We earn commission when you buy through affiliate links.

This does not influence our reviews or recommendations.Learn more.

FreshBooks

FreshBooks is accounting, and billing software for startups, small businesses and freelancers.

Ill share my experience to help you decide if it is good for your new business.

We evaluated essential features and calculated a combined overall rating for each.

What is FreshBooks?

FreshBooks is a comprehensive cloud-based account and invoicing software suitable for service-based businesses, freelancers, and independent contractors.

Founded in 2003 by Mike McDerment, FreshBooks started as a small agency in a basement.

Today, the company serves over 30 million customers in 160+ countries and has more than 500 employees worldwide.

In addition to the cloud-based software, they have a FreshBooks invoicing mobile app for Android and Apple devices.

The dashboard gives users all the information about invoices and payments.

you could view the overdue amount, the total outstanding, and the invoices in the draft.

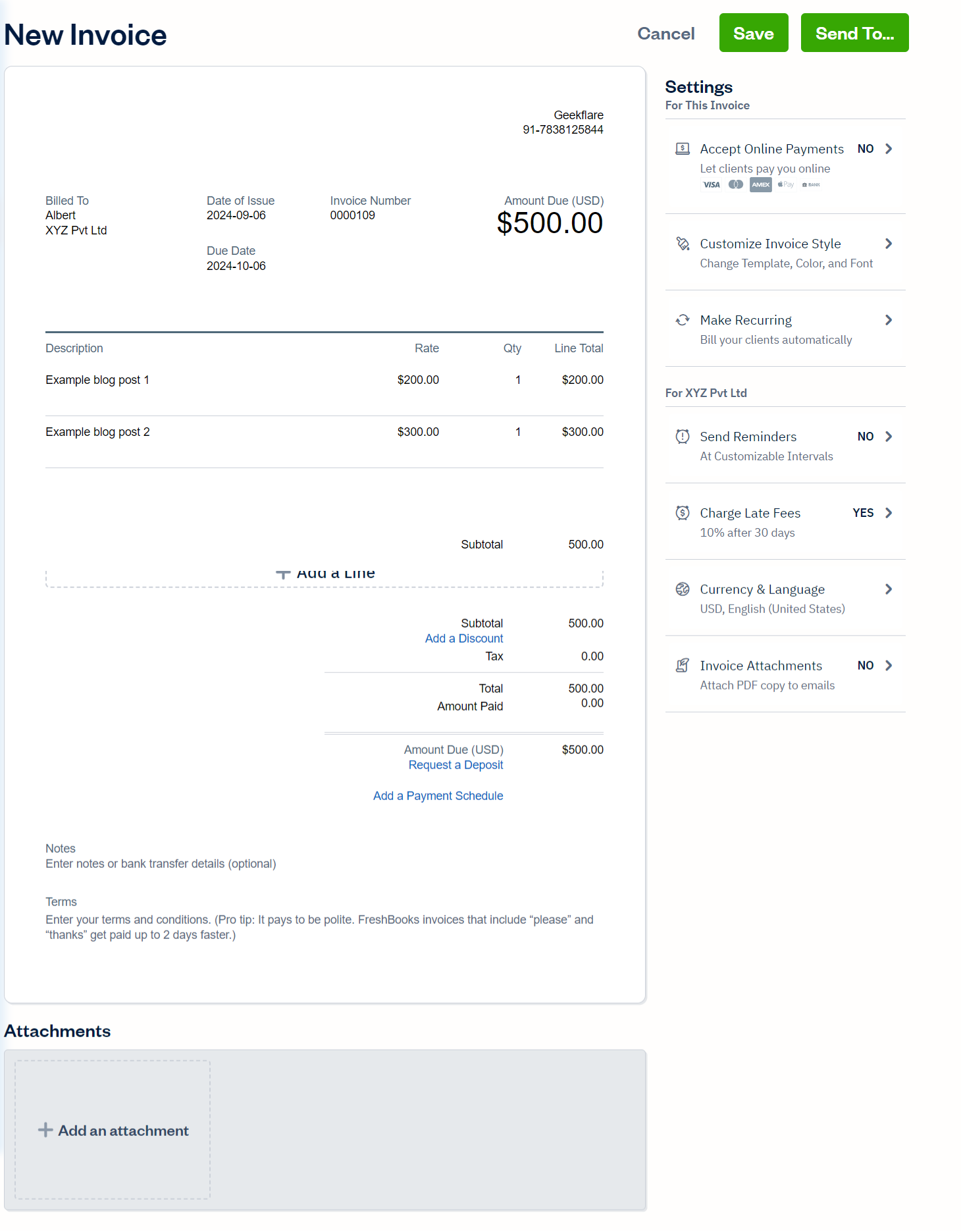

One thing to appreciate about FreshBooks is its ability to customize the invoices and add new columns accordingly.

it’s possible for you to add new columns or remove the existing ones.

I use the following invoice format for most clients.

FreshBooks offers three invoicing templates: Simple, Modern, and Classic.

FreshBooks also allows you to set up recurring invoices and accept online payments through credit cards.

Moreover, it offers multi-currency invoicing, allowing you to send invoices in your local currency.

Once youve sent the invoice, you might set up automatic email reminders to ensure youre paid on time.

FreshBooks allows you to share invoices through the link or email.

Payments

FreshBooks tracks all your payments through the payment dashboard.

Additionally, FreshBooks allows you to set up checkout payment links through Stripe and PayPal.

These links can be used on websites, shared on social media channels, or sent via email.

As an add-on, the Advance Payments feature lets you accept credit card payments from the phone.

This feature costs $20 monthly for the three cheapest plans and is included in the Select plan.

Upon payment, FreshBooks sends an automatic receipt to customers and merchants.

