We earn commission when you buy through affiliate links.

This does not influence our reviews, ranking, or recommendations.Learn more.

Both Xero andQuickBooksare topaccountingsolutions, but which one do you choose?

you might trust Geekflare

At Geekflare, trust and transparency are paramount.

Use forAccounting, bookkeeping, payroll, invoice, expense tracking.

$17.5/month

Companies that need to add less than 3 users.

$4.7/month

Companies that need to reconcile bank transactions in bulk.

$32.5/month

Companies that deal with multiple currencies and need to add employee time in the invoice.

$8/month

Companies doing international business in multiple currencies.

$49.5/month

Companies that need financial planning, inventory management, and project expense tracking.

$117.5/month

Businesses with 20+ users and that need workflow automation.

Alternatives

Sage

Wave

Midsize to large businesses that need advanced reporting, budgeting, and invoice management.

Free accounting software for freelancers, solopreneurs, and small businesses.

FreshBooks

Zoho Books

Freelancers, self-employed individuals, and teams with contractors.

Small to medium-sized businesses, eCommerce businesses that needs foreign transactions.

What is Xero?

What is QuickBooks?

QuickBooksis an onlineaccountingsoftware that helps users track receipts, bank transactions, and income.

It is popular among small to medium-sized businesses and offerscloud-based and on-premises applications.

QuickBookssimplifies finance management by allowing users to organize receipts and track mileage easily using its mobile program.

QuickBooksallows users to tag things while working to track projects, locations, events, and more.

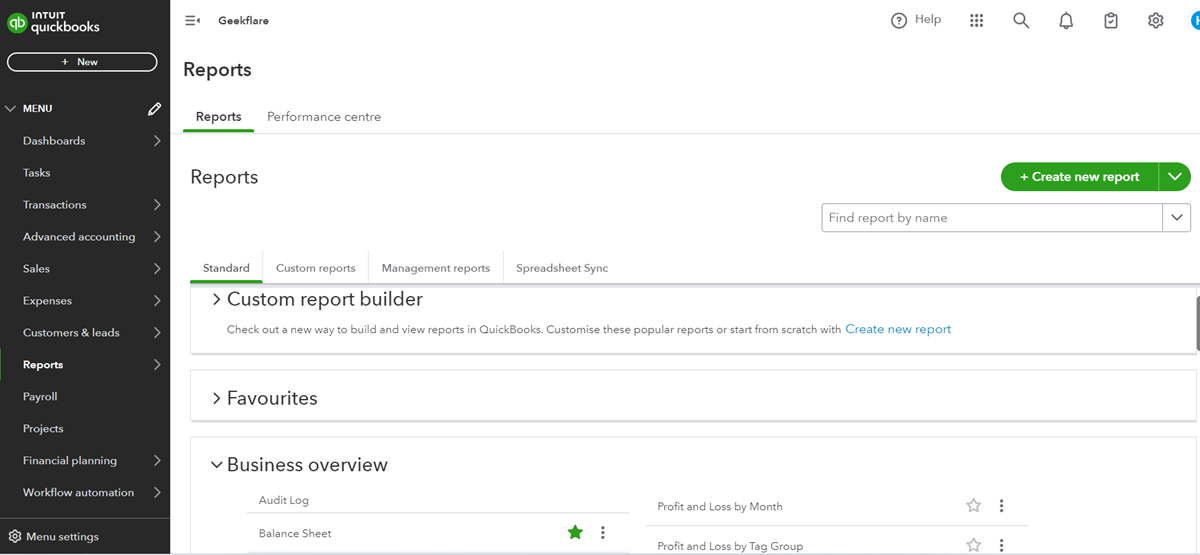

![]()

Users can run custom reports related to the tags to get an instant picture through the insights.

What is the Difference Between Xero and QuickBooks?

We will examine the differences between Xero andQuickBooksin detail and determine thebest accounting software.

![]()

