We earn commission when you buy through affiliate links.

This does not influence our reviews or recommendations.Learn more.

Crypto trading exchange is an online platform that allows users to buy and sell cryptocurrencies.

Once you complete the purchase, youll receive your cryptocurrencies in your exchanges custodial wallet.

Below are the best crypto trading exchanges based on user experience, security features, and staking and rewards.

you might trust Geekflare

At Geekflare, trust and transparency are paramount.

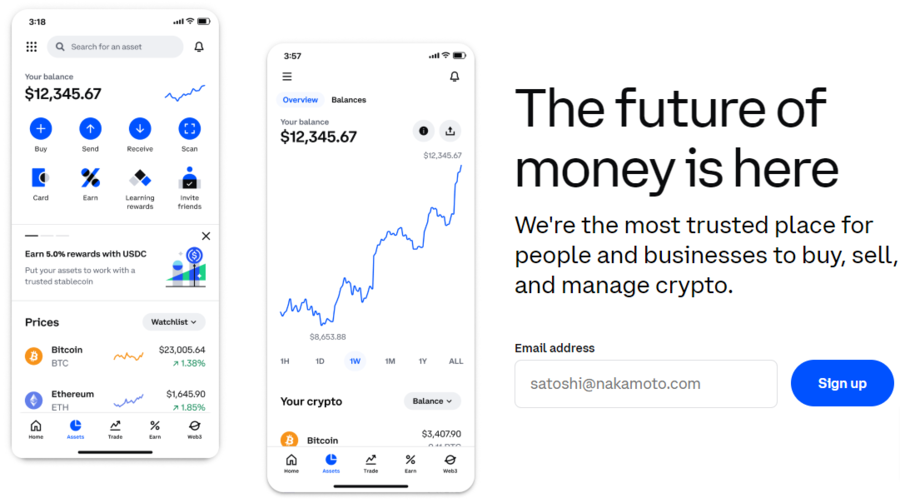

Coinbase became a publicly listed company in 2021, and that ensures transparency by publishing quarterly financial statements.

In addition, this company uses state-of-the-art security and encryption methods to protect their users assets.

Coinbase Pros

User-friendly interface.

Supports 400 active trading pairs.

Coinbase Cons

Has control of your wallets private keys.

Poor customer ratings on Trustpilot.

Orders that provide liquidity are charged a maker fee.

On the other hand, orders that take liquidity are charged a taker fee.

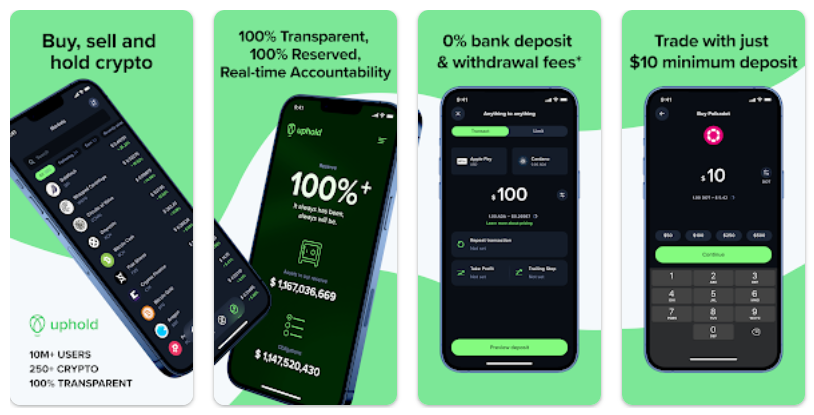

Seasoned investors and traders can use Uphold to spot trade cryptocurrencies using crypto wallets or bank cards.

Moreover, this platform offers cashback on every card purchase.

Uphold offers complete transparency to its users.

The platform also conducts 24/7 security monitoring to detect and fix potential threats.

Uphold Pros

Provides its crypto services to over 180 countries.

Availability of one-step trading.

They reserve 100% of their users funds.

Uphold Cons

Limited advanced trading tools.

Crypto staking services are not available in Europe, the U.S., Canada, etc.