Time Tracking

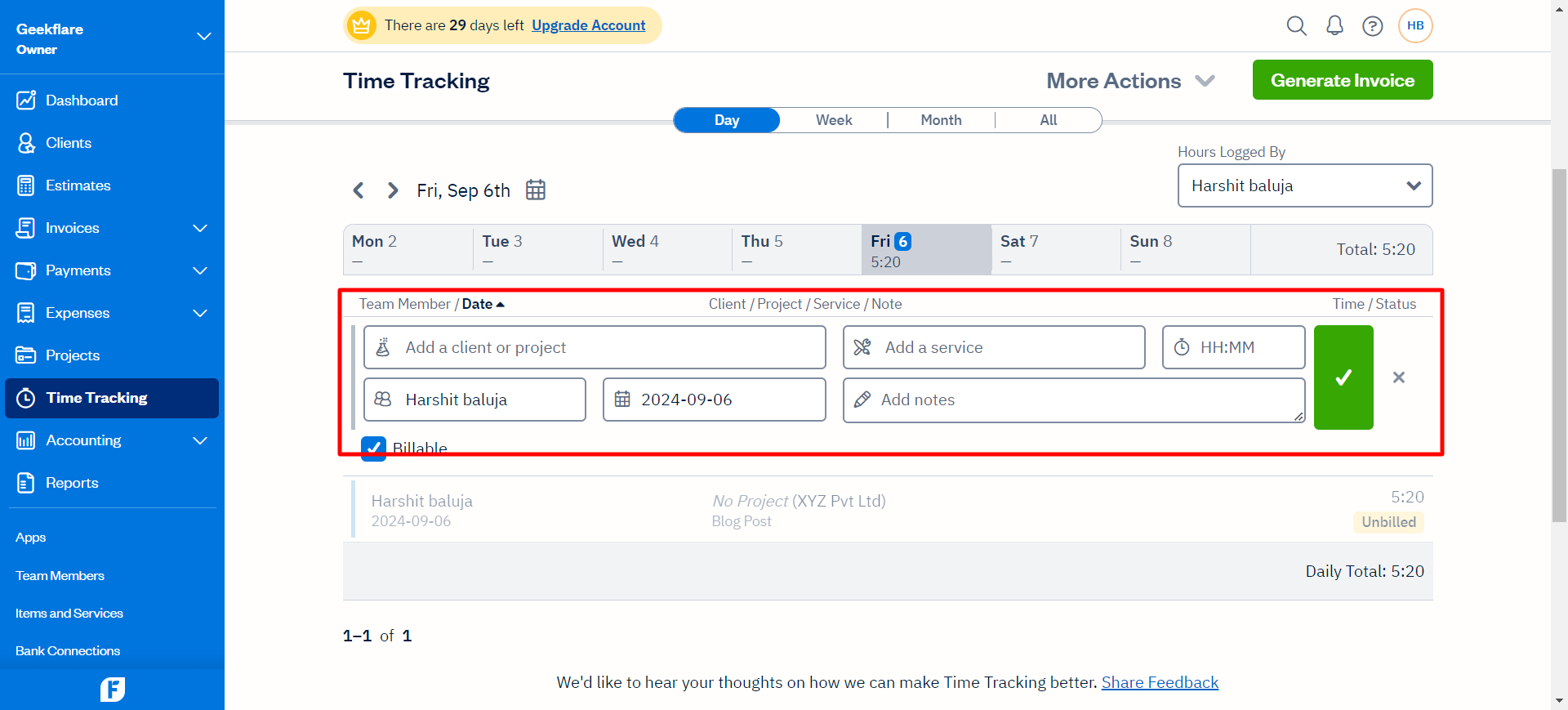

FreshBooks time-tracking feature is most suitable for freelancers and contractors who are paid hourly.

I found this time tracker intuitive and easy to set up, and it converts billable hours into invoices.

you’re able to also choose to create invoices for weekly or monthly hours.

Users can assign a task to a team member and use the timer.

![]()

I liked this in-build time feature instead of relying on third-party timers.

Additionally, FreshBooks allows you to connect with the bank of your choice and supports over 14,000 financial institutions.

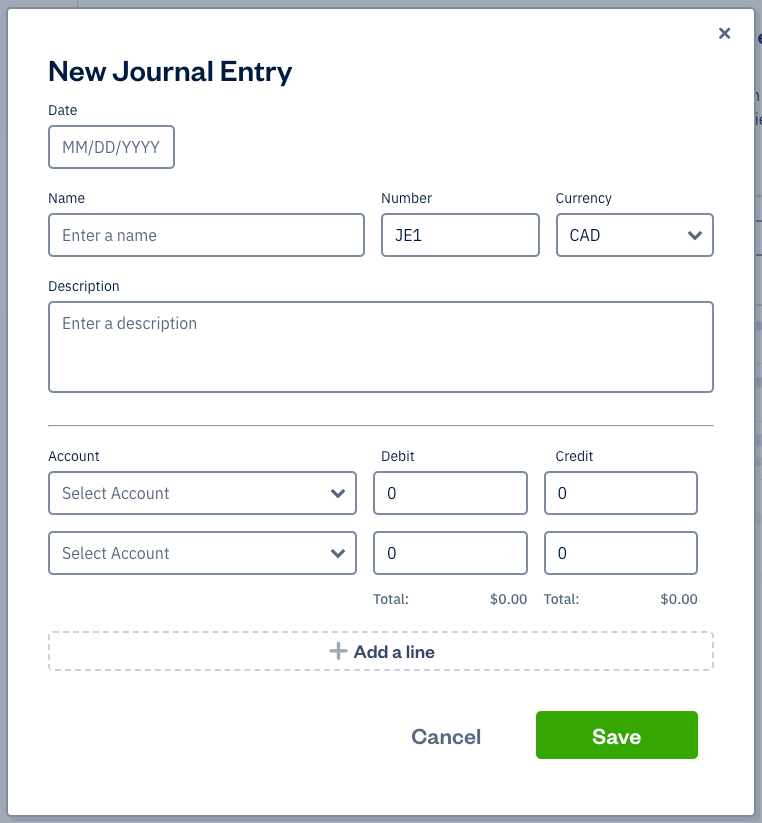

I even liked the journal entry interface, which transparently records credited and debited accounts.

Here, the bank reconciliation summary compares your bank account with FreshBooks balance to find mismatches.

The good part is that it can export and customize these reconciliation reports using the filters.

Instead of manually entering the invoices and expenses, FreshBooks fetches them automatically from your bank account.

