We earn commission when you buy through affiliate links.

This does not influence our reviews, ranking, or recommendations.Learn more.

Wave Accounting

Wave is an accounting and bookkeeping software that helps you manage your businesss finances.

It is suitable for small businesses, freelancers, consultants, contractors, and startups.

We evaluated essential features and calculated a combined overall rating for each.

What Is Wave Accounting?

WaveAccountingis a cloud-based double-entryaccountingsoftware with a suite of tools and services that streamline bookkeeping and invoicing.

It also allows users to accept online payments and easily managepayrolland taxes without having specialized knowledge.

Wave, headquartered in Toronto, Canada, launched theaccountingsoftware in 2010.

It is only available to users in the US and Canada.

Wave allows you to access it on any unit with a modern web app and an internet connection.

It also has a dedicated mobile app for Android and iOS devices.

10 Best Wave Accounting Features

Key features that make WaveAccountingpopular among users are listed below.

This leads to greater efficiency and accuracy when dealing withsales tax.

you might edit and delete it anytime using the web or mobile app.

Invoicing

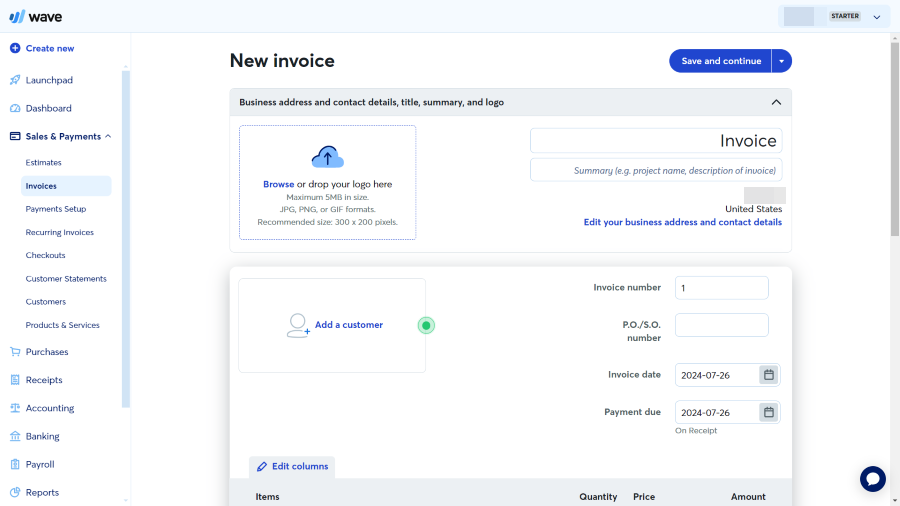

In WaveAccounting, you’re able to easily create professional-looking invoices.

Furthermore, the software automates sending invoice reminders to customers if they have overdue invoices.

That way, youre not chasing busy payments but getting paid and focusing on your business.

When you send your customers an invoice, they will see the Pay Now button.

Once they click it and pay, the funds will appear in your account in 1-2 business days.

Meanwhile, Wave is keeping track of every payment in the background using the double-entry method.

The best part of using Wave is, you dont have to worry about a payment gateway like Stripe.

it’s possible for you to use Wave Payments to receive payments for your invoices.