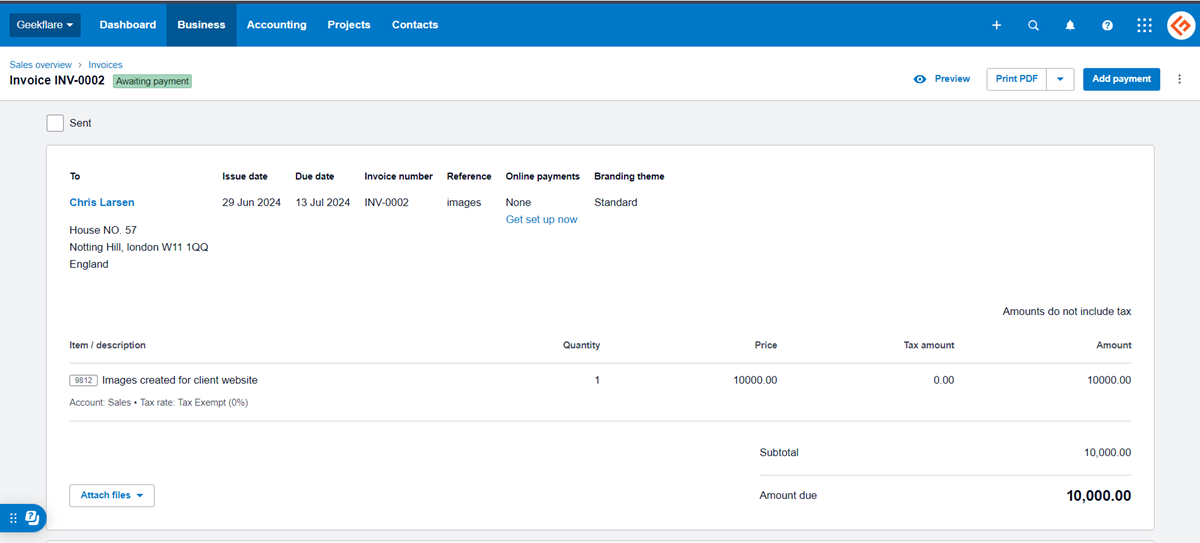

Xero also shows when a client views the invoice and alerts businesses when the invoice is paid.

They can include an invoice PDF link and a button to online invoice in the reminder email.

Xero allows users to connect to payment services with no monthly subscription costs.

![]()

It uses encryption and strong security measures to protect against fraud.

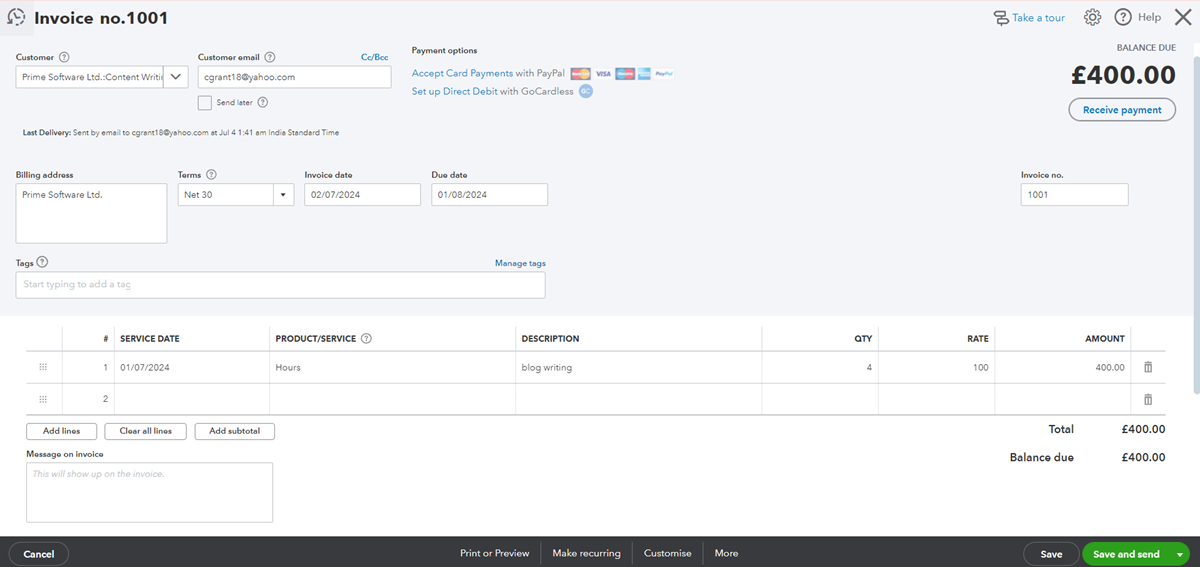

QuickBooksoffers advanced invoicing features such as customization, recurring invoices, email sending, and payment options.

Users can also personalize their email to send invoices electronically.

![]()

QuickBookssupports in-person payments using theQuickBooksGoPayment app and mobile credit card reader.

It supports foreign exchange bank accounts and payments in any currency.

Xero updates the exchange rate every hour and revalues the company balance.

It lets users view transactions, invoices, or bills in a foreign currency.

Xero also tracks all transactions across currencies and access reports to analyze monthly trends and identify areas for improvement.

QuickBooksis advancedaccountingsoftware that can manage a companys fixed assets.

It supports business transactions in 155 currencies.

Users can connect their bank accounts to automate income and expense tracking.

It also tracks receipts throughGoogleDrive and email.