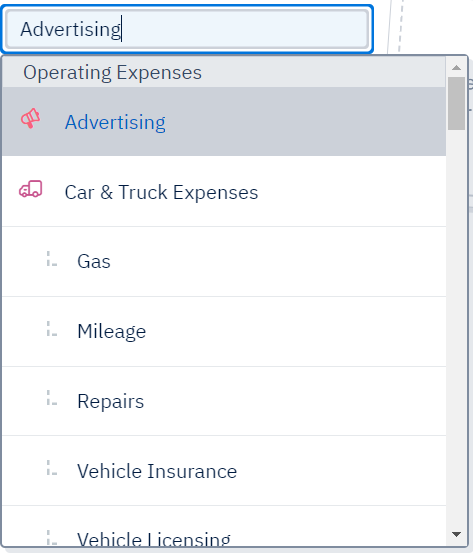

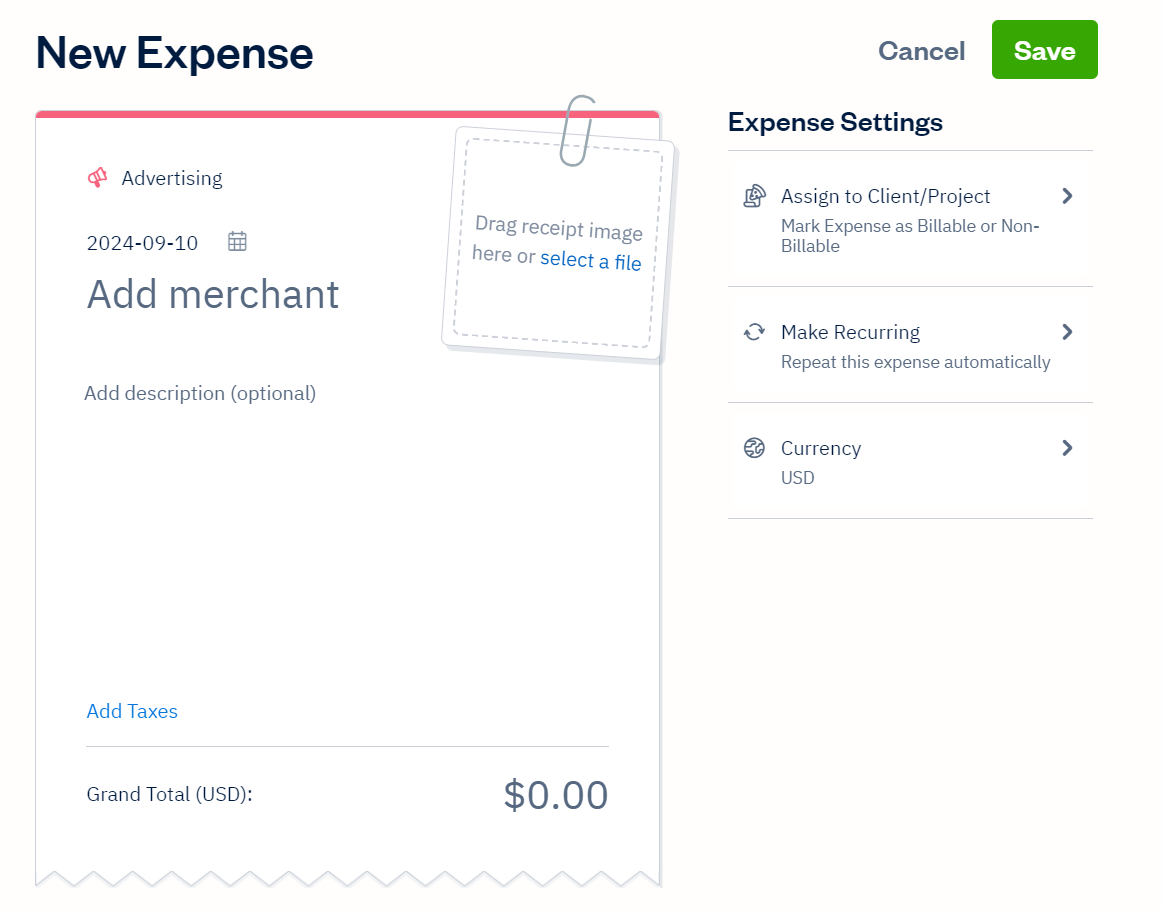

It allows you to create recurring expense receipts and mark them as billable or non-billable.

FreshBooks offers a robust vendor management feature that allows you to track invoices and manage expenses on the go.

it’s possible for you to add multiple vendors and track each of their expenses individually.