Accounting

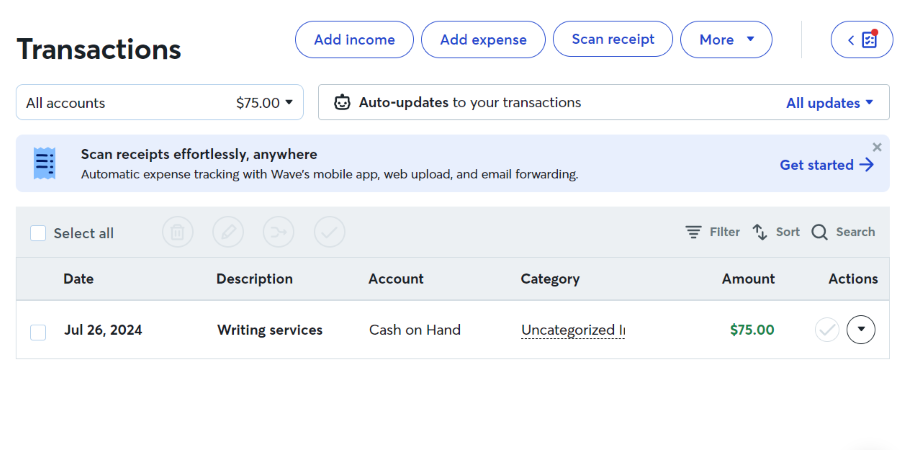

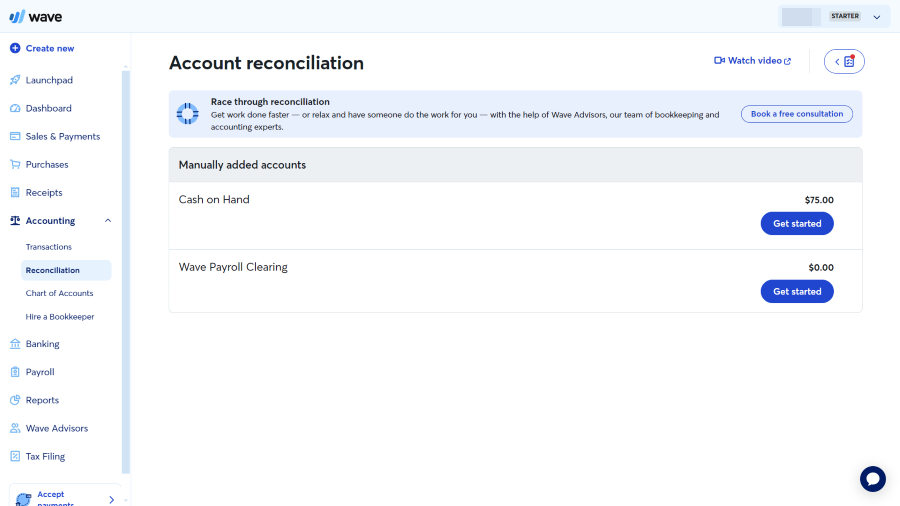

Wave uses double-entryaccountingto monitor transactions based on income and expenses.

you’re free to even edit it manually by adding and removing accounts to suit your business needs.

It also allows you to generate reports on all reconciled records and any discrepancies that need handling.

So, if there is a problem with your accounts, WaveAccountingwill let you know.

Bank Connection

Wave allows you to import transactional data from your bank account or credit card.

you might add as many bank accounts and credit cards as you need.

Furthermore, this provides another way to track expenses and stay on top of your taxes.

It also allows you to easily organize and categorize your receipts, making them easier to find when searching.

Payroll

Wave Accountingspayrollfeature helps you manage paying your employees, independent contractors, and yourself.

you could process all the payments with a single click, which saves time and reduces manual errors.

WaveAccountingalso offers an automated tax service.

Learn accounting.

Access to Advisors

WaveAccountinghas a service where you get personalized bookkeeping service support andaccountingcoaching from in-house experts.

What are the Benefits of Using Wave Accounting Software?

Wave Payments fees depend on transaction payment methods and your subscription plan.

Credit card processing fees under the Pro plan are cheaper than Stripe.

Stripe charge 2.9%+$0.30 per transaction, where Wave is just 2.9%.

Yousave 30 cents per transaction.

However, if you gotta accept internationally and need more payments methods, thenStripeis a no-brainer.

How to Access Wave Accounting for Free?

it’s possible for you to sign up using an email and password or your Google account.

Afterward, you should probably complete the onboarding steps.

This involves describing your business (e.g., name, location, industry, and number of employees).

After this, you will have access to the web version of the software.

Also, it offers a handy FAQ section that contains solutions to common problems.

you could get in touch with the team from 9 AM to 4:45 PM ESTMondaythrough Friday.

