We earn commission when you buy through affiliate links.

This does not influence our reviews or recommendations.Learn more.

you might trust Geekflare

Imagine the satisfaction of finding just what you need.

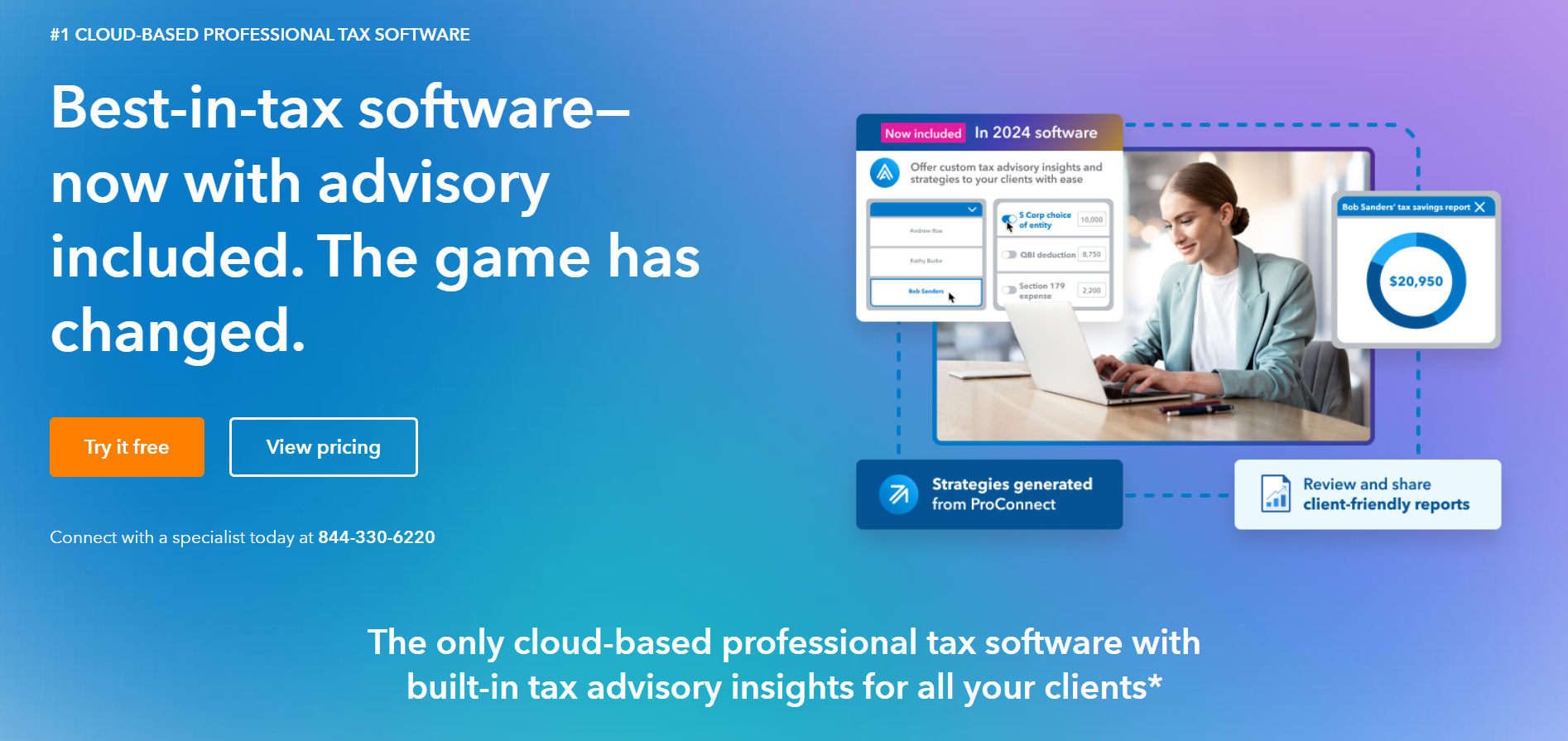

Its tax strategy engine, Lacerte, uses automation and advanced tools to handle complex tax returns and scenarios.