Financial Reports

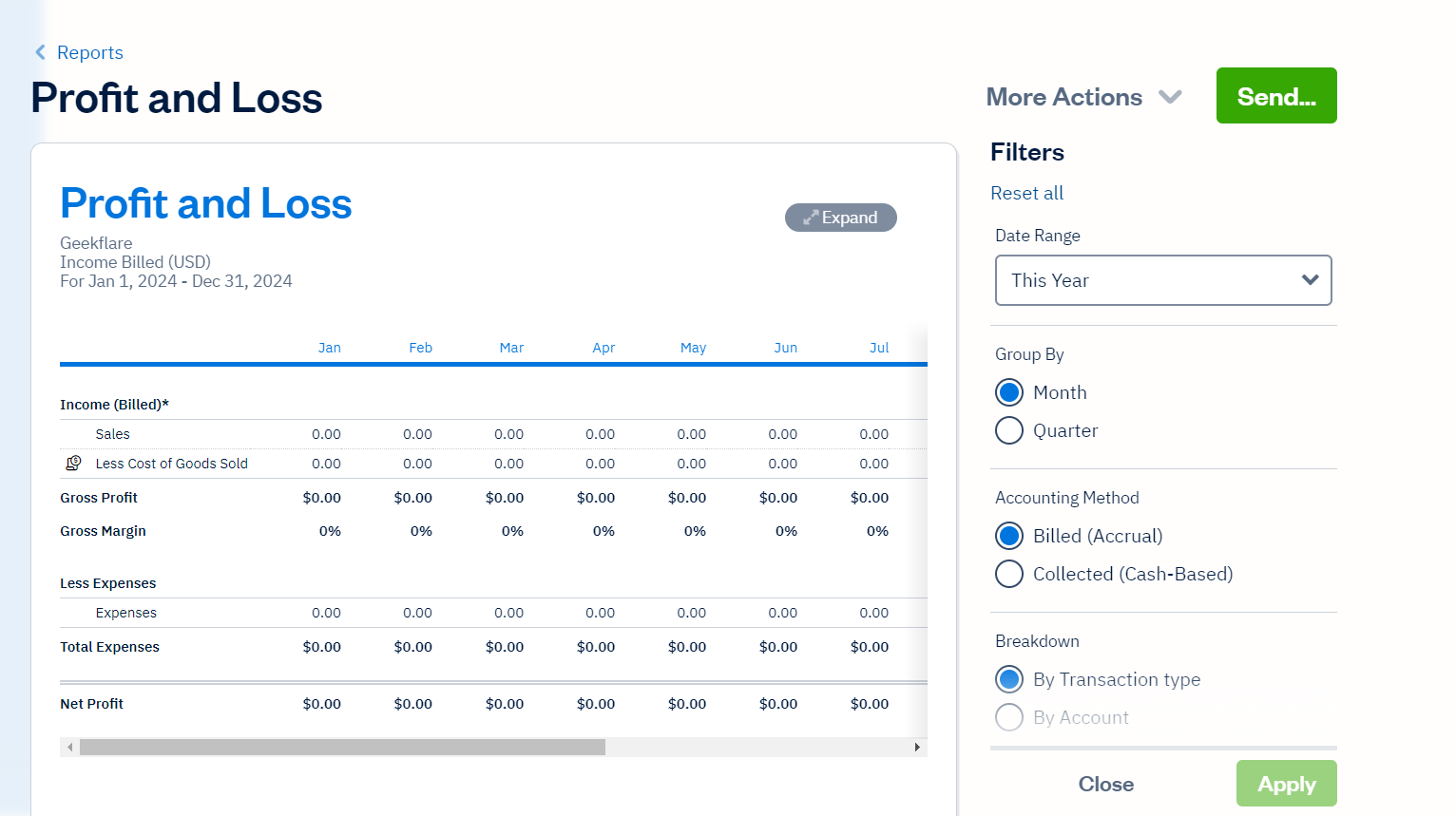

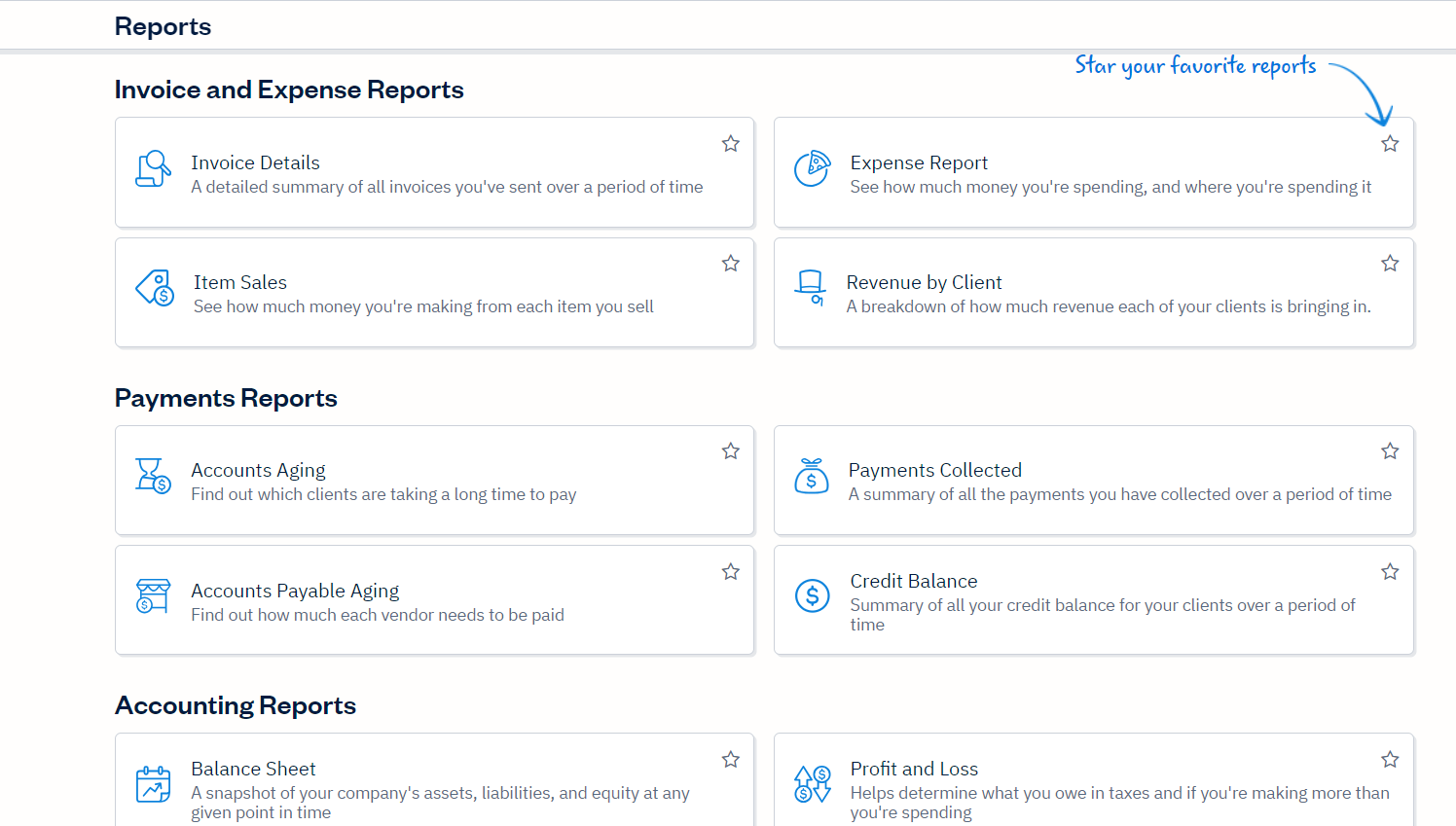

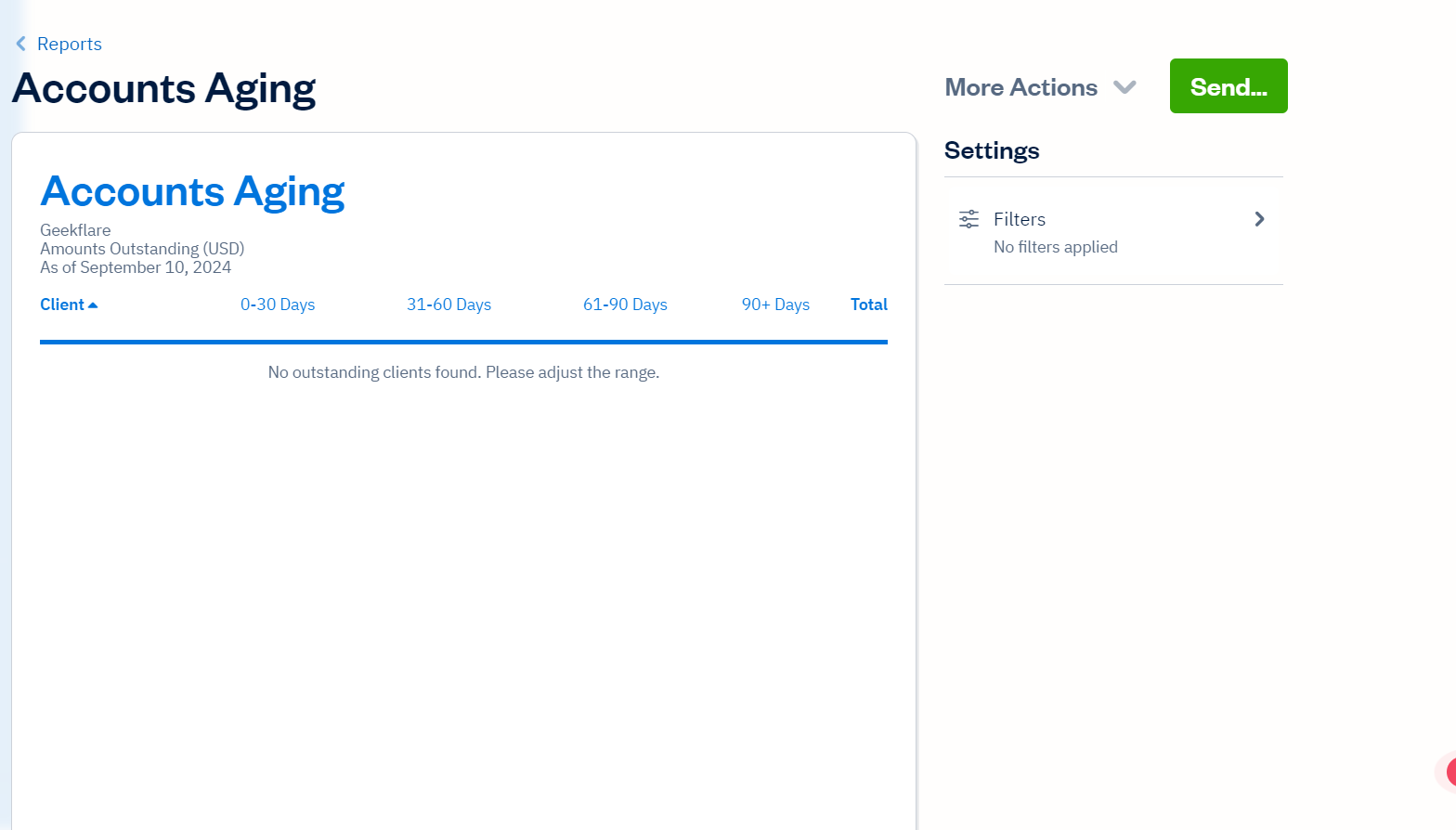

FreshBooks offers numerous financial reports for businesses, individual users, or even agencies.