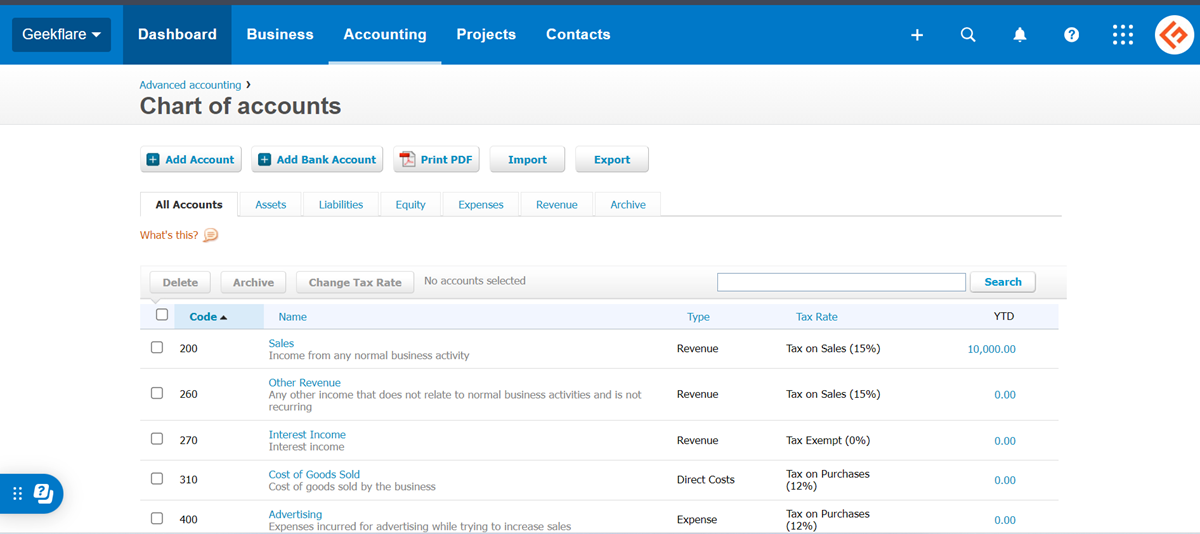

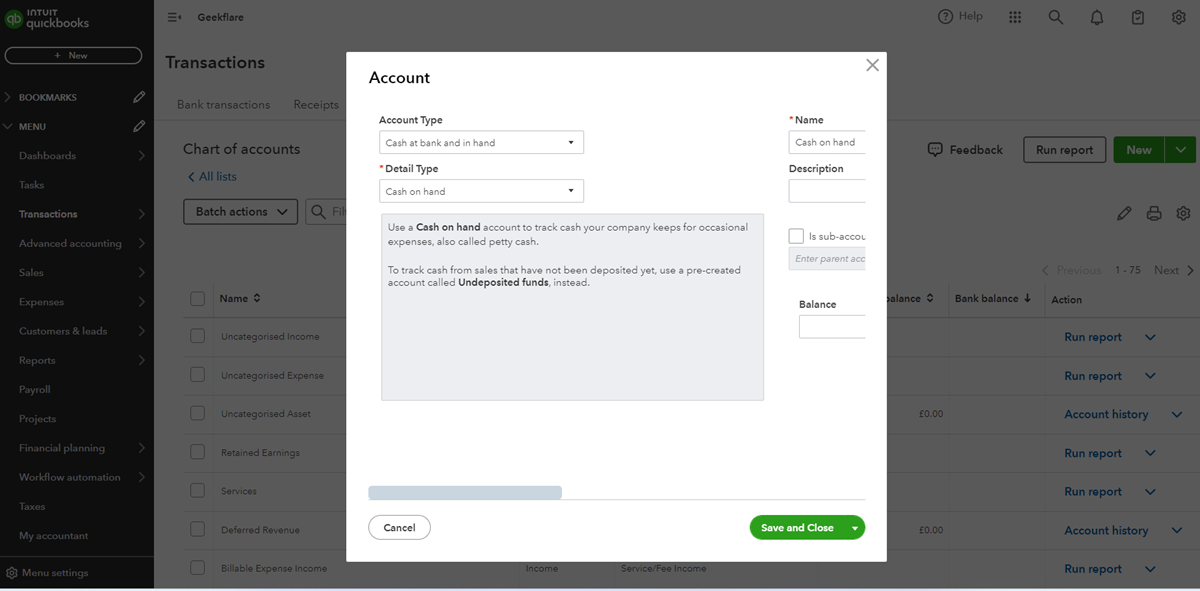

QuickBooksoffers charts ofaccountingto track assets and liabilities usingbalance sheetaccounts and categorize transactions with income and expense accounts.

It allows users to create custom tags to track income and expenses.

It supports matching bank statements to invoices or bill payments using rules or accepting a suggested match.

Users can sort and group transactions in bulk before reconciling them and receive alerts for suggested matches.

Once the reconciliation is complete,QuickBooksautomatically generates a reconciliation report.

Time Tracking

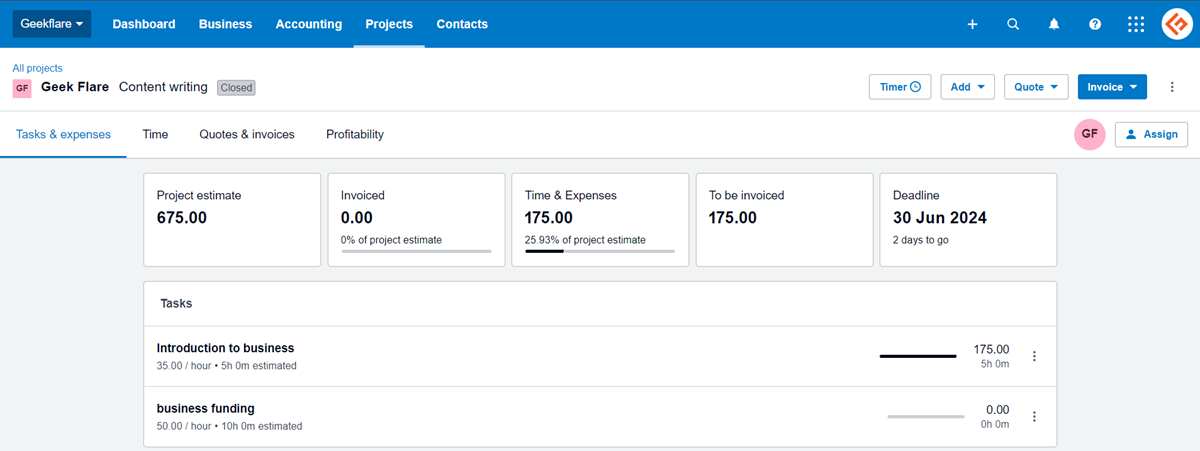

Xeros time-tracking feature is included in its project management tool.