Its direct integration with Intuits QuickBooks Online Accountant makes it a complete package for implementing effective tax strategies.

It also provides in-built tax advisory services that help centralize information and design custom tax plans and reports.

These include varying limits for filing individual and business returns, eSignatures, and user access.

The pricing for these plans is available on request.

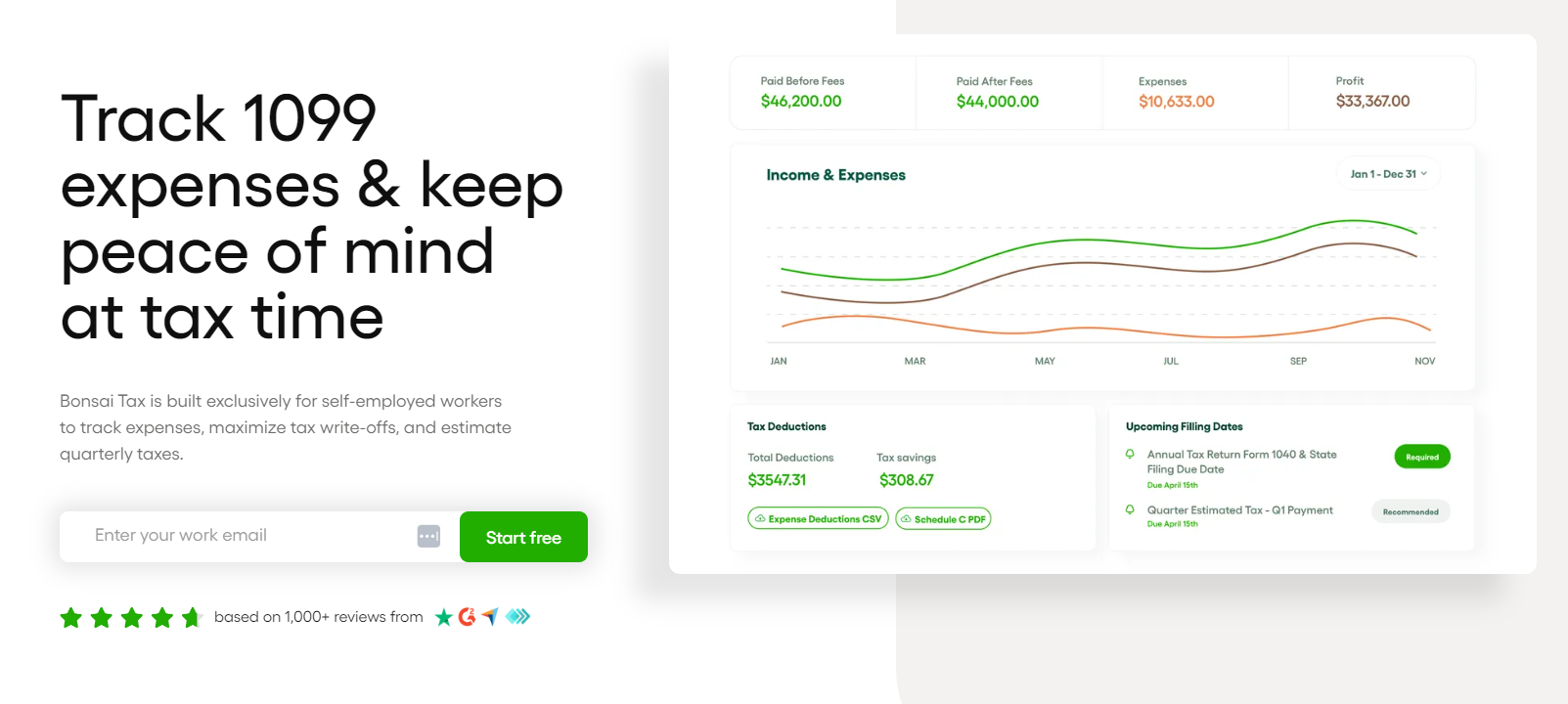

It centralizes your expense tracking and categorizes them to simplify taxes and identify tax planning opportunities.

