We earn commission when you buy through affiliate links.

This does not influence our reviews or recommendations.Learn more.

Digital workspaces have completely changed the way we work.

Gone are the days when companies were restricted to hiring locally.

While exciting, this shift brings with it new responsibilities, particularly around employer responsibilities.

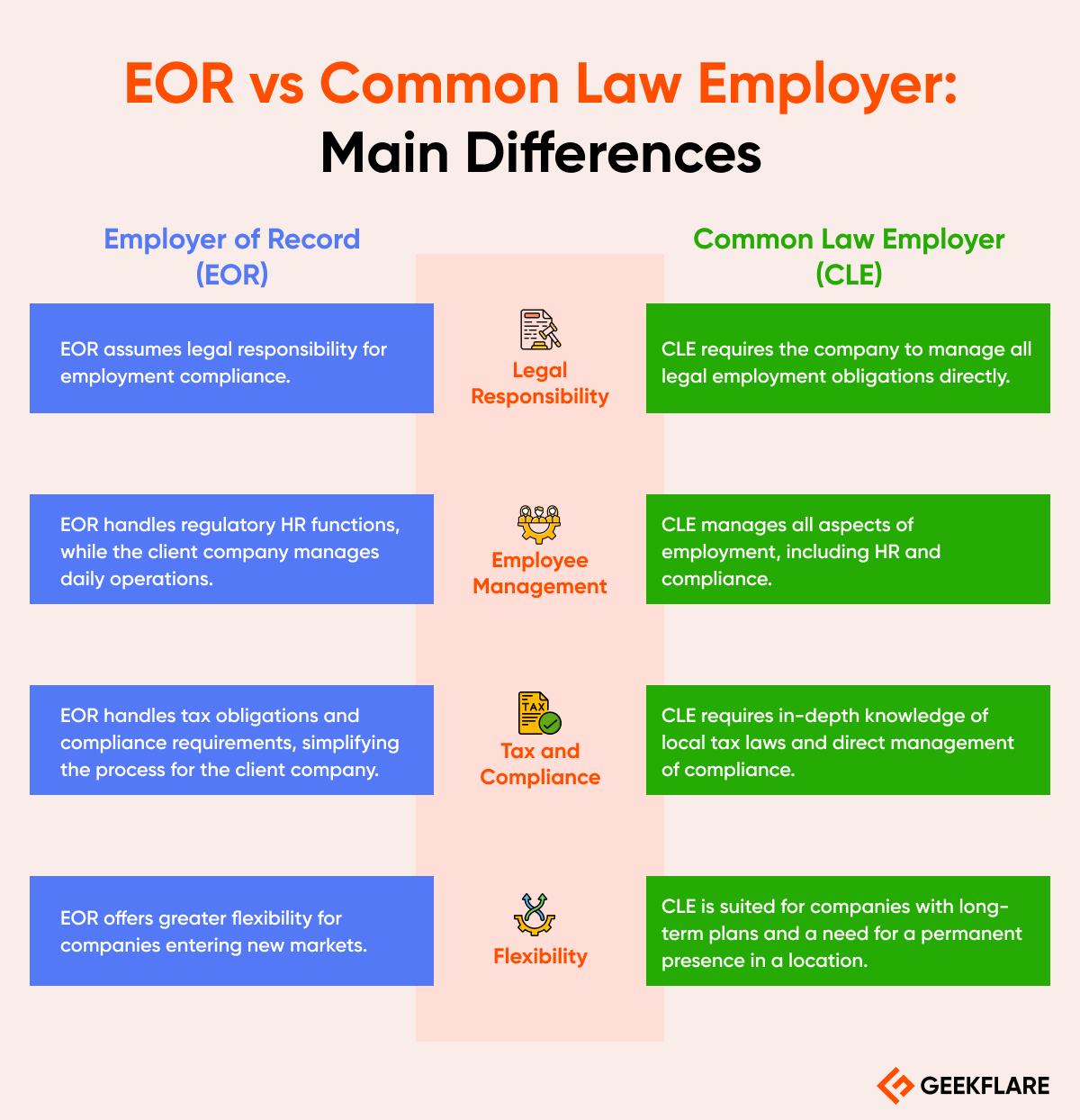

Both of these are types of employers.

However, each has distinct differences in handling their legal responsibilities and managing employees.

What is an Employer of Record?

So youre still in charge of your employees daily activities, work assignments, and performance management.

Which means they handle everything from payroll processing and administering benefits to adhering to local labor laws.

So, youre free to focus on managing your teams and achieving your business goals.

What is a Common Law Employer?

And you want more hands-on control over compliance and aspects of employment administration.

In other words, youll have full autonomy in structuring and managing your teams.

This means youre accountable to that regions employment laws and regulations.

As a CLE, youre directly responsible for managing all the employment-related legal obligations.

So youre liable for everything from the initial setup of employment contracts to ongoing adherence to government regulations.

When partnering with an EOR, you trust a locally based third party to take on this role.

Employee Management

In a CLE arrangement, your company oversees every aspect of employee management.

So hiring, training, remuneration, leave, career development, and more all fall under your purview.

Now, with the EOR model, your employees technically have two employers.

Tax and Compliance

As a CLE, youre responsible for meeting all your employees tax obligations.

This includes income tax withholding, social contributions, and regulatory filings.

With an EOR, they handle all these tax and compliance requirements on your behalf.

Flexibility

Of the two employment models, a CLE is typically less flexible.

So, its most suitable for companies that have fixed, long-term plans in a specific location.

This is particularly true for long-term employees or larger teams.

This can be costly and time-intensive, especially for small or temporary expansions.

Which is Right for You?

So, how do you choose which employment model you should use?

Remember that higher upfront costs and complex administrative tasks are involved.

However, you also get full control over your compliance and HR processes.

Ultimately, your choice will depend on your business goals, team size, and market entry plans.

Understanding the strengths and weaknesses of each model will help you make the best decision for your needs.