It also provides a staff time overview to monitor individual employee efficiency.

QuickBooksoffers a time-tracking app calledQuickBooksTime for employers to create schedules, track projects, and manage time-offs.

It syncs withQuickBooksPayrolland allows employees to enter their time manually or through theQuickBooksWorkforce app.

Expense Tracking

Xero makes expense tracking paperless by scanning receipts and auto-filling claims from the scanned copy.

After employees submit an expense claim, admins can review and approve it in seconds.

With real-time notifications, reports, and insights, companies can get a forecast to manage cash flow.

Users can also use labels to keep the expenses organized.

Quick claim submission and approval are also possible from the Xero Me app.

QuickBooksallows users to track and manage various expenses, including bills, checks, purchase orders, etc.

It offers tools for time tracking, project planning, budgeting, expense monitoring, quoting, and invoicing.

Xero also has a built-in timer to track time invested in a particular task.

Users can add the tracked time to their tasks easily.

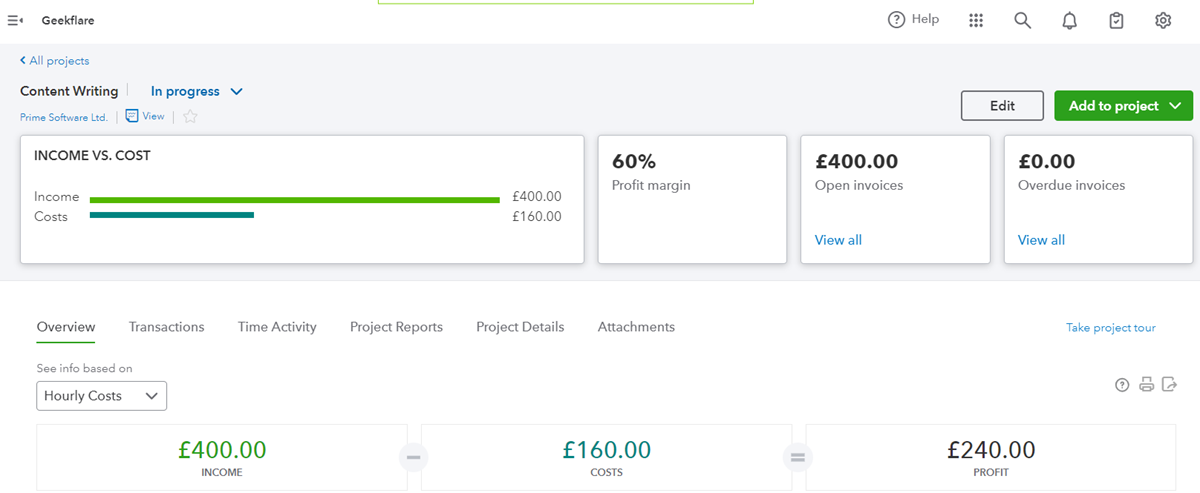

QuickBooksallows users to include project details to calculate profitability.

QuickBooksProjects also stores time activities, attachments, and transactions associated with each project.

Xero has no built-in proposal feature but can integrate with third-party proposal software.

Users can use its quotation feature for simple projects with basic scope and pricing details.

