We earn commission when you buy through affiliate links.

This does not influence our reviews or recommendations.Learn more.

Accounting cycles help businesses monitor their financial activities by recording and analyzing financial transactions over a specific accounting period.

This systematic review ensures accurate, timely, and organized financial information for an organization.

What is an Accounting Cycle?

The Federal government follows a fiscal year from October 1 to September 30 of the next year.

Each fiscal year needs a fresh cycle to maintain consistent financial reporting across all periods.

Below are the accounting cycle steps.

Each transaction must be accurately identified, classified, and analyzed for its impact on the companys financial position.

These transactions are usually gathered from source documents such as sales invoices, receipts, and purchase orders.

However, most modern businesses use point-of-sale (POS) systems directly linked to accounting software.

This setup automates the recording of sales transactions and reduces the chances of human error.

Beyond sales, other financial activities like expenses can differ widely, including rent, utilities, and wages.

These details must be carefully identified and analyzed to ensure completeness and accuracy in the financial records.

Each entry specifies the transaction date and accounts involved in the amount to be debited or credited.

This represents the fundamentalaccounting equationthat must remain balanced.

Every time a transaction is posted, the account balance is updated to reflect the updated financial position.

This must be reflected uniformly in the journal and ledger.

A business may choose how frequently it posts transactions.

It lists all the accounts from the ledger and their balances.

This ensures that the total debits equal the total credit.

Note: This version of the trial balance doesnt yet reflect any adjustments for accrued revenues or expenses.

Once adjustments are made, the adjusted trial balance will be prepared for final reporting.

If the numbers dont match, these worksheets make it easier to spot what exactly went wrong.

If there is a mismatch, the balance can be adjusted before finalizing the numbers.

These entries correct possible timing discrepancies that occur during transaction recording.

Next, anadjusted trial balanceis prepared to ensurethe books are balanced with equal debits and credits.

This final trial balance is then used to prepare financial statements to correctly report revenues and expenses.

With this step, debit equals credit, and the books are balanced for the following year.

You may check theseaccounting coursesto learn more about these concepts.

What are the Benefits of an Accounting Cycle?

An accounting cycle helps a business keep its financial position in check at each step in several ways.

This reduces the chances of mistakes, which could lead to fines or even audits from the government.

Measuring financial performance is extremely important because it helps businesses set realistic feature goals.

This consistency is necessary because it simplifies comparing financial statements of different companies or the same company over time.

Some businesses choose to close their books each month to regularly analyze their financial health.

The timing of the accounting cycles can also depend on theircost-benefit analysis.

For example, monthly reports provide frequent insights but require a lot of resources.

Quarterly or yearly reports, on the other hand, save costs but provide less timely insights.

Here are some of the most common accounting challenges and how to solve them.

Data Entry Errors

Data entry errors are quite common in accounting.

They happen when incorrect data is entered in the records.

However, this will be hard to detect because the book may still appear balanced regardless.

Such errors can also happen when numbers are accidentally reversed during entry.

This could be due to human error, software issues, or simply forgetting to enter data.

This could also mean non-compliance with regulations because businesses need to keep accurate records for tax and legal purposes.

If any entry related to this doesnt exist in the records, it can result in penalties.

What is the Difference Between a Journal and a Ledger?

Journals and ledgers are two of the most important documents in which financial transactions are first recorded.

Once recorded, these transactions are moved to the ledger, which organizes them by account and not date.

