We earn commission when you buy through affiliate links.

This does not influence our reviews or recommendations.Learn more.

A payroll cycle is the fixed period between two consecutive employee paydays, such as weekly or monthly.

So, is it just another HR term, or does it hold a deeper significance?

What Is a Payroll Cycle?

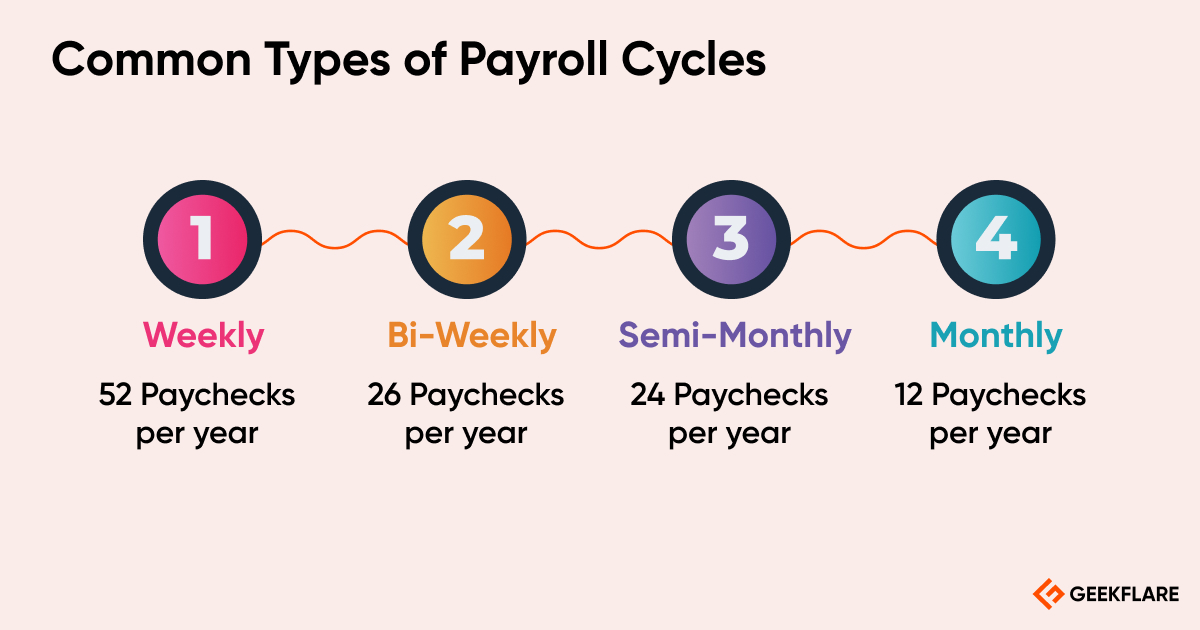

Common cycles include monthly, semi-monthly, weekly, and bi-weekly.

But a payroll cycle isnt just a timeframe from one paycheck to the next.

It alsoincludes all the activities carried out by the HR department in managing employees wages.

These include performance evaluations, employee benefits administration, earnings calculations, and compliance management.

It depends upon factors like company policies, industry standards, companys cash flow, and administrative efficiency.

Below are a few common payroll cycles:

1.

For employers, it improves job satisfaction but increases administrative effort due to the frequency of payroll processing.

Suitable for both hourly and salaried positions, it provides a balance between pay frequency and administrative effort.

Semi-Monthly Payroll

Similar to biweekly pay schedules, semi-monthly payroll employees are paid every two weeks.

Semi-monthly payroll is typically used for salaried employees.

With two paychecks each month, it is easier for them to manage their finances.

However, if used for hourly employees, calculating weekly overtime becomes complex and prone to errors.

Monthly payroll is commonly used for paying expatriates in global companies.

If youre managing international employees, aShadow payroll guidecan help you stay compliant and avoid double taxation.

How the Payroll Cycle Works?

A payroll cycle involves several key steps to ensure accurate employee compensation and compliance with regulations.

How to Choose the Right Payroll Cycle?

Below are a few factors to consider while choosing the right payroll cycle.

On the other hand, large-scale businesses typically use a weekly or bi-weekly payroll cycle.

They employ a diverse workforce, including hourly and low-income employees who benefit from frequent paychecks.

Step 3: Understand Industry Norms

Different industries have different payroll norms based on workforce needs.

In contrast, professional service firms prefer a monthly cycle because most workers earn a fixed salary.

This makes it easier for them to manage the payroll process and plan cash flow.

However, employers mustnt forget their own operational efficiency and cash flow stability when considering employee preferences.

The key here is to strike a balance between employee satisfaction and business sustainability.

Step 6: Payroll Resources

A company must consider its administrative capacity when choosing a payroll cycle.

In contrast, larger companies have dedicated HR teams and advanced systems.

Investing inpayroll softwarefurther bridges this gap.

Why Is the Payroll Cycle Important?

A payroll cycle is more than an assurance of fair and timely employee pay.

It supports the overall health of an organization.

Off-Cycle Payroll vs.

Such a cycle is heavily regulated by federal and state laws to ensure employees receive timely and fair compensation.

Although its predictable, it requires careful planning to avoid legal pitfalls.

Companies must balance meeting deadlines with maintaining accurate records to avoid legal or financial penalties.

For example, businesses often implement off-cycle payroll during layoffs to ensure immediate severance payments.

The retail industry also uses it to pay seasonal bonuses during peak shopping seasons.

An off-cycle payroll offers employers the flexibility to address immediate payment needs without waiting for the next payday.

However, it comes with challenges.

Update Employee Information Regularly

Regularly updating employee data ensures operational efficiency, legal compliance, and employee satisfaction.

If this employee is underpaid consistently due to outdated information, they may lose trust in the company.

An overpayment, on the other hand, may incur financial loss to the company.

Once a discrepancy occurs, it must be rectified immediately when identified.

Integrate Payroll Software

Imagine dealing with a flood or fire while also going nuts over damaged payroll records.

Perishable and fragile punch sheets are a liability since they can be altered, missing, or destroyed.

Payroll software eliminates this risk by securely storing data in the cloud.

For example, a delayed or incorrect payment is inevitable if HR fails to inform payroll about approved bonuses.

But theres a catch.

When it comes to payroll, theres a fine line between communication and confidentiality.

Information like salary, deductions, medical information, and appraisals shouldnt be casually discussed outside the payroll department.

The result was the loss of two employees over the breach of confidentiality.

Regular Payroll Audits

Payroll errors can cost you money, reputation, and employee trust.

Conducting regular payroll audits can help identify discrepancies before they can cause huge damage.

For instance, audits highlight outdated employee information, missed tax deadlines, or unpaid overtime.

Prioritize Employee Concerns

Employees rely on timely, accurate compensation.

A delayed paycheck or incorrect deduction can escalate quickly into dissatisfaction or even a legal dispute.

Therefore, it is vital for businesses to prioritize payroll-related concerns.

When employees feel their concerns are heard and valued, it strengthens the workplace.

This fosters trust and minimizes turnover.

Setting up tools like a feedback portal helps employees report payroll issues easily.

Quickly resolving payroll problems not only boosts morale but also helps retain employees.