It connects directly with the bank account to identify any potential tax write-offs that could lead to valuable savings.

Bonsai also includes comprehensive invoicing features; thus it offers complete financial planning software for independent workers.

It aims to become their productive working hub that enables them to deliver exceptional service to their clients.

It offers its tax planning software on desktop and cloud.

For unlimited returns, the below products are offered.

Note: You must purchase cloud hosting for Drake Tax software at $99/user.

These are equipped with advanced diagnostics to clear issues and data mining-based search tools to identify tax advisory opportunities.

Such features help tax professionals effectively manage various client scenarios, including multi-entity planning.

TaxWise includes live refund monitoring, a client portal, integrated e-signatures, and bilingual support.

It provides a cloud-based web, mobile, and desktop app to enable you to work anywhere and anytime.

Request a quote to purchase paid plans by contacting the TaxWise sales team.

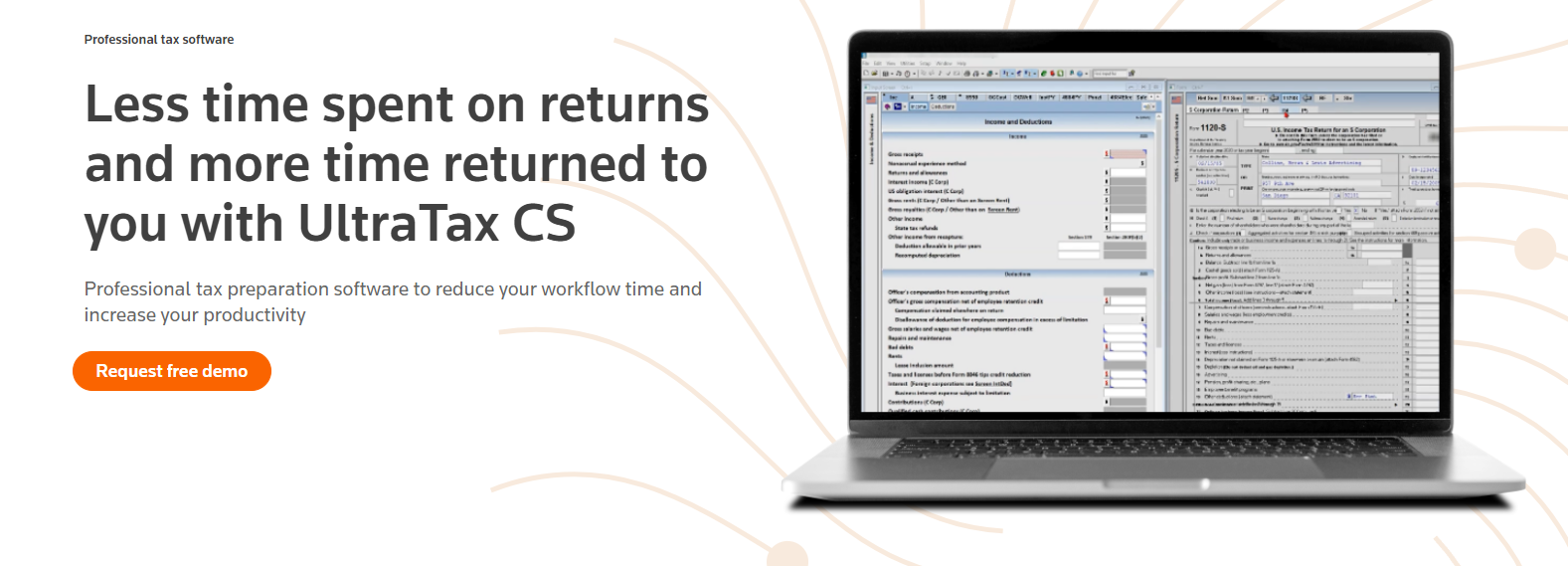

It comes with dedicated features to handle multi-entity tax planning.