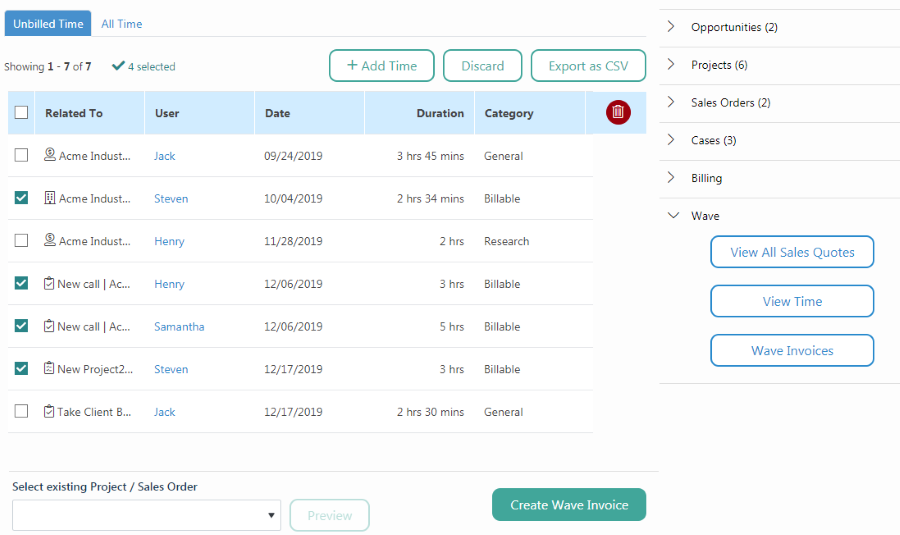

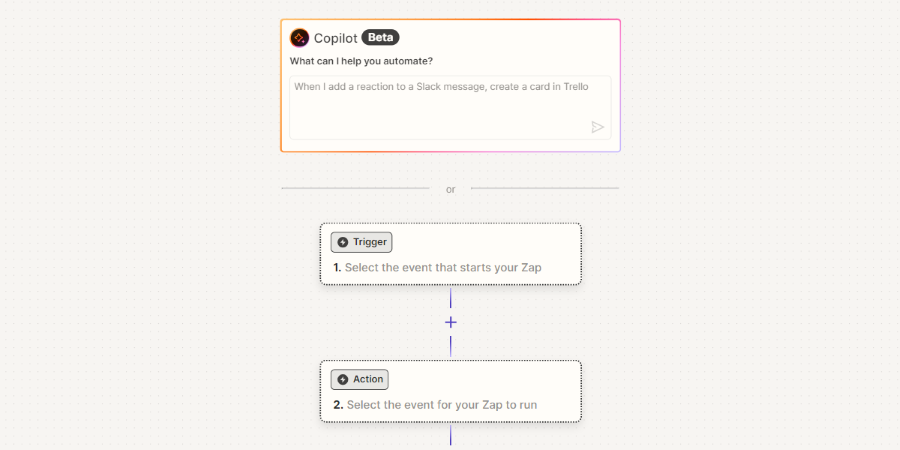

Wave Accounting Integrations

WaveAccountingintegrates with several applications that can enhance its functionality and streamline your workflow.

It was designed to help you move data between Wave Account and other platforms.

For example, when an invoice is created in WaveAccounting, this can trigger the Zap.

Then, a predefined action will occur in another app.

For example, invoice details can be added to a spreadsheet or Notion database.

Does Wave Accounting have Mobile Apps?

Yes, it has an Android and iOS mobile app for bookkeeping and invoicing while on the move.

Can I Import My Data From Other Accounting Apps Like QuickBooks?

If you have Wave Advisor with bookkeeping support, a trained, in-house professional can help you.

This ensures a smooth transition of yourfinancial recordsfrom one system to the other.

Wave Accounting Alternatives

Here are some alternatives to WaveAccountingthat you might consider for your business needs.

Furthermore,QuickBookscan be integrated with over 750 apps.

So, while WaveAccountingis ideal for small businesses and freelancers on small budgets, larger businesses preferQuickBooks.

However,QuickBooksdoesnt have a free plan.

The lowest-paid plan starts at $17.50.

It does have a 30-day free trial, though.

Read ourQuickBooks Online review.

Zoho Books

ZohoBooks is a cloud-basedaccountingsoftware that offers a comprehensive suite ofaccountingand business management tools.

ZohoBooks also has a time tracker, multiple-currency support, inventory tracking, project management, andCRM.

The best part is that it has a free plan that you might use forever.

Theres even a 30-day trial to test the premium features.

Furthermore,ZohoBooks is available outside the US and Canada.

So,ZohoBooks is a great alternative to WaveAccountingsince it has all the basicaccountingfeatures.

However, it also allows companies to scale with tiered plans that provide advanced features lacking in WaveAccounting.

Readour Zoho Books review.

Xero also offers inventory, project management, contact management, sales quotes, and multiple currencies.

It allows you to create and track purchase orders and fixed assets.

Xero has an app store with dozens of apps built to extend the softwares functionality and streamline business processes.

However, it is suitable for businesses who want to scale since the pricier tiers offer the needed features.

Who Should Use Wave Accounting?

Wave is suitable for anyone who needs robustaccountingsoftware on a budget.

Who Shouldnt Use Wave Accounting?

Waveaccountingis not for businesses with complex needs, such as high-volume transactions and multiple currencies.

Also, anyone outside the US and Canada or operating a medium-to-large organization should look into alternative businessaccountingsoftware likeQuickBooksandZohoBooks.

Wave Accounting Verdict

WaveAccountingis an easy-to-use onlineaccountingsoftware ideal for businesses seeking a cost-effective solution for theiraccountingwork.

Its free features make it a valuable tool for managing finances without high costs.

However, businesses with complex needs or those operating outside the US and Canada might need other alternatives.