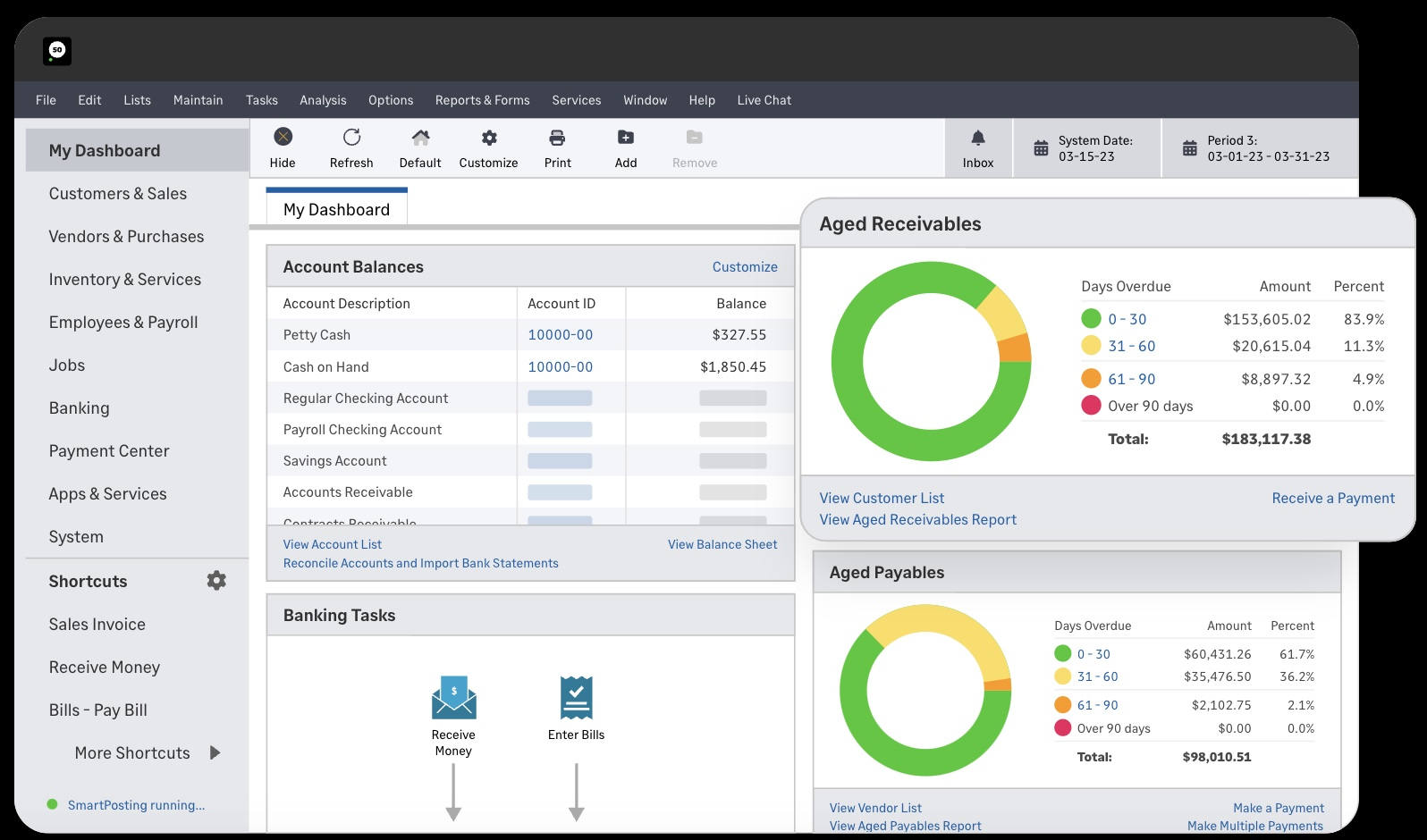

However, automating this process withaccounting softwarecan save a huge chunk of time and effort in accounting processes.

Some of these leading solutions are listed below.

Xero

Xerois a specializedcloud-based accounting softwareprimarily suitable for small and medium-sized businesses.

With Xero, you could produce detailed summary reports of transactions belonging to any accounting period.

It automatically checks the reports for errors and any discrepancies that may go unseen with manual handling.

It automatically runs reports to update the records in real-time and sends alerts to make necessary adjustments.

Moreover, it can be easily integrated with banks to get a clear view of finances and transactions.

QuickBooks can manage everything from invoicing to billing and setting automatic approval requests for clients for a streamlined workflow.

This automates the entire accounting cycle to reduce the time and possibilities of human errors.