It also provides tax planning workflows for estate planning and insurance risk management.

For more than 150 uploads, there are additional slab-based charges.

Accountants can sync with accounting software like Xero and QuickBooks.

This includes proposal creation to implementation and helping visualize ROI in a single platform.

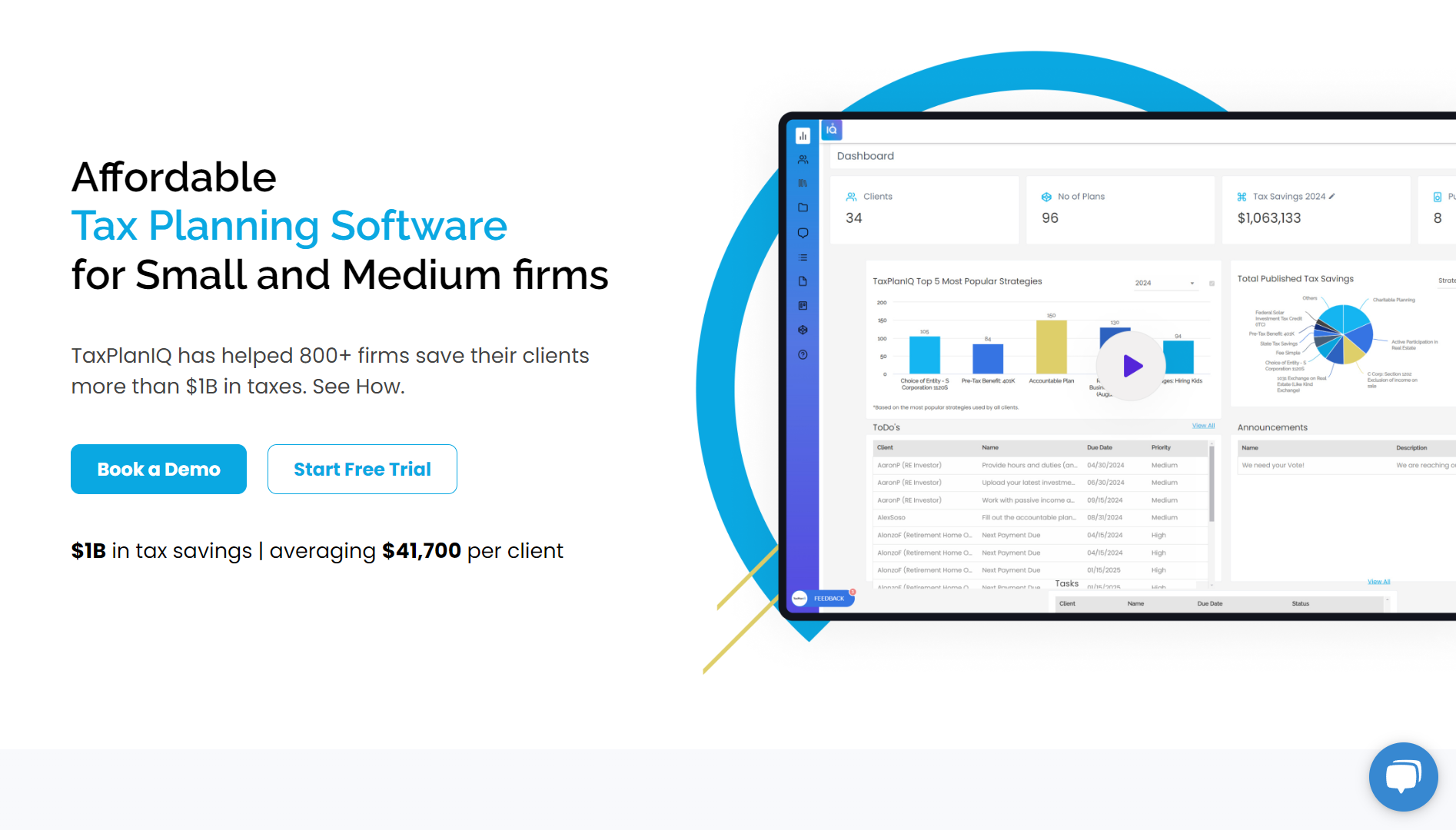

TaxPlanIQ also provides collaboration features for accounting firms and clients to work together on creating custom tax plans.

Upon booking the demo, you will receive a complimentary tax management portfolio.

What is Tax Accounting Software?

Tax Accounting Software integrates and automates accounting and tax planning workflows to enable users to implement effective tax strategies.

This includes automating the tax planning process, tracking expenses, and ensuring compliance with tax laws.

Tax planning software primarily helps you align your dynamic business operations with tax regulations.

This helps you stay prepared for tax filing ahead of time.

Here is how this helps streamline your businesss accounting and taxation workflows.

The software will automatically calculate the total tax owed based on the latest tax rates thus avoiding manual work.

Such automated tax calculations minimize the risk of human error and ensure accurate results.

It gives tax professionals enough time to help you strategize to avail valuable savings.

For example, lets say a freelancer anticipates a significant increase in income due to a new contract.

The tax planning software estimates the additional taxes owed.

This enables them to set aside funds accordingly to avoid surprises during tax season.

This ensures that users are always compliant and aware of any new deductions or credits available.

It can also help avoid potential fines due to, for example, changes in submission dates.

For example, lets say, a new set of tax laws is introduced for remote organizations.

The tax planning software will consider these changes and make provisions within the software to modify tax calculations.

This saves time for the user to research these changes themselves.

Integration with accounting software

Direct integration with accounting software saves efforts in sharing or migrating expense data.

This simple step helps avoid duplicates, maintains consistency, and reduces errors associated with data migration.