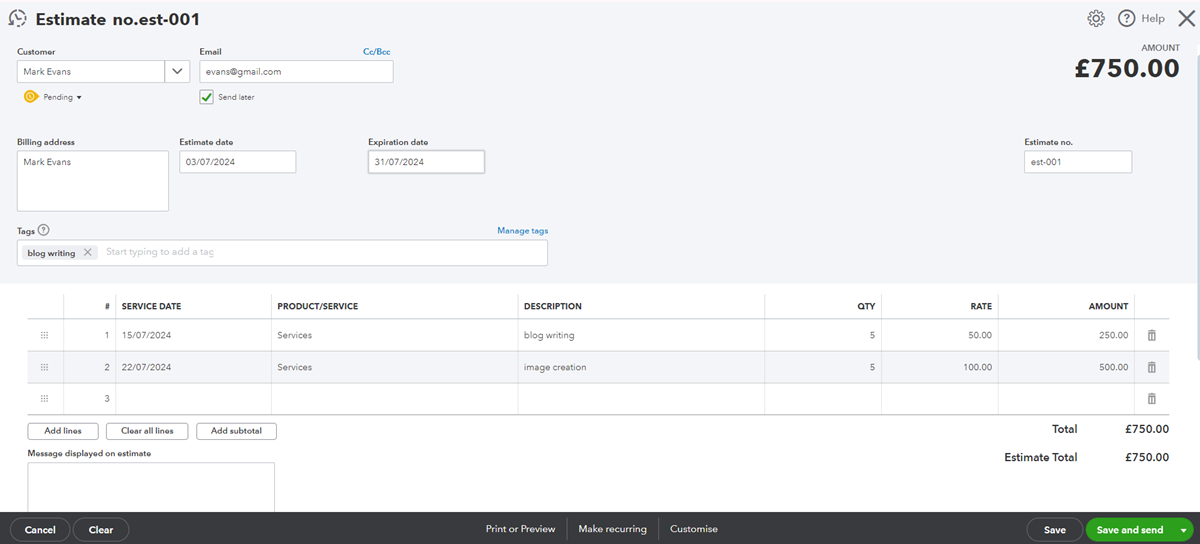

QuickBooksallows companies to create and send estimates on different products and services seamlessly.

Users can turn the same estimate into an invoice in one click if approved.

It even offers a free estimate template.

Integrating with third-party proposal applications is also an option.

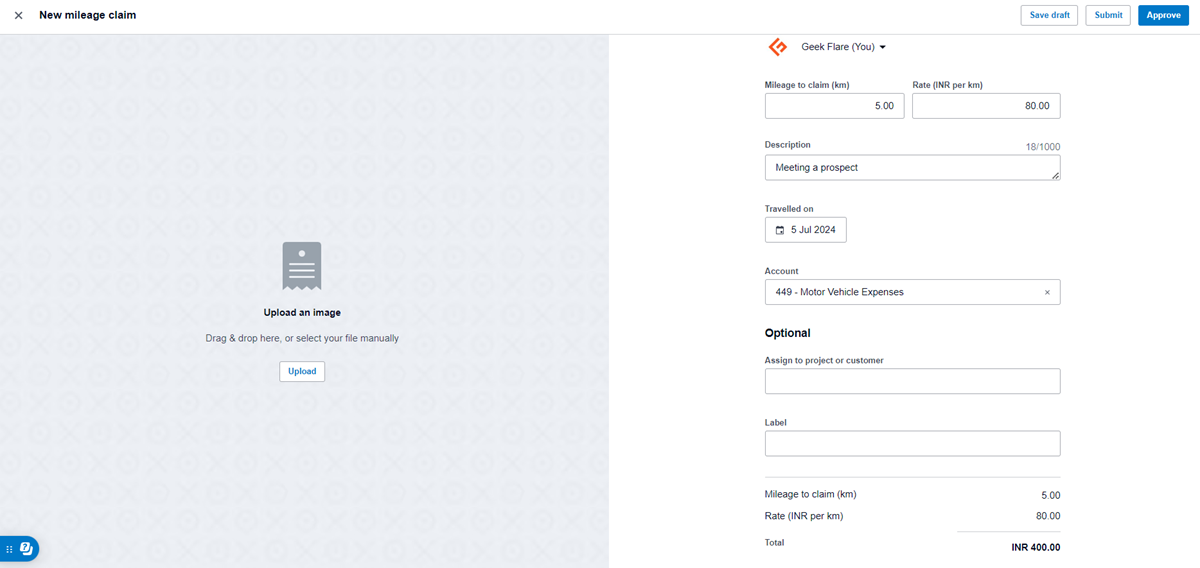

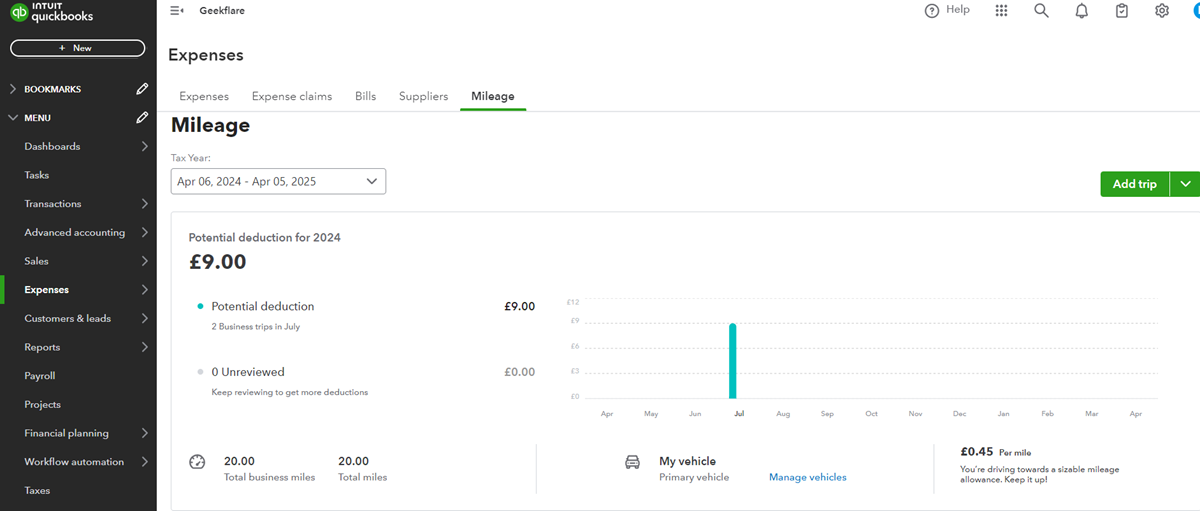

Admins can review and approve mileage claims to reimburse employees quickly.

