We earn commission when you buy through affiliate links.

This does not influence our reviews or recommendations.Learn more.

The global environment of business is shifting constantly, which requires solid decision-making.

When it comes to getting success, the art of decision-making is the heart of every business.

A single decision can make or break a company.

Thus, businesses can make smart, data-driven decisions that help them balance cost & benefit to maximize profitability.

In this article, Ill dive deep into CBA and the best possible scenarios to conduct it.

What is a Cost-Benefit Analysis?

The foundation of this process lies in meticulous economic principles.

This structured approach gives you a comprehensive assessment of the financial costs and benefits related to a specific project.

Between these two, the second project is more feasible because of its cost-benefit ratio.

Therefore, the sales advantages come to $240,000.

This kind of data-driven decision-making is applied in both reputed businesses as well as startups.

It can highlight possible costs and benefits in a form that is simple to comprehend and compare.

Its particularly useful for significant decisions that could impact your team or projects success.

To evaluate the sustainability and profitability of new investments, businesses often conduct CBA.

It assists in making well-informed judgments regarding proceeding with the investment.

CBA can be effective if you are wondering whether a proposed project will be worthwhile investing time and money.

CBA can offer you essential information if youre willing to modify your marketing, sales, or business strategy.

CBA is frequently used when deciding which activities an organization will fund as part of its strategic objectives.

Also, its employed when considering the launch of a new program or discontinuation of service.

Understanding the potential benefits and related drawbacks aids in decision-making regarding new projects.

Implement CBA While facing a variety of options or courses of action.

This guarantees that gains and expenses in the future are accurately discounted to their present value.

Thus, the project encounters a more realistic picture of the long-term economic effect.

CBA is often used by government organizations to evaluate the projected economic effects of policies or programs.

This is especially important when thinking about initiatives that could have broad social effects.

Thus, policymakers can make well-informed choices based on economic effectiveness.

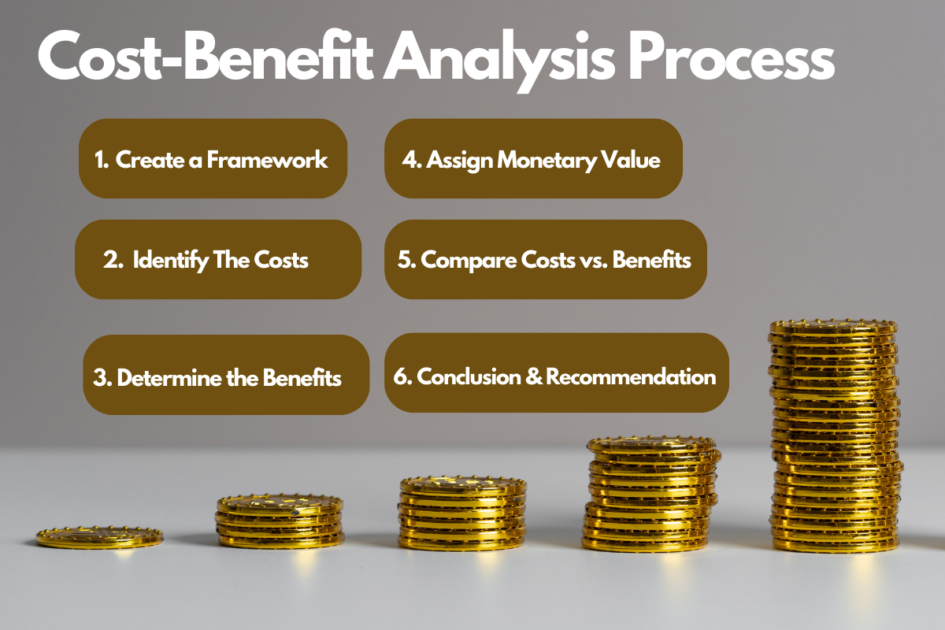

Since it establishes the stage for the whole analytic process, you should carefully set the stage.

This stage is for determining the goals once the issue or choice has been identified.

What goals do you want to accomplish with the decision or project?

How would one define success?

The remaining steps of the analytical process will be guided by these goals.

Example:In this instance, the objective is obviously maximizing the profit.

A successful launch that expands market share without adversely affecting the companys financial performance would be considered successful.

Example:The scope of the analysis should include all expenses related to creating and introducing the new product.