Small decisions of shifting numbers here and there can result in massive changes, especially for multi-entity tax planning.

For such complex scenario analysis, tax planning software is a must.

For example, lets say a business owner considers purchasing new equipment.

Performing scenario analysis will help determine projections on how this investment will affect their taxable income.

Such complex tax calculations require tax planning software.

How to choose the right Tax Planning Software?

Is your business losing sight of tax-saving opportunities?

Or are your accountants making errors due to your companys rapid expansion efforts?

This would ensure they capture all deductible travel expenses accurately.

One must consider potential tax savings when investing in good tax planning software.

It is not just about affordability having clarity on pricing structures is also important.

This gives you enough time to thoroughly review your financial situation to test potential tax strategies.

For example, consider the government launches a new scheme under which startups can avail of tax benefits.

But that requires document submission and approvals that can take 3 months.

For this, tax planning software with expense tracking features or accounting integration can help.

Then, one has to simply feed this data for tax calculations, reducing the time taken and errors.

Understand tax laws and changes

Tax regulations can often change frequently as the government changes.

This impacts deductions, credits, and overall tax liability.

Choose tax planning software that offers real-time access to databases and news about tax laws.

It helps adapt tax strategies in response to new legislation, ensuring compliance and maximizing available benefits.

Use tax-efficient investments

Investing in tax-efficient vehicles can significantly reduce taxable income.

One can also offset capital gains by selling underperforming investments at a loss.

This strategy can reduce taxable income and improve overall portfolio performance.

Conduct regular reviews

Regularly reviewing your financials helps detect issues and plan better for taxes.

Tax planning software helps implement this proactive approach to tax management.

This would help them evaluate, put a cap, or increase spending based on their tax strategy.