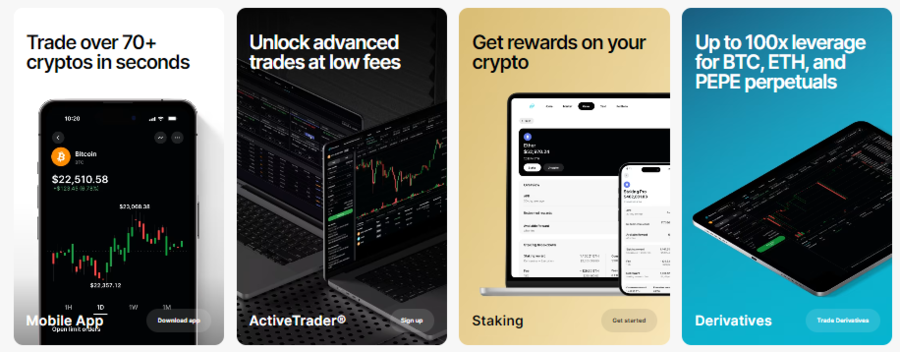

In addition, traders can use these tools to choose to trade on 300+ trading pairs across 70 cryptocurrencies.

Gemini also stores its users private keys at high-security data centers to avoid possible crypto wallet hacks or attacks.

Gemini Pros

Smooth trading interface.

Easy account creation process.

Crypto rewards on Gemini Credit Card purchases.

Staking is not available in the UK.

US-based users cant stake their Solana (SOL) tokens.

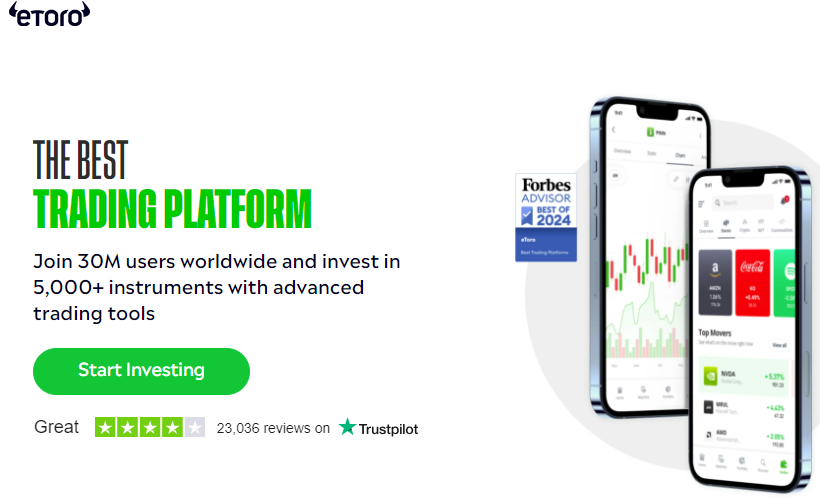

Traders can choose spots or derivatives according to their trading style.

eToro stores its users assets in a segregated account and provides a 2FA feature to enhance user security.

eToro Pros

Users receive a $100K demo trading account.

Advanced trading and chart analysis tools.

eToro Cons

Unavailable in U.S. states such as New York, Nevada, and Hawaii.

All withdrawal requests are charged with a $5 fee.

eToro Pricing

eToro charges a flat 1% fee for trading cryptocurrencies.

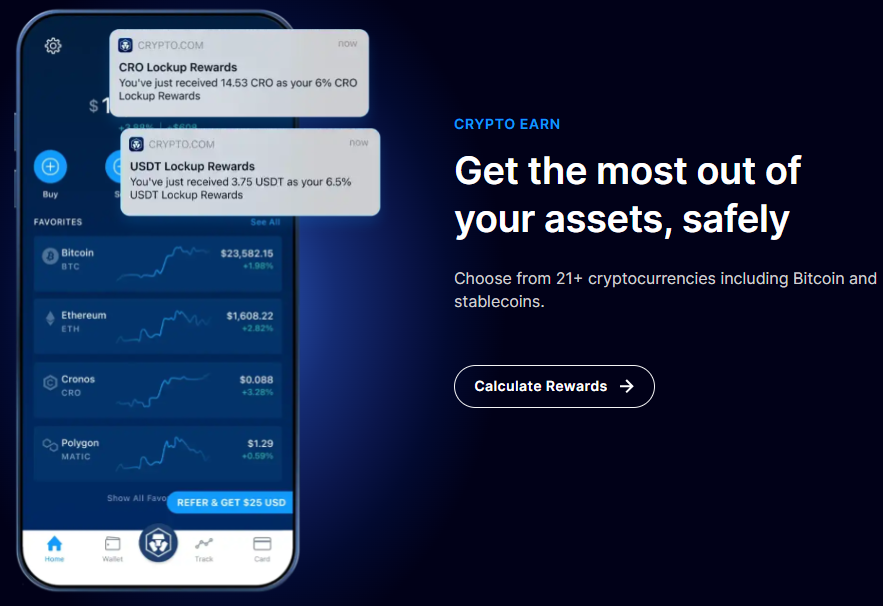

you’re free to also use Crypto.com to stake almost 20 cryptocurrencies for staking rewards.