It tracks various accounting aspects in automation and gives a clear picture.

These reports can be exported into various formats and are stored in your dashboard.

This helps track expenses and budgets year by year.

These reports can be emailed to clients, stakeholders, or anyone outside of your organization.

These tax deductions get added to your expenses or accounting systems automatically.

Unlike other accounting software, mileage tracking is included with all paid plans for Android and iOS apps.

Bench provides year-round bookkeeping, unlimited tax advisory support, and the ability to track payments.

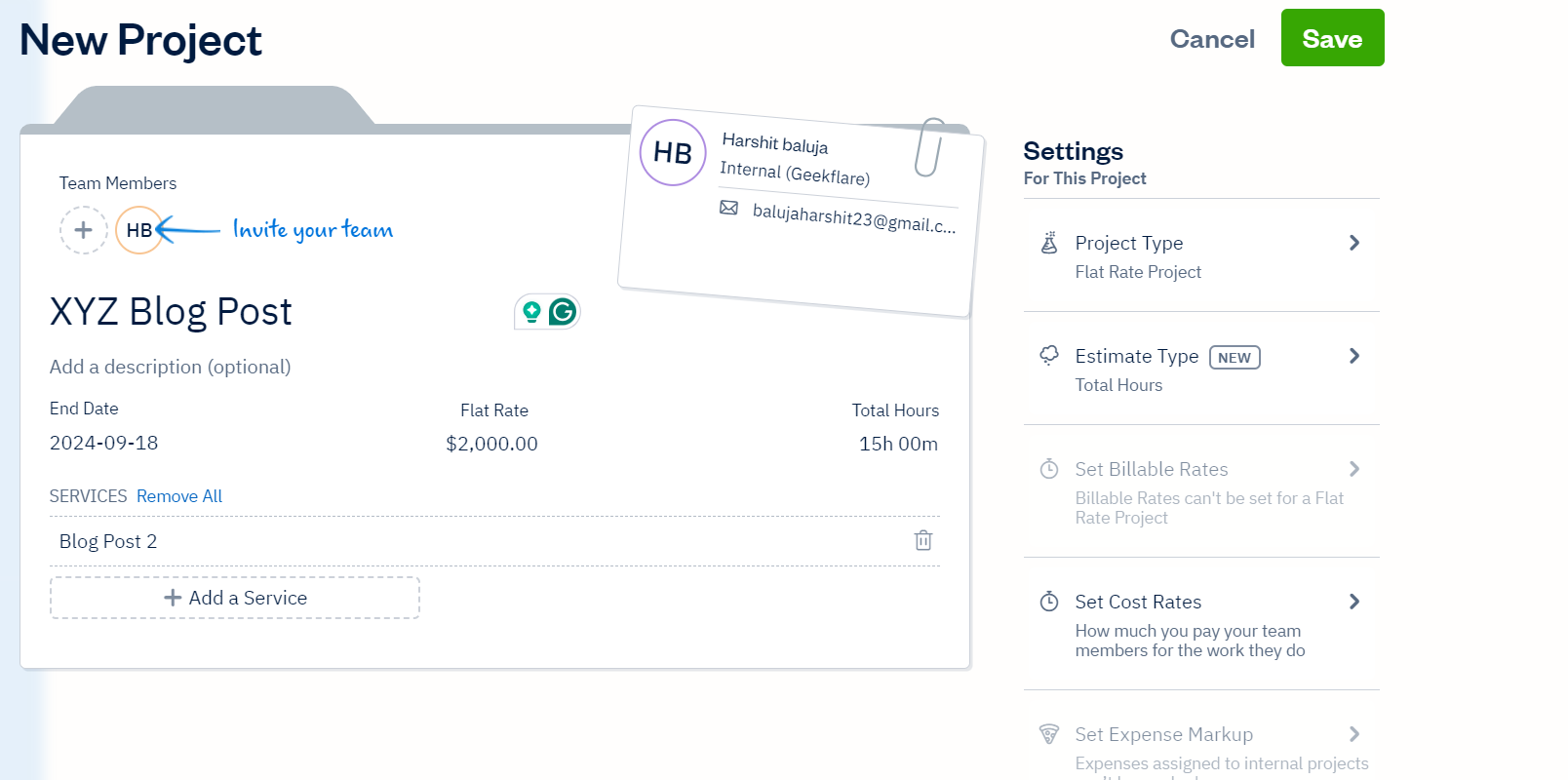

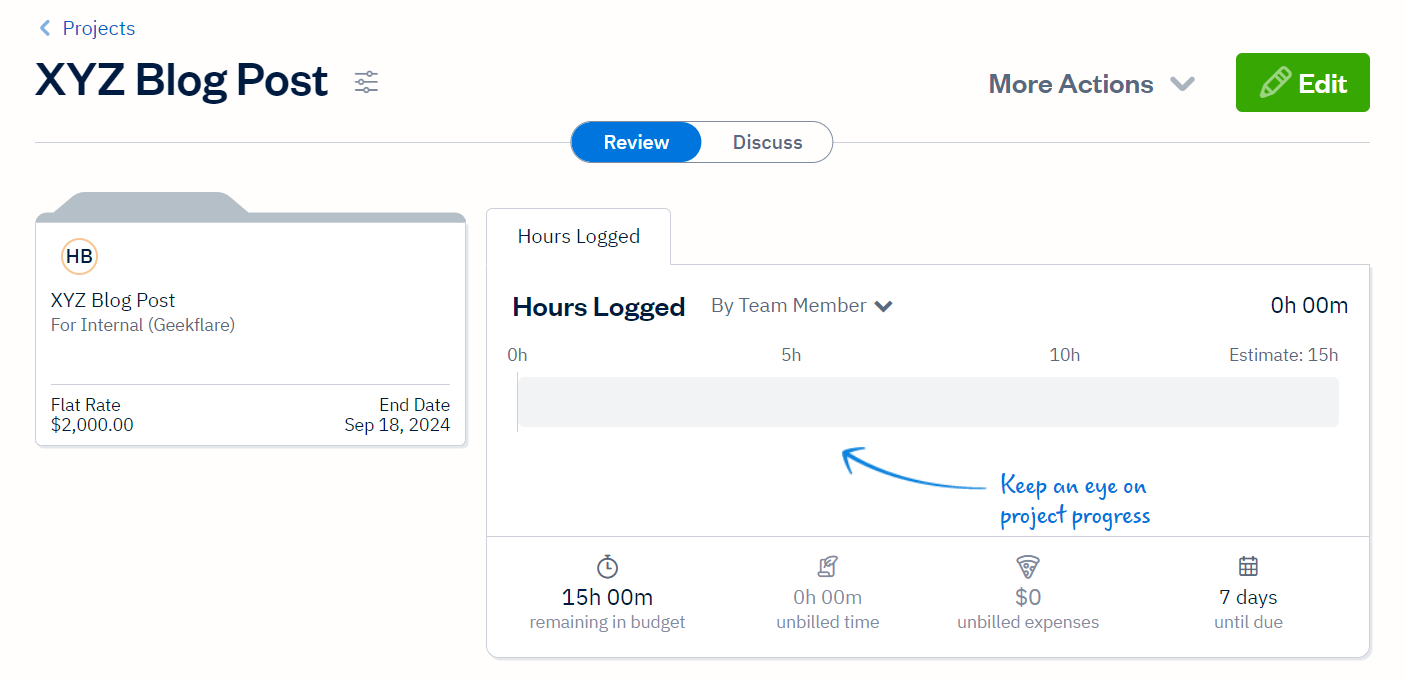

Project Collaboration

FreshBooks is moderately good at project management.

