We earn commission when you buy through affiliate links.

This does not influence our reviews or recommendations.Learn more.

Managing your payroll is one of the most essential parts of running your business.

But thanks to various legal obligations, its also one of the most complex.

This guide will explain payroll outsourcing and how it works.

Ill also discuss its pros and cons and how to decide whether its the right choice for your business.

What Is Payroll Outsourcing?

These include anything from employee wage calculation and payroll taxes to generating pay stubs and complying with labor laws.

Outsourcing doesnt just stop atpayroll administration, though.

Many payroll providers offer an all-inclusive solution for a variety of business needs.

If your company operates internationally, some providers will offerglobal payroll servicesto ease compliance with foreign regulations.

This would include employee information such as hours worked, salaries, tax deductions, bonuses, and overtime.

They use advanced payroll software to guarantee the accuracy and conformance of the calculations to regulations concerning payroll.

This minimizes the possibility of penalties and keeps your company in full compliance with local and international payroll laws.

Then, theyll produce any required reports.

Outsourcing your payroll responsibilities saves crucial time that you would have wasted on repetitive administrative chores.

Cons of Outsourcing Payroll

Outsourcing payroll can present some disadvantages, too.

Cost

While payroll outsourcing saves time, it comes at a cost.

And that would impact both your employees satisfaction and your finances.

Should You Outsource Payroll?

Key Considerations

Here are a few variables to consider regarding payroll outsourcing decisions for your business.

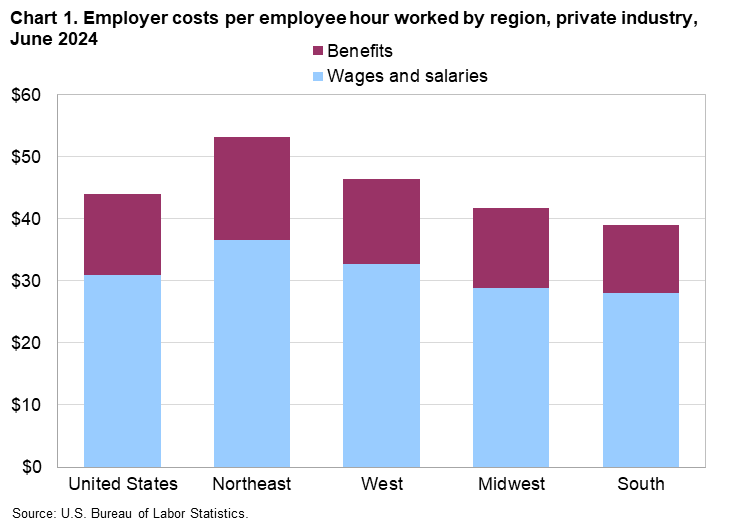

Budget and Cost Analysis

Compare payroll outsourcing costs with the costs of keeping an in-house payroll team.

Consider the direct cost, time savings, and reduced errors in analysis.

This hybrid approach to payroll is ideal for those businesses that want the best of both worlds.

What Is Payroll Co-sourcing?

Co-sourcing is a payroll model in which certain payroll functions are outsourced while others remain with the company.

There are several occasions when co-sourcing would work perfectly:

Co-sourcing payroll combines maximum autonomy with specialist backup support.

It is scalable with the growth in business because you will be billed based on exactly what is utilized.