Not just that, Crypto.com offers a loyalty program to reward its community.

It provides crypto wallets for mobile devices, web browsers, and desktops to access various DeFi platforms.

Crypto.com Pros

Offers 5% back on spending made using Crypto.com Visa cards.

The platform is secured with multiple certifications, including the Singapore Data Protection Trust Mark.

Uses a high-speed matching engine to execute orders.

Crypto.com Cons

Customer support is limited to chats.

Crypto.com Visa card service is not available for U.S. ## Crypto.com Pricing

6.

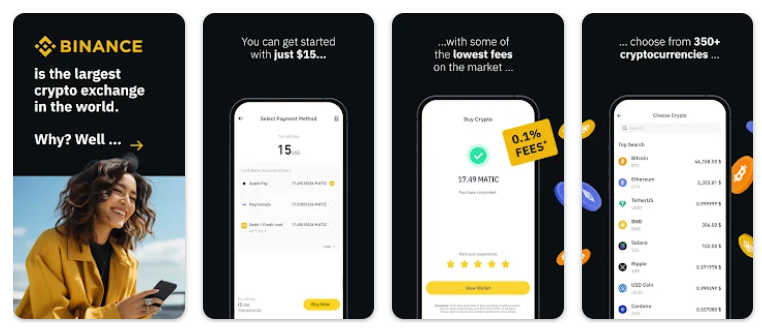

Additionally, you might use their platform to stake your cryptocurrencies in exchange for weekly token rewards.

Binance Pros

24/7 customer support is available in 40 languages.

Low trading fees for crypto purchases.

Binance Cons

Complex trading platform for beginners.

Facing regulatory issues in several countries, including the U.S.

Binance Pricing

7.

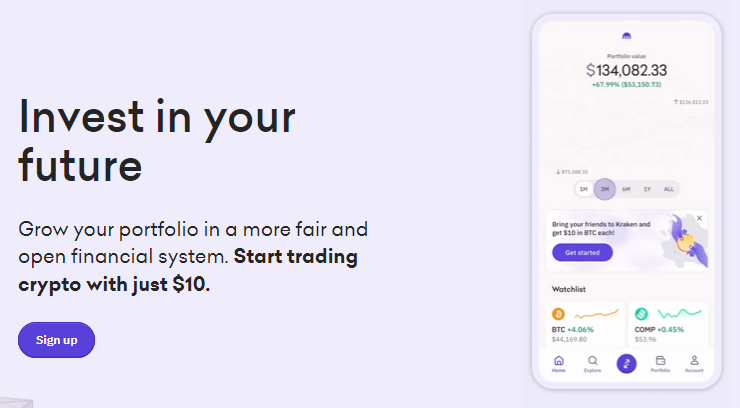

Users from over 190 countries can also stake 15+ assets to receive their staking rewards.

Krakens security management system is certified by international security standards like ISO/IEC 27001:2013.

In addition, high-priority email and live chat support are available to address users urgent security concerns.

Kraken Pros

Good customer care support system.

High trading liquidity for crypto investors and traders.

Supported over 190 countries.

Kraken Cons

Staking is unavailable for U.S. residents.

U.S. users cant trade in futures.

Margin trading is restricted for Canadian users.

Kraken Pricing

8.