These costs are related to marketing, manufacturing, distribution, and research and development.

This will help you make a better choice by putting the framework in place.

Working with stakeholders in this phase can assist you in making use of their specialized knowledge.

These costs are linked as a consequence of the project, but they are not directly related to it.

Administrative costs, utility bills, and rent could be categorized as indirect costs.

Fixed expenditures, like rent or salary, are expenses that remain constant regardless of the volume of production.

Spending the rent for the factory of production is a fixed cost.

These are the costs incurred by forging the next best option.

These are the unrecovered expenditures that have already been spent.

Since sunk costs cannot be altered, they normally shouldnt have an impact on the decision-making process.

Learn more about thebasics of cost accountingto help you identity the above costs.

This entails figuring out every possible benefit that the undertaking or choice can provide.

These benefits fall under the following categories:

These benefits are directly connected to your project or business decisions.

It can include the money that a business generates by selling the new product line.

Benefits that have a monetary value can be assessed and defined as tangible benefits.

One example can be revenue generated from sales, which is a tangible benefit.

Conversely, intangible benefits are those that have worth even if they cant be valued monetarily.

It can include things like higher brand awareness or higher consumer satisfaction.

Benefits that can be exchanged for money are known as monetized benefits.

Examples of non-monetized advantages include the value of increased customer happiness or staff morale.

Having real data or example data from industry trends will surely help you in this phase.

Heres a thorough explanation:

This entails putting a monetary value on every expense related to the project.

This requires placing a monetary value on the projects benefits.

Benefits that are hard to measure such as increased staff morale and customer satisfaction.

In the same way, a negative impact on a brands reputation can count as an intangible expense.

A perfect illustration can be thereturn on investmentfrom other initiatives you have started with the same resources.

Give these opportunity costs a monetary value to conduct a more thorough study.

Potential risks can include issues related to financial, operational, reputational, etc.

So, based on their probability and possible consequences, give these potential hazards a monetary value.

While assigning monetary value, be specific and accurate since these approximations influence the outcome of your analysis significantly.

Cost-Benefit Ratio:This illustrates how costs and benefits are related to one another generally across time.

The projected total cash benefit is divided by the estimated total cash expenses to arrive at the calculation.

Benefits exceed expenses whenever the benefit-cost ratio is greater than one.

Sensitivity Analysis:This establishes the impact of uncertainty on your choices, costs, and revenues.

It lets you weigh the worst- and best-case possibilities for your choice.

What can you infer about the feasibility of your project or choice from these results?

Draw a conclusion according to the outcome of the analysis youve made.

Keep in mind that you should weigh more than just the cost-benefit analysis while making decisions.

Implement the project or decision if it turns out to be feasible.

This might include creating a schedule, assigning resources, and creating a project plan.

Did your projections match the real expenses and benefits?

If not, what circumstances led to the difference?

Make future judgments using this knowledge to improve your cost-benefit analysis procedure.

However, its crucial to take into account other variables and to periodically evaluate and modify your strategy.

Ive already provided the monetary value in all the steps.

This implies that in less than a year, the project would begin to pay for itself.

Based on these projections, it seems that the business would benefit financially from investing in the new equipment.

A real-life example can be more complex compared to this example.

Optimal Resource Allocation:CBA ensures responsible resource distribution by weighing costs and benefits.

Risk Analysis:By assisting in the identification of possible hazards, CBA enhances the management and mitigation process.

Transparency:CBA offers an understandable process for assessing decisions.

Lets now explore some of the disadvantages of cost-benefit analysis.

Limitations of Cost-Benefit Analysis

Though CBA is a powerful tool, it does have some limitations.

Therefore, you should also consider the limitations and then minimize those factors before decision-making.

Measuring Intangible Costs and Benefits:Assigning monetary value to intangible costs and benefits can be challenging.

Plus, there is some uncertainty related to the change in monetary value over time.

Biased Estimation:The analysts conducting CBA can mistakenly evaluate the findings by overestimating benefits or underestimating costs.

It helps in figuring out if the financial benefit exceeds the costs of building and maintaining.

It helps determine if the expenditures paid are justified by the health benefits.

It aids in optimizing the resource distribution.

Incorporatingcarbon accounting softwareinto this process allows companies to accurately measure and track their greenhouse gas emissions.

The reason is simple: you cannot monetize all the related costs and benefits of your project.