Before creating a project, the platform allows you to choose between an hourly rate and a flat price.

I like this feature for its simplicity and ability to create projects quickly.

Enter the project details, such as the client name, end date, pricing, and time period.

you’re free to also set cost rates in advance to maintain transparency.

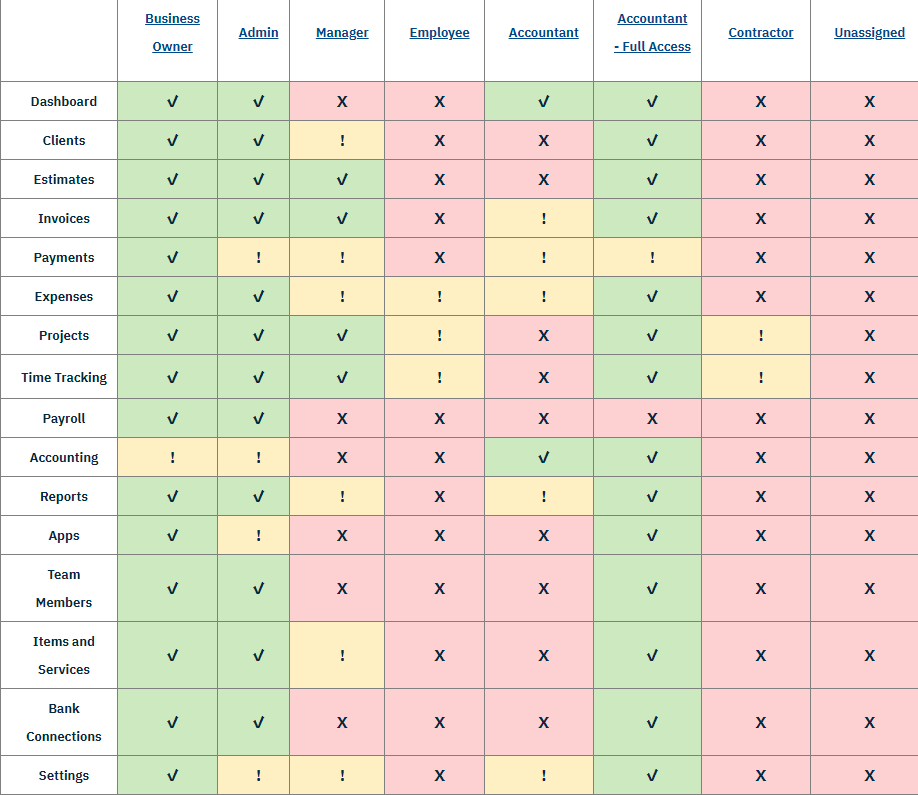

Like other project management and collaboration tools, admins can limit the accessibility and permissions.

FreshBooks offers a range of features for seamless collaboration.

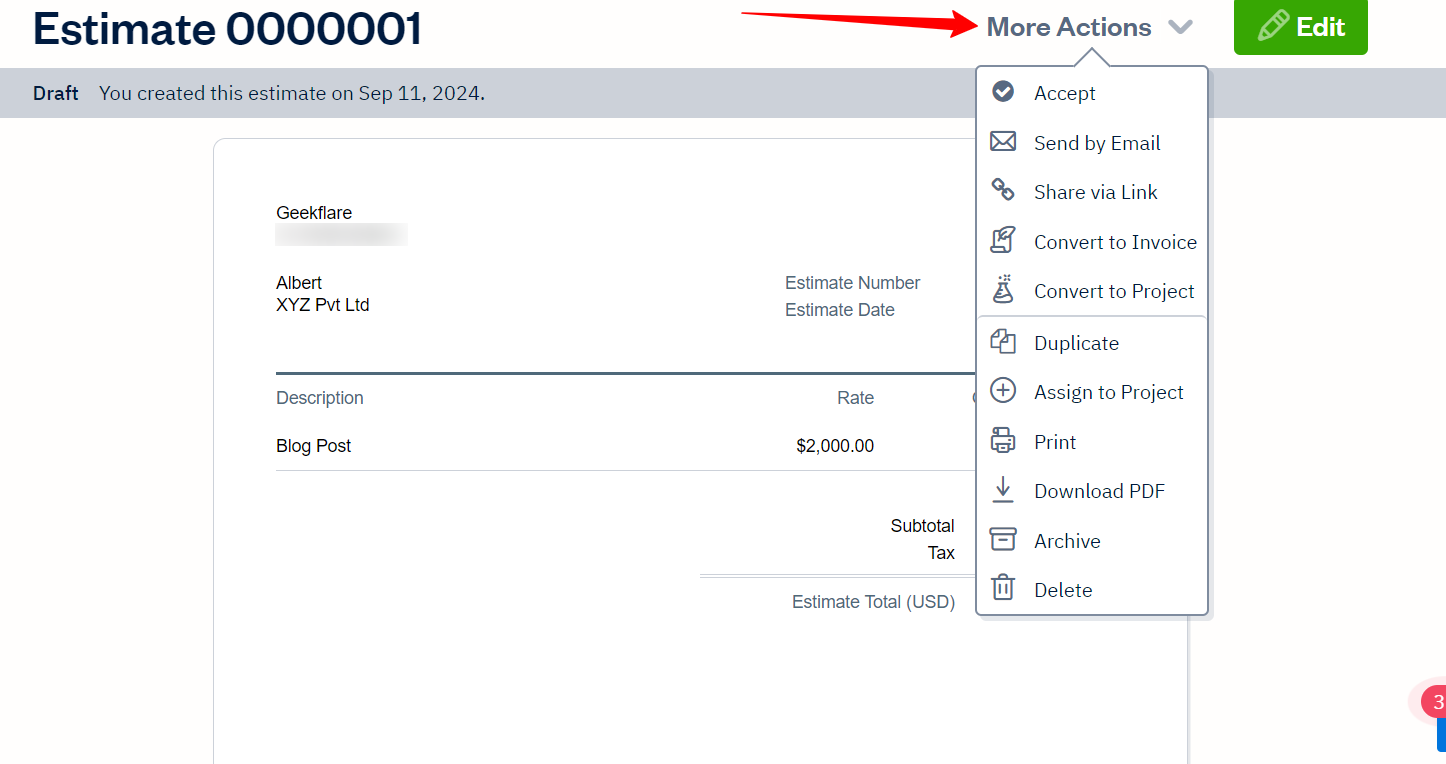

FreshBooks lets you create a project estimate with an outline of all the services and an estimated cost.

you might customize the estimate style or choose from a range of templates.