It also sends notifications, accepts receipt photos, and offers analytics data to monitor employee spending.

QuickBookssupports mileage tracking with its mobile app, which enables automatic GPS tracking from mobile phone locations.

Users can also add trips manually and categorize trips as businesses for tax deductions.

QuickBooksgenerates sharable mileage reports with a breakdown of miles and potential deductions.

It also lets users keep a mileage log according to the IRSs requirements.

Tax Calculations

Xero allows companies to set upsales taxrates to calculatesales taxautomatically.

Users can also generatesales taxsummaries, edit tax rates whenever needed, and prepare tax reports for return.

Users can accesssales taxinformation from theSales TaxLiability Report and get assistance from live tax experts for tax filing.

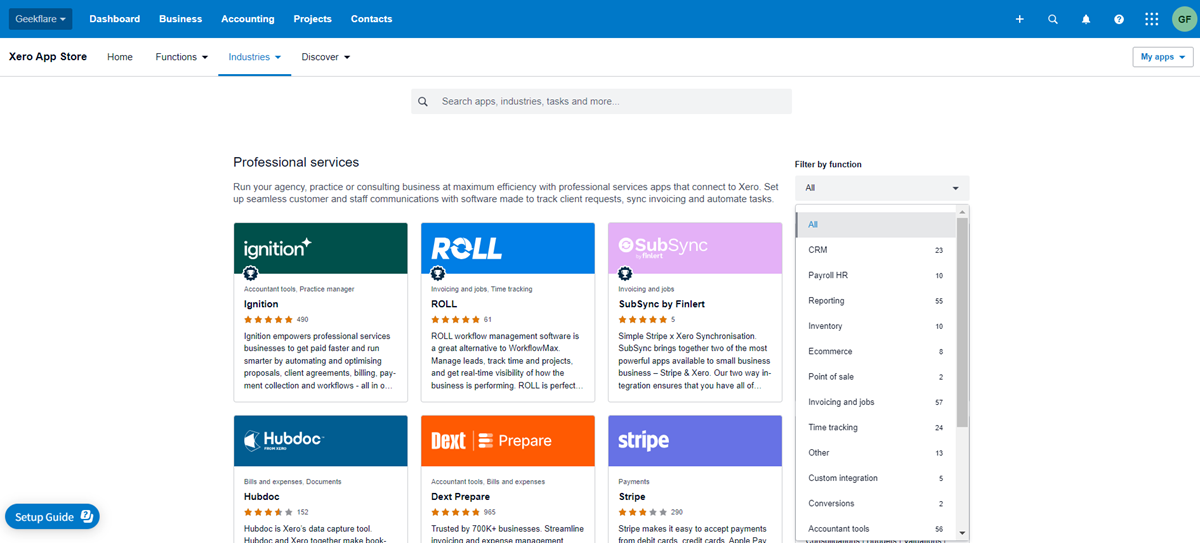

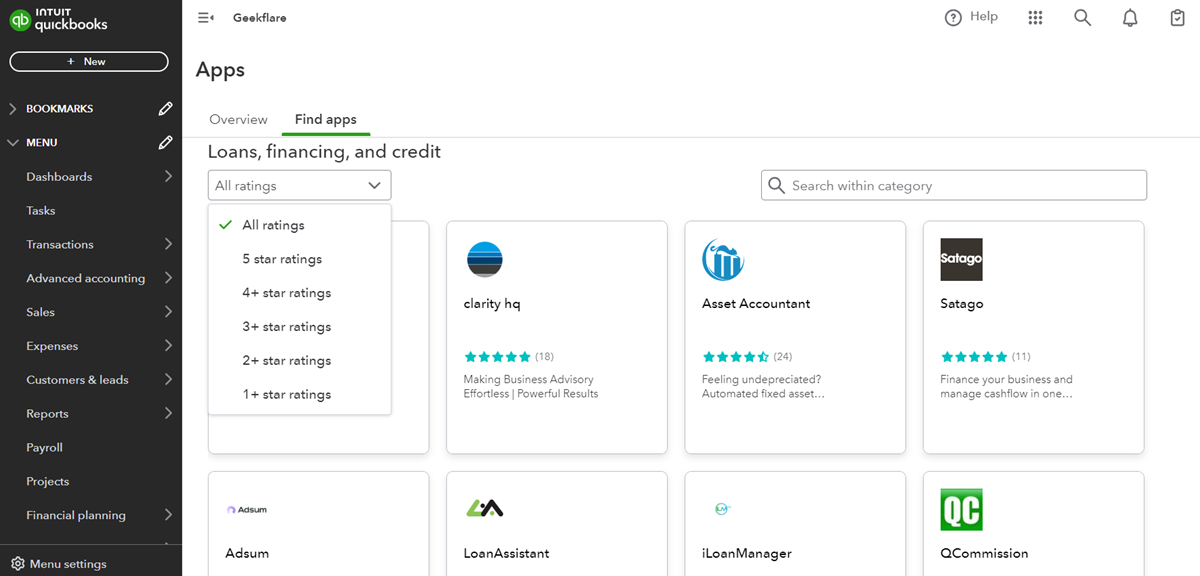

The Xero App Store allows users to filter and customize apps to suit their industry and needs.

