We earn commission when you buy through affiliate links.

This does not influence our reviews or recommendations.Learn more.

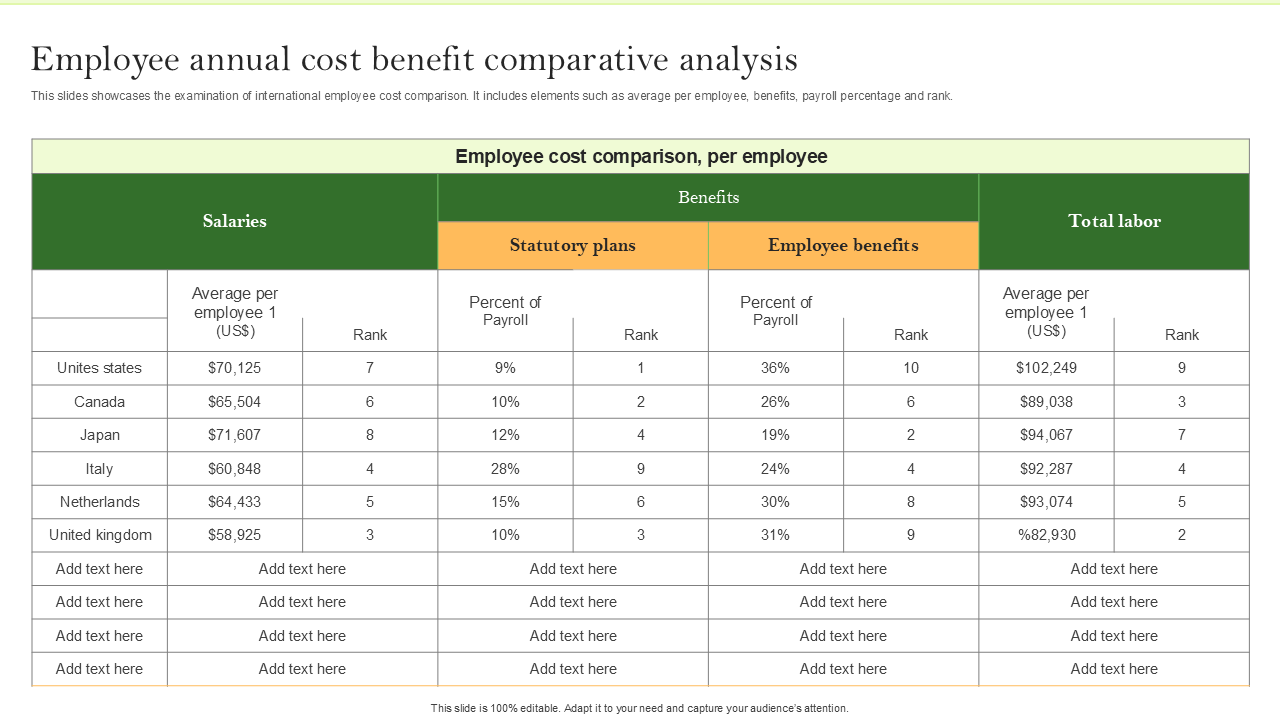

Payroll is one of the most significant expenses when running a business.

This means the question ofwho should handle payrollHR or Financeisnt a one-size-fits-all answer.

Both departments bring valuable expertise, and the choice depends on various factors.

These include your companys structure, the complexity of your payroll, and the resources available to you.

Heres why HR departments often process payroll for a company.

Employee Data Management

Managing employee data is one of the core functions of HR.

Centralizing all this datareduces the risk of errors and streamlines payroll.

Compliance with Labor Laws

Labor laws and regulations are at the heart of the payroll function.

It helps reduce the risk of costly penalties and legal issues that not complying can lead to.

All of which are related to and have an impact on payroll.

This pop in of close interaction with employees means fewer misunderstandings and also fosters transparency.

Employee Experience and Confidentiality

Employee experienceis a top priority for HR.

From onboarding to exit interviews, HR professionals work hard to ensure that employees feel supported and valued.

A big part of this is ensuring that payroll is processed accurately and on time.

Of course, payroll involvessensitive personal information, from Social Security numbers to bank account details.

Leveragingmodern HR platformscan ensure compliance, and efficient employee communication, making HRs role in payroll even more efficient.

Lets take a closer look.

Theyre responsible for budgeting, and payroll is one of the largest expenses they manage.

Theyll analyze historical payroll data to forecast future costs and identify potential cost-saving measures.

This analysis is also important to keeping payroll in line with what your company can afford.

And all of this helps keep your business on a stable financial footing.

Finance professionals specialize in these areas, which is essential to maintaining payroll compliance.

Additionally, your finance department has to generate the payroll reports needed for audits and your other financial records.

This knowledge of financial reporting and compliance is essential to avoiding penalties and maintaining transparency with your stakeholders.

This contributes to financial integrity by making sure that payroll is processed accurately and in accordance with relevant regulations.

Company Size and Structure

Different-sized companies tend to structure their payroll systems in different ways:

2.

Complexity of Payroll

HR handling your payroll may be the best choice for businesses with straightforward payroll needs.

Available Resources and Expertise

Consider each departments resources, such as payroll software, staffing, and training.

Cross-Department Collaboration

In many companies, the best approach is collaboration.

HR can manage employee data and relations, while finance handles tax compliance and reporting.

This division of labor leverages the strengths of both departments to complete payroll efficiently.

However, it is important to clearly define each departments duties and responsibilities.

Their focus on employee experience and accessibility makes them better suited to handle these inquiries for your staff.

Having ready access to payroll systems means they can address them without unnecessary delays.

Finance complements this by managing the technical side, such as compliance, audits, and budgeting.

Together, they address both the human and regulatory sides of payroll.

And the bridge between HR and finance is often integrated payroll software.

This reduces errors and eliminates delays because of manual handoffs.

Collaboration also improves accountability.

This dual oversight creates a system that minimizespayroll errorsand builds trustboth within the organization and with external stakeholders.