FreshBooks saves time by creating a smoother workflow and connecting all the features.

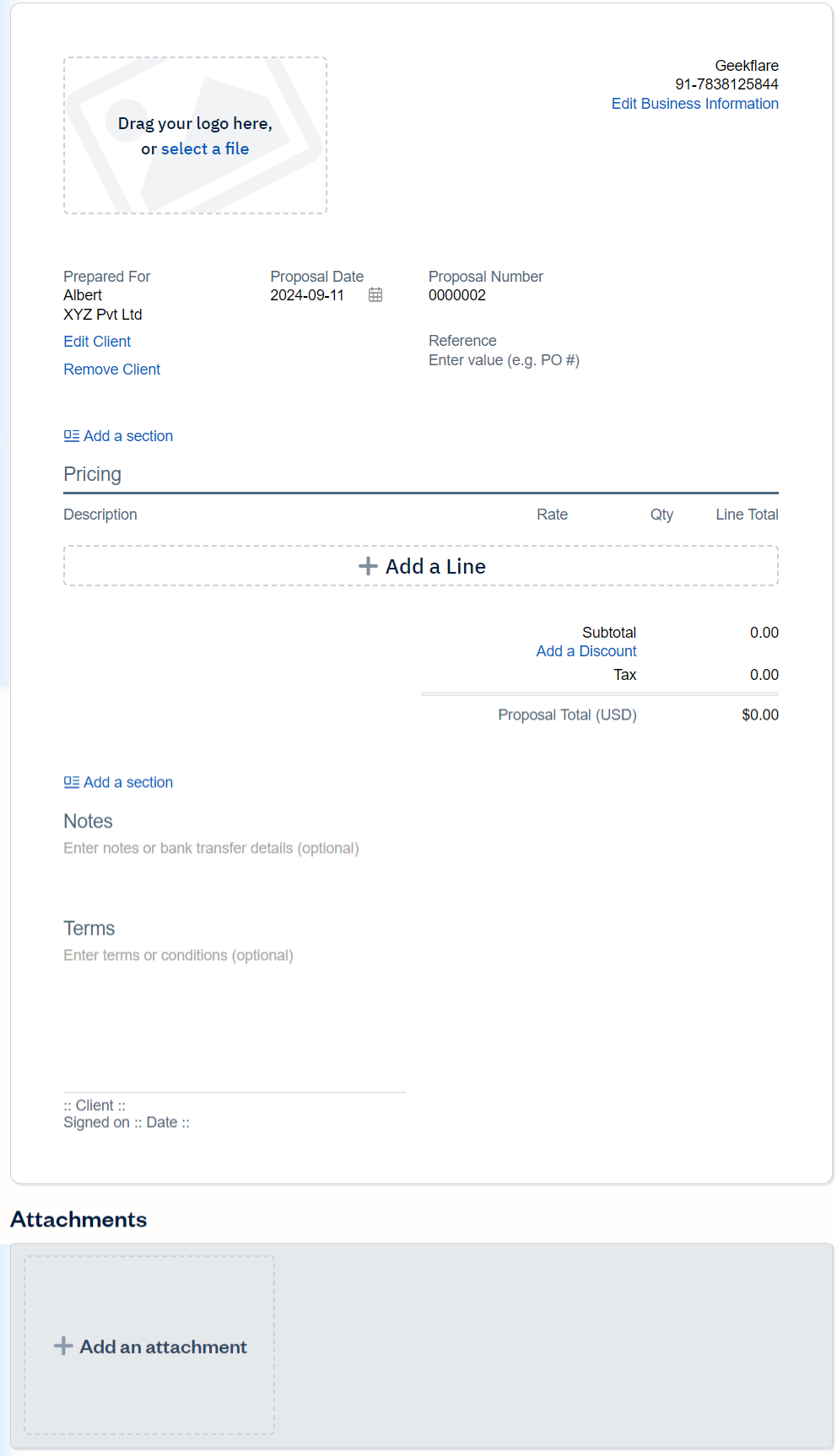

FreshBooks has a proposal template similar to the estimates.

Users can create a brandable proposal and list their items.

The template allows users to share the proposals with clients and get their electronic signatures right away.

However, it lacks specific fields such as goals, timelines, and objectives.

