support, and customization options.

Offers a free forever plan with no limit on features or data.

The paid plan starts with a high price tag, billed on a per-user basis.

Complex customizations may need expert skills and increase costs, requiring professional assistance.

Key features include invoicing, expense tracking, advanced inventory management, and efficient tax handling.

Users can also benefit from real-time reporting, advanced budgeting tools, and seamless collaboration through cloud access.

Check Geekflares detailedSage 50 Accounting reviewto know more.

Sage 50 Features

Automate data entry by capturing data from bills, receipts, and bank statements.

Gain insights into your cash flow with features like cash flow forecasting and projections.

Effortlessly reconcile your bank statements with automatic bank feeds, saving time and ensuring accuracy.

Simplify recurring payments by integrating with GoCardless to collect payments directly from customers bank accounts.

Track stock levels, manage product variants, and generate inventory reports.

Enjoy secure access controls that protect your financial data.

Sage 50 Pros/Cons

Has a long-standing reputation as a reliable and robust accounting software.

Provides advanced tools for accounting, job costing, payroll, tax compliance, and reporting & analytics.

Offers advanced inventory management suitable for product-based businesses.

Supports multi-company management in a single dashboard.

Seamlessly integrates with other Sage products like Sage Payroll or Sage CRM, streamlining workflows.

On the expensive side starts at $60.08/user/month.

Advanced features and comprehensive functionality make it difficult to use, especially for non-accountants.

Limited mobility as the software is primarily desktop-based.

The interface can feel outdated and less intuitive compared to more modern accounting software.

FreeAgent

Best for Freelancers

About FreeAgent

FreeAgent is designed specifically for freelancers and small businesses.

It provides essential features such as invoicing, expense tracking, and financial reporting packed in a user-friendly interface.

FreeAgent simplifies tax management with built-in VAT and self-assessment tools, ensuring compliance and accurate submissions.

The platform offers automatic bank feeds for easy bank reconciliations and real-time financial insights.

FreeAgents time-tracking and project management features help users manage client projects and billable hours effectively.

The software also supports multi-currency transactions and integrates with various third-party applications.

Additionally, FreeAgent is known for its straightforward setup and excellent customer support.

Create and send polished estimates and invoices with ease.

Connect your bank accounts with FreeAgent for automatic bank feeds, allowing for effortless reconciliation and real-time financial data.

Organize projects efficiently by grouping expenses, invoices, and time entries by project for a clear overview.

Track project progress, collaborate with team members, and ensure accurate billing for each project.

FreeAgent Pros/Cons

Tailored specifically for freelancers and small business owners.

Allows users to create, send, and automatically chase invoices.

Offers a great deal with 50% off for your first six months as a new customer.

User-friendly interface with a focus on simplicity.

Limited features for larger businesses with complex needs.

Not as scalable due to a single pricing plan, making it less suitable for growing businesses.

Limited integration relies on Zapier for many integrations.

Reporting and customization features are limited.

What is Cloud Accounting?

Cloud-based accounting softwareis hosted on remote servers rather than being installed locally on your gear.

This eliminates the need for installation, maintenance, and updates offering several advantages over traditional software.

Although some cloud accounting solutions might offer a desktop client or program that you’re able to download.

However, this client still connects to the internet to synchronize data with the cloud.

Note: For those starting with a limited budget, there are severalfree accounting softwareoptions available to explore.