These integrated apps support flexible workflows and data syncing for a comprehensive business overview.

These integrations streamline tasks like inventory management, time tracking, andaccounting, enhancing users financial management capabilities.

Users can access these apps in the My Apps section, which is categorized for easy navigation.

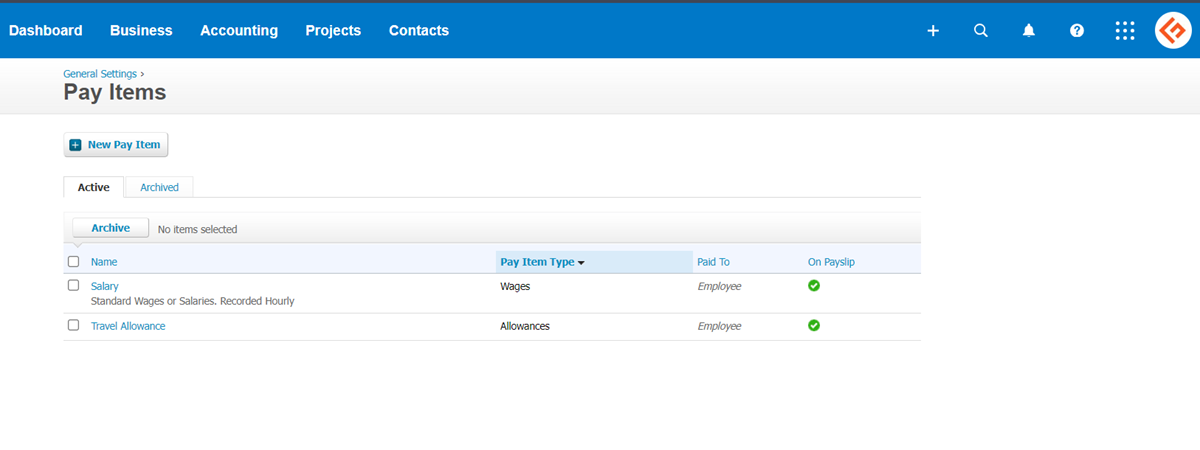

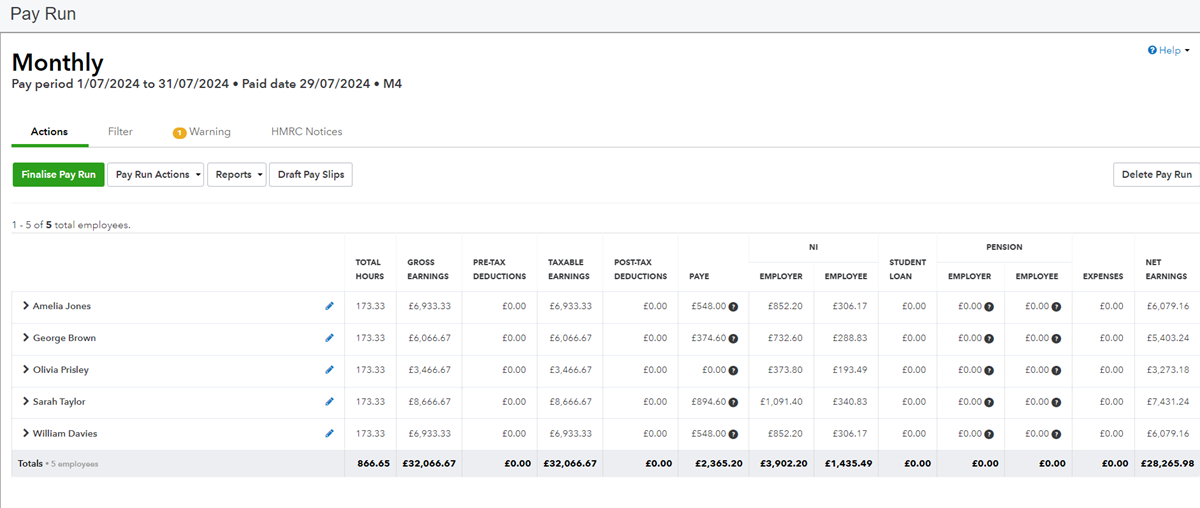

Payroll

Xero automates recurring online pay runs and stores employee data, personal details, andpayrollrecords.

While Xero doesnt include built-inpayrollaccountingfunctionality, it integrates smoothly with Gusto for streamlinedpayrollprocessing.

Users need to integrate third-party applications for advancedaccountingfeatures.

The QuickBookspayrollfeature streamlines payday tasks by setting up thepayrollto run automatically.

Users can runpayrollanytime, and the teams will get paid on time or the same day through direct deposit.

QuickBooksalso accurately calculates, files, and payspayrolltaxes with tax penalty protection.

It also syncs with theQuickBooksWorkforce app to track time forpayroll.