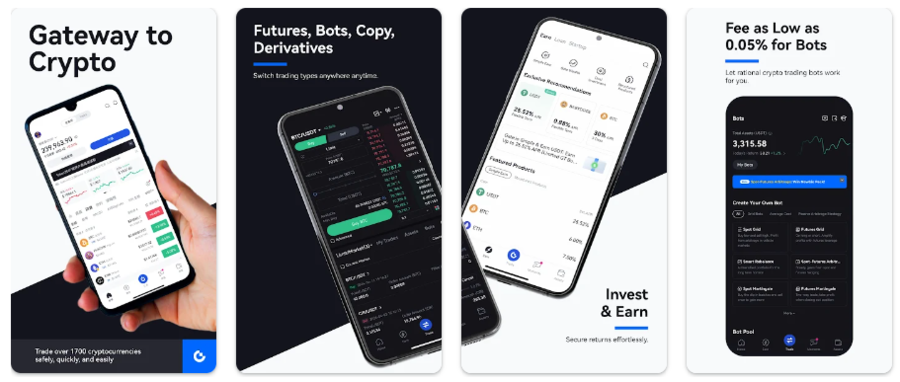

Likewise, you could use this platform to perform spot, derivative, and margin-based trades.

Additionally, you might use their crypto trading bots and copy trading features.

Gate.io also provides cloud mining and crypto staking features to reward their users.

Gate.io Pros

Advanced trading tools and charting options.

Block trading availability to execute large transactions at once.

Supports around 100 fiat currencies and over 300 other payment methods, including bank transfers.

Gate.io Cons

Complex trading interface for beginners.

It is not supported in many countries, such as Ireland, Italy, and New Zealand.

Gate.io Pricing

9.

OKX is best for high-volume traders to trade over 350 cryptocurrencies with a wide range of trading pairs.

Moreover, you could opt for flexible staking for over 30 crypto tokens and receive daily rewards.

OKX Pros

User-friendly trading interface.

Leverage up to 100x for futures.

Advanced trading data availability.

OKX Cons

Unavailable for users in the U.S., Canada, India etc.

Poor customer reviews on Trustpilot.

OKX Pricing

10.

KuCoin Pros

Advanced trading platform with charts and trading tools.

Availability of 1,300 trading pairs.

Supports over 70 payment methods.

KuCoin Cons

Not suitable for new traders.

Restricted in the U.S., Malaysia, and more.

KuCoin Pricing

11.

Its Pro platform offers advanced tools and charts for expert traders, along with live customer support.

This exchange allows spot trading on around 100 crypto assets, including top cryptocurrencies.

Bitstamp also offers institutional-grade security to encrypt your data while protecting your privacy.

Pros

Low fees for stablecoin trading pairs like PYUSD/USD, USDC/USDT, etc.

Dedicated platform for professional and institutional traders.

Cons

Only three crypto assets are available for staking.

No margin trading features.

Bitstamp Pricing

12.

For new traders, Bitfinex also provides paper trading options to test trading strategies without depositing real funds.

Security audits are conducted annually to ensure that all safety measures on Bitfinexs trading platform are in ideal condition.

Moreover, this platform offers advanced verification tools to its web and mobile unit users for added security protection.

Bitfinex Pros

Provides tools to create multiple trading orders at a time.

Bitfinex Cons

Limited customer support.

Unavailable for users in the USA, Canada, Spain, etc.

Bitfinex Pricing

13.

In addition, you might stake over ten cryptocurrencies on this platform to earn rewards.

CEX.IO provides spot trading options with advanced trading instruments and charting tools for traders.

Moreover, this platform provides crypto APIs for advanced traders.

The majority of the users crypto assets are stored in cold wallets to avoid online security exploitation.

Trading pairs availability with high trading volumes.

Only email-based customer support is available.

High minimum daily deposit/withdrawal limit for U.S. residents.

CEX.IO Pricing

Crypto Trading Exchange Comparison Table

How Does a Cryptocurrency Exchange Work?

A cryptocurrency exchange operates as an intermediary between a crypto buyer and a seller.

All orders placed by sellers and buyers are sorted by price on the order book.

Millions of such trades are automated within the exchange in real time.

How Does a Cryptocurrency Exchange Make Money?

A cryptocurrency exchange makes money by charging a fee on every trade.

How to Choose a Crypto Exchange?

Moreover, these brokerages provide a user-friendly interface for those who prefer a simple trading experience.

Moreover, these exchanges provide advanced trading features suitable for expert traders.

For example, negative market sentiments can lead to a significant price drop for crypto assets within minutes.

Crypto exchanges are not completely safe as there always exists a possibility for hacks and cyber theft.

In addition, multiple crypto firms have filed for bankruptcy in the last few years.

Crypto exchanges must strictly follow the regulatory framework mandated by government authorities to operate in the US.

These complex procedures restrain crypto exchanges from providing their services in the US.