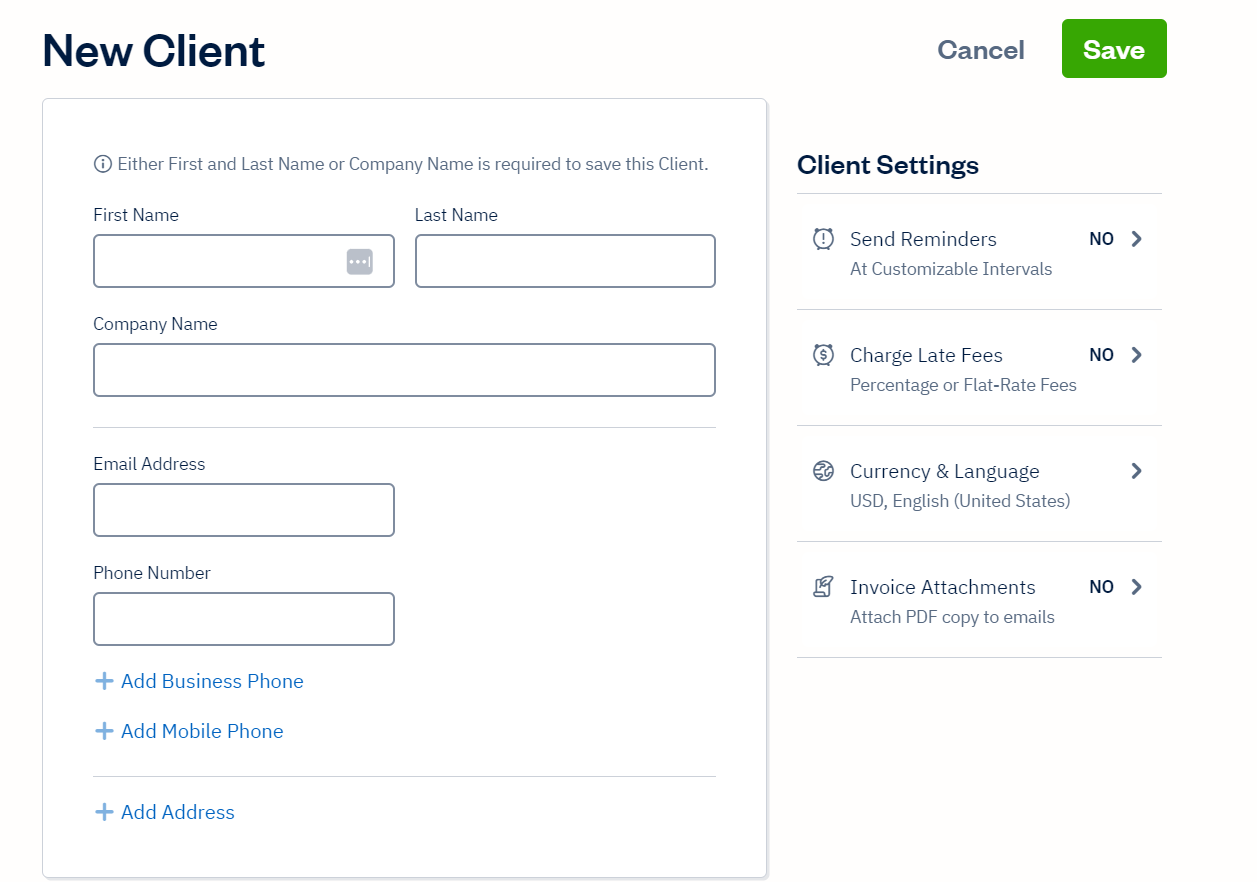

Clients

FreshBooks is a repository for all your clients in a single place.

The client creation process is quick and smooth.

The client dashboard also gives insights into the total outstanding amount, overdue amount, or pending transactions.

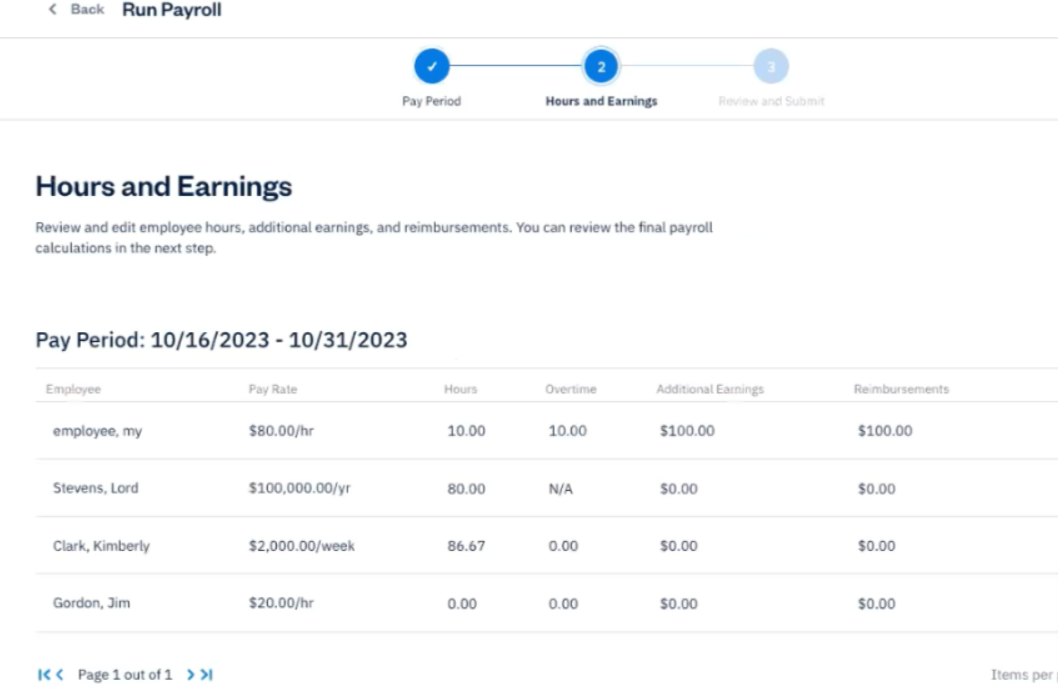

Payroll

Payroll management isnt an in-built feature of FreshBooks.

The platform provides a long payroll history and detailed insights into payroll expenses.

This comes as an add-on, which costs $11 per user per month.

Using the team management profile, you might streamline payrolls and generate invoices.

Heres what FreshBooks offers to different users:

What are the Benefits of FreshBooks?

An annual plan provides a 10% savings.

Also, they are providing a limited-period offer of 70% off for 4 months.

FreshBooks also offers some add-ons, which come at an additional cost.

If you do business with contractors, choose from any of the three high-tier pricing options.

Premium and Select plans are considered the best choice for businesses with employees.

Is FreshBooks Invoice Free?

FreshBooks invoice generator is free to use.

FreshBooks Customer Support

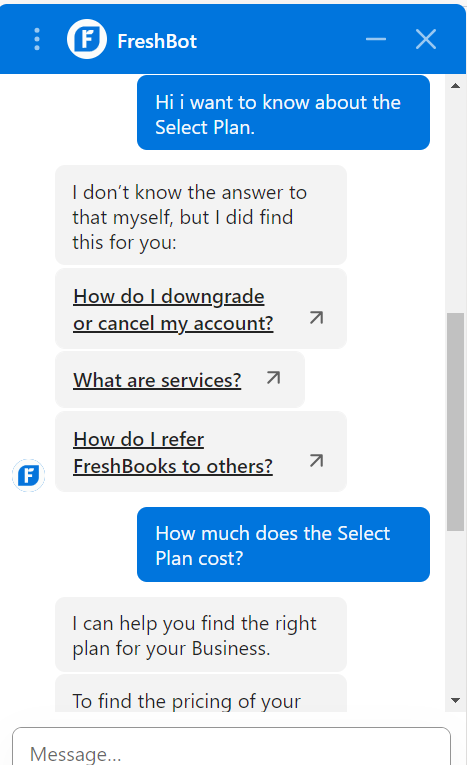

FreshBooks offers various support channels, including phone, email forms, and chatbots.

For the Select plan users, the company provides dedicated customer support with full onboarding and training.

FreshBooks live chat agent, FreshBot, was quick and replied to my queries within seconds.

For instance, I asked about upgrading to the Select plan and its pricing.

However, their live chat needs a more human touch.

FreshBooks offers integration with over 150 third-party tools to streamline your accounting process.

Does FreshBooks Have Mobile Apps?

Yes, FreshBooks has mobile apps foriOSandAndroiddevices.

What is the difference between FreshBooks and QuickBooks?

The major difference betweenFreshBooks vs QuickBooksis its user base.

Who Should Use FreshBooks?

FreshBooks is best suited for freelancers, self-employed, and small businesses with fewer employees.

It works best for businesses that require basic accounting features.

From invoicing to expense tracking, bookkeeping to payroll, it offers everything under one roof.

Itd be great to start with a free trial and give it a shot.

FreshBooks receives theGeekflare Value Awardfor its robust features that dont feel overwhelming.