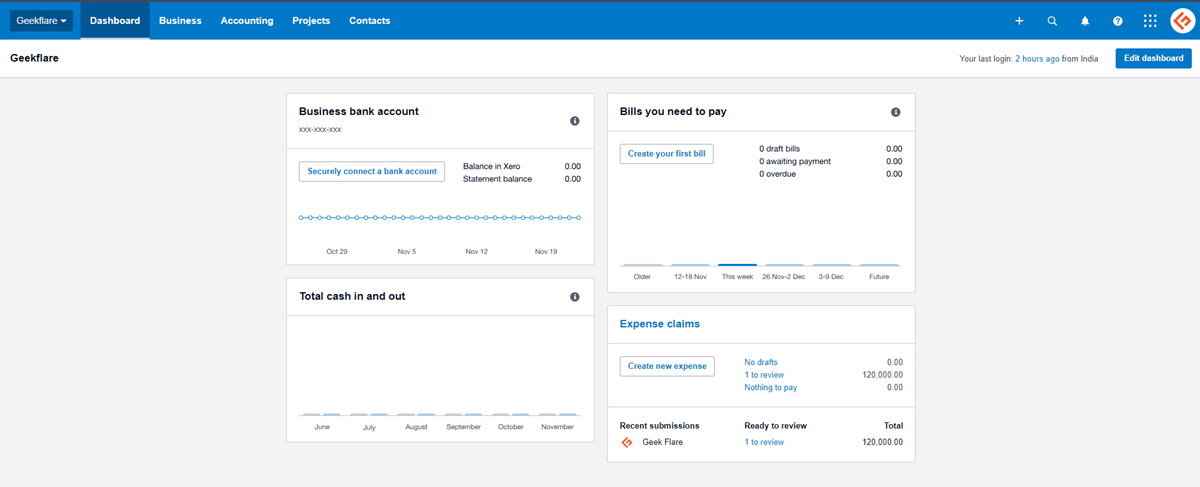

Dashboard and Reporting

Xero has an editable dashboard that lets users choose their preferred sections.

Users can search and filter their contacts, transactions, invoices, bills, and purchase orders from there.

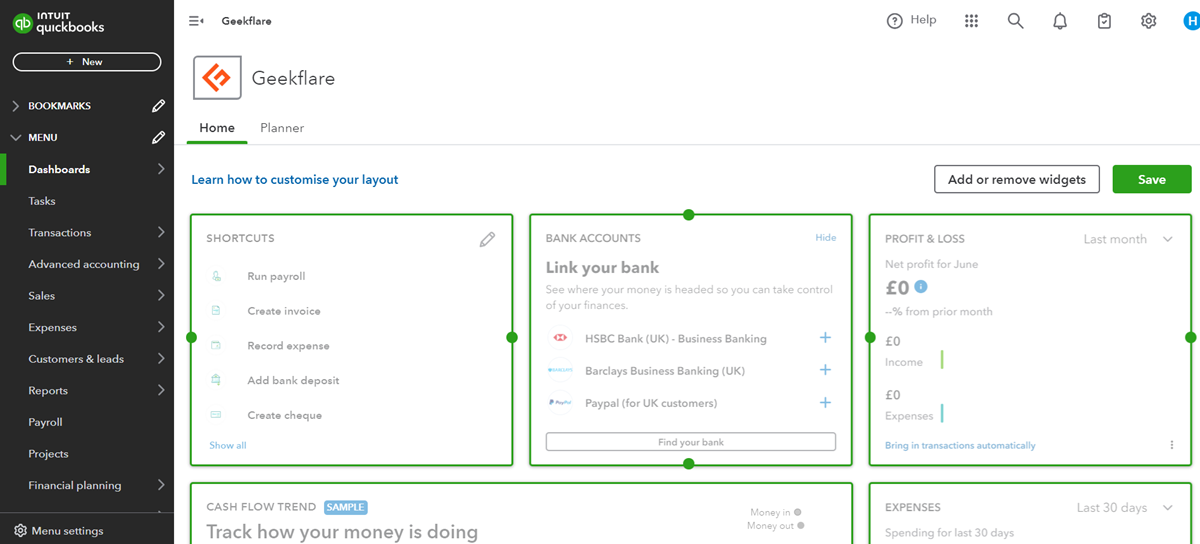

QuickBooksdashboard has a customizable home page with widgets and a planner page, allowing a real-time cash flow view.

Users can personalize widget placement and hide the menu panel for distraction-free work.

The dashboard also displays all activities from the audit log.

Ease of Use

Xero has a clean, distraction-free interface where users can find what they want.

Each dashboard section has an i button containing basic information about it.

It also offers one-click access to help articles that users can refer to anytime.

Notifications, tasks, searches, and configs are readily accessible from the dashboard.

Learn more about Xero in ourfull review of Xero accounting.

It is popular amongaccountingfirms and businesses with less than 25 users, requiring advanced invoicing customization and industry-specific features.

What are the Best Invoicing Software besides Xero and QuickBooks?

When looking for thebest invoicing softwarebesides Xero andQuickBooks, the best options will vary based on the business size.

Is There Any Free Accounting Software Available?

Yes, there arefree accounting softwareapplications available for companies and freelancers.

Which Accounts Payable Automation Software is Good for Streamline Payments?

Both Bill.com and Melio are reliableaccounts